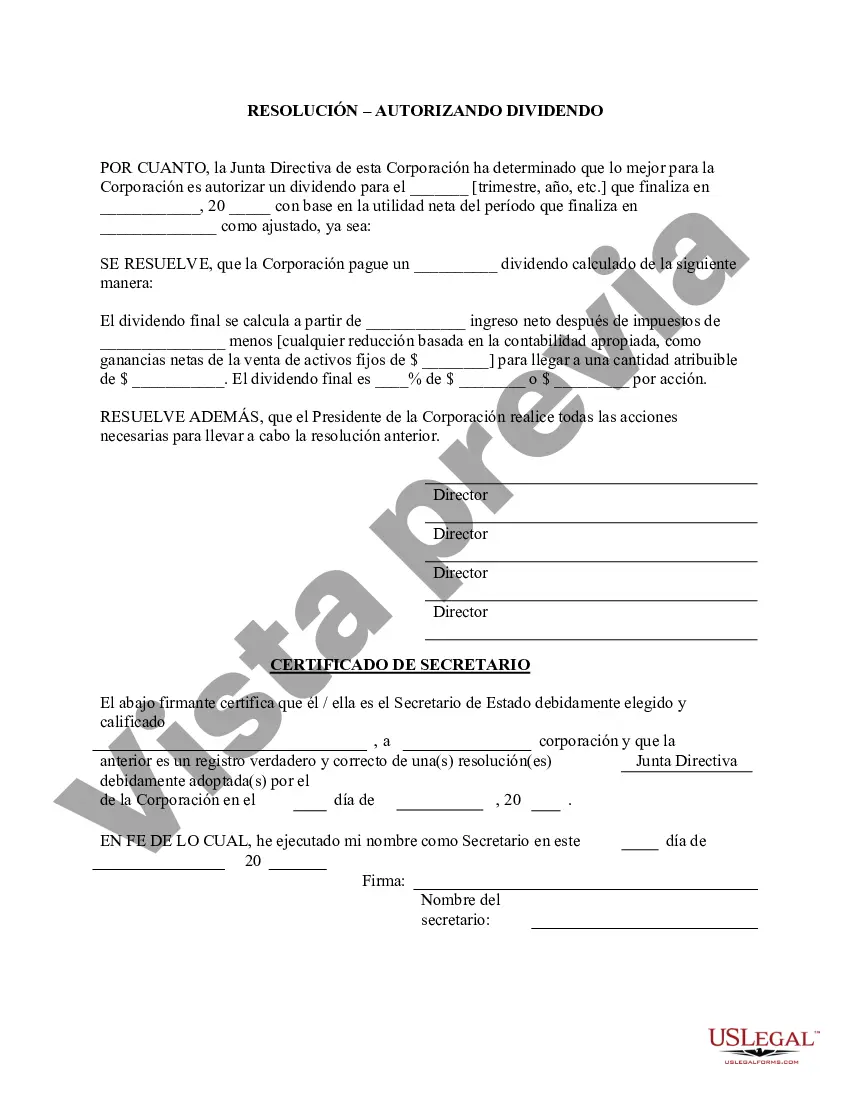

Maine Stock Dividend — Resolution For— - Corporate Resolutions is a legal document used by corporations in Maine to declare and distribute stock dividends among shareholders. This resolution form outlines the details and procedures involved in implementing a stock dividend, ensuring transparency, accuracy, and compliance with state laws and regulations. The purpose of a stock dividend is to distribute additional shares of a company's stock to its existing shareholders. This form enables corporations to request approval from their board of directors and shareholders for the declaration and issuance of a stock dividend. The Maine Stock Dividend — Resolution Form typically includes the following key elements: 1. Corporate Information: The form begins with providing the name of the corporation, its address, and other identifying details. 2. Resolution Details: The resolution form outlines the purpose of the resolution, which is to declare and distribute a stock dividend to the shareholders. It specifies the date of the resolution and the number of shares to be issued as dividends. 3. Board of Directors Approval: The form includes space for the signatures of the board of directors, indicating their approval or disapproval of the resolution. 4. Shareholders Approval: The form also includes a section for the shareholders' approval. It specifies the date and location of the shareholder meeting where the resolution will be presented for voting. 5. Voting Results: This section records the voting results, indicating the number of votes in favor, against, and any abstentions. It also requires the signature of the meeting chairperson. Different types of Maine Stock Dividend — Resolution Forms within the category of Corporate Resolutions include: 1. Cash Dividend Resolution Form: This is a resolution form used when a corporation declares a cash dividend, where shareholders receive cash payments in proportion to their held shares. 2. Stock Dividend Resolution Form: This is the most common type of resolution form, where additional shares of the corporation's stock are distributed among shareholders without any monetary payment. Shareholders' percentage of ownership increases, but their overall value remains the same. 3. Property Dividend Resolution Form: This resolution form is used when a corporation decides to distribute assets, such as real estate, equipment, or intellectual property, as dividends among shareholders. It is important for corporations in Maine to use the appropriate Maine Stock Dividend — Resolution For— - Corporate Resolutions to ensure compliance with state regulations and facilitate efficient distribution of dividends among shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Maine Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

US Legal Forms - one of several most significant libraries of authorized types in the United States - delivers a wide array of authorized papers layouts you may down load or produce. Making use of the website, you may get a large number of types for organization and person uses, sorted by types, suggests, or search phrases.You will discover the latest versions of types like the Maine Stock Dividend - Resolution Form - Corporate Resolutions within minutes.

If you already have a registration, log in and down load Maine Stock Dividend - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Acquire button can look on each kind you look at. You have accessibility to all earlier saved types from the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, allow me to share easy recommendations to get you started:

- Be sure to have picked out the right kind to your town/area. Select the Review button to examine the form`s content. Browse the kind outline to actually have selected the correct kind.

- If the kind does not suit your demands, use the Research area near the top of the display to obtain the the one that does.

- When you are pleased with the form, verify your choice by clicking on the Get now button. Then, opt for the prices prepare you like and supply your credentials to sign up on an account.

- Process the transaction. Make use of your charge card or PayPal account to complete the transaction.

- Find the file format and down load the form on your own gadget.

- Make alterations. Fill out, revise and produce and indicator the saved Maine Stock Dividend - Resolution Form - Corporate Resolutions.

Every template you included with your bank account lacks an expiry time and is yours forever. So, in order to down load or produce another copy, just go to the My Forms section and then click in the kind you require.

Get access to the Maine Stock Dividend - Resolution Form - Corporate Resolutions with US Legal Forms, one of the most considerable library of authorized papers layouts. Use a large number of specialist and condition-certain layouts that meet your small business or person demands and demands.