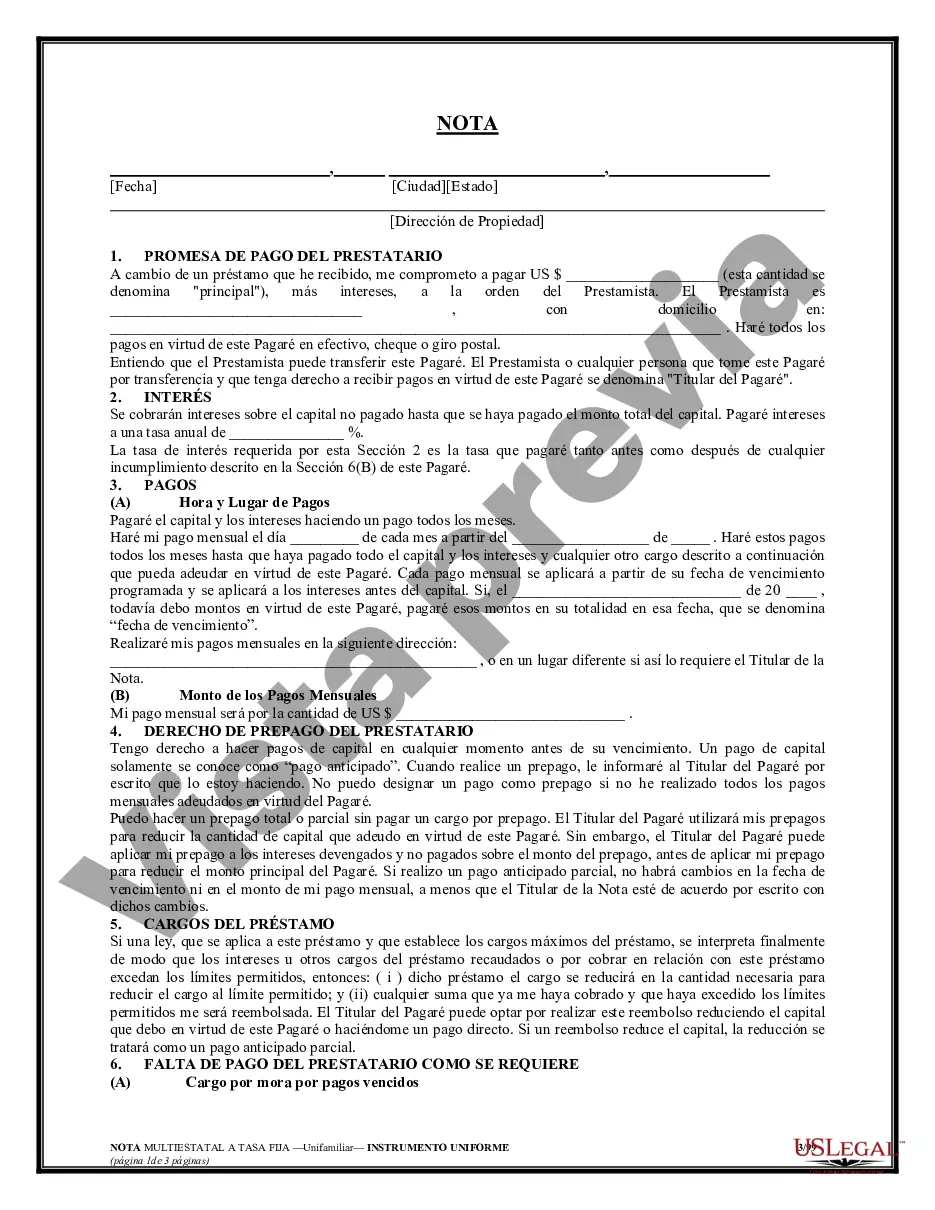

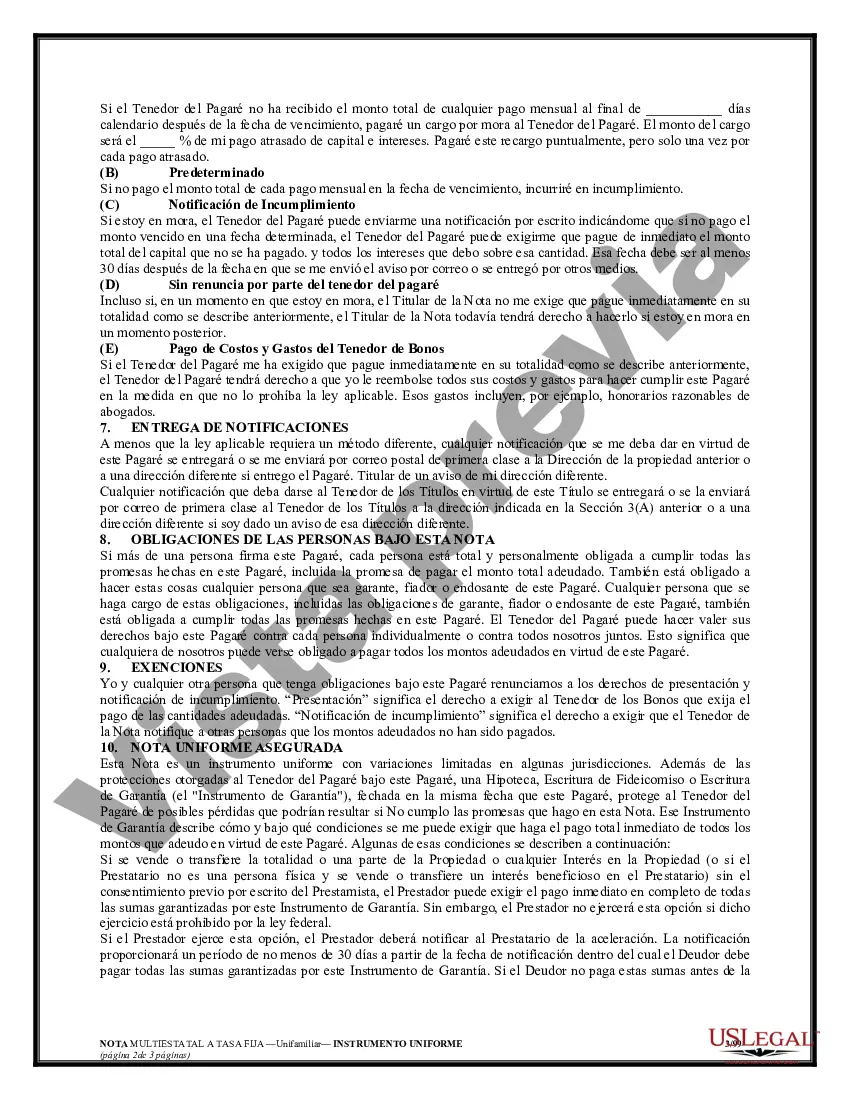

Maine Multistate Promissory Note — Secured is a legally binding document used in Maine and several other states to ensure repayment of a loan. It includes relevant terms and conditions that protect both the lender and the borrower. This type of promissory note is specifically designed to secure the loan with collateral such as real estate or personal property. The collateral provides an additional layer of security for the lender in case the borrower defaults on the loan. The Maine Multistate Promissory Note — Secured encompasses various types based on different factors. These include: 1. Real Estate Secured Promissory Note: This type of note is secured by the borrower's real estate property. It specifies the details of the property used as collateral, including the address, legal description, and any encumbrances or liens. 2. Personal Property Secured Promissory Note: In this case, the note is secured by the borrower's personal property, such as vehicles, valuable assets, or inventory. It outlines the specific items being used as collateral, along with their estimated value. 3. Business Asset Secured Promissory Note: When a loan is granted to a business, this type of promissory note is used to secure the loan with the company's assets. It delineates the assets being pledged as collateral, which can include equipment, machinery, intellectual property, or inventory. The Maine Multistate Promissory Note — Secured typically includes key information, such as the names and addresses of both the lender and borrower, the principal amount of the loan, the interest rate, repayment terms, and any penalties for late or missed payments. It also incorporates provisions to protect both parties' rights and outlines the steps to be taken in the event of default or breach of contract. Overall, the Maine Multistate Promissory Note — Secured is a versatile legal document that provides security to lenders while establishing clear terms and expectations for borrowers. It ensures a transparent and mutually beneficial agreement for both parties involved in a secured loan transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Pagaré Multiestado - Garantizado - Multistate Promissory Note - Secured

Description

How to fill out Maine Pagaré Multiestado - Garantizado?

If you need to comprehensive, down load, or printing legal papers web templates, use US Legal Forms, the most important collection of legal types, which can be found online. Use the site`s easy and handy research to get the documents you want. Various web templates for enterprise and individual uses are categorized by types and states, or keywords. Use US Legal Forms to get the Maine Multistate Promissory Note - Secured in a few click throughs.

When you are already a US Legal Forms consumer, log in in your bank account and then click the Download key to obtain the Maine Multistate Promissory Note - Secured. Also you can gain access to types you earlier downloaded from the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for that proper city/region.

- Step 2. Make use of the Preview solution to look through the form`s articles. Never overlook to see the description.

- Step 3. When you are not satisfied together with the kind, take advantage of the Research industry near the top of the screen to locate other models of the legal kind template.

- Step 4. When you have found the form you want, click on the Purchase now key. Choose the rates program you choose and add your accreditations to register for the bank account.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Pick the structure of the legal kind and down load it on your device.

- Step 7. Full, change and printing or signal the Maine Multistate Promissory Note - Secured.

Each and every legal papers template you get is the one you have forever. You have acces to each kind you downloaded with your acccount. Go through the My Forms segment and decide on a kind to printing or down load once more.

Compete and down load, and printing the Maine Multistate Promissory Note - Secured with US Legal Forms. There are thousands of specialist and state-particular types you may use for your personal enterprise or individual needs.