Maine Triple Net Lease

Description

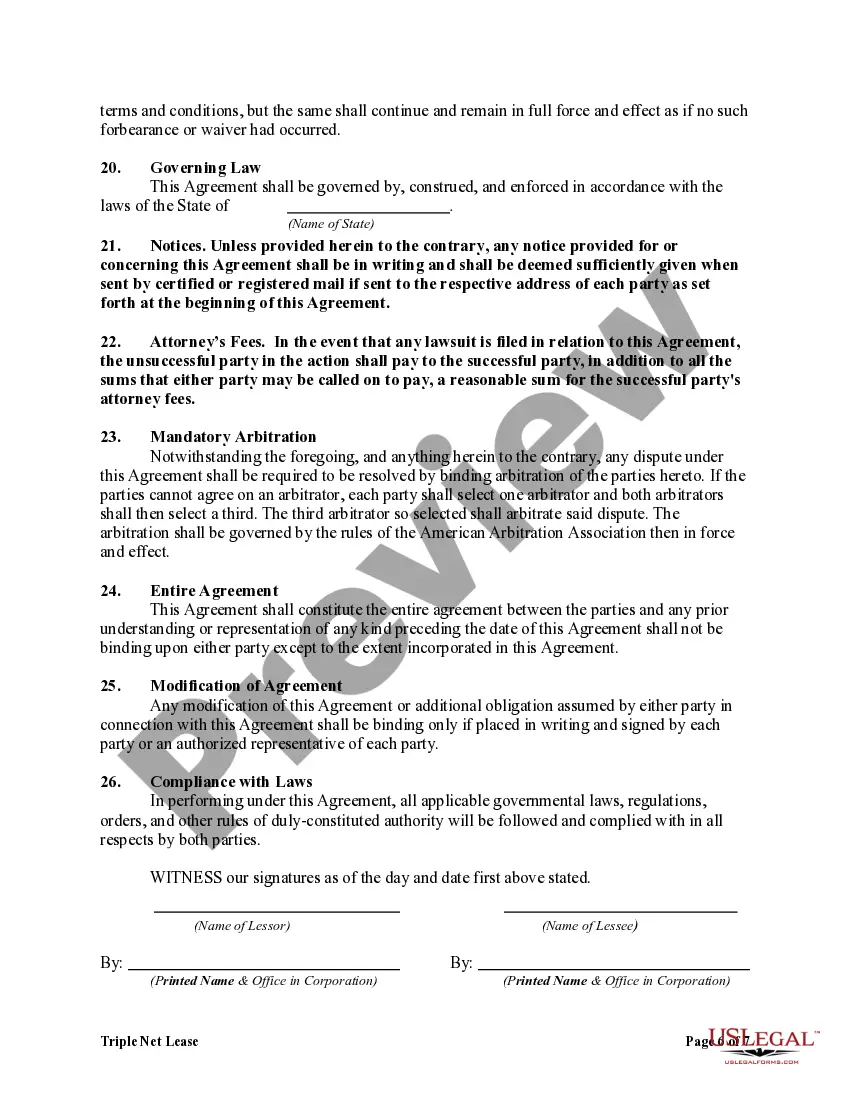

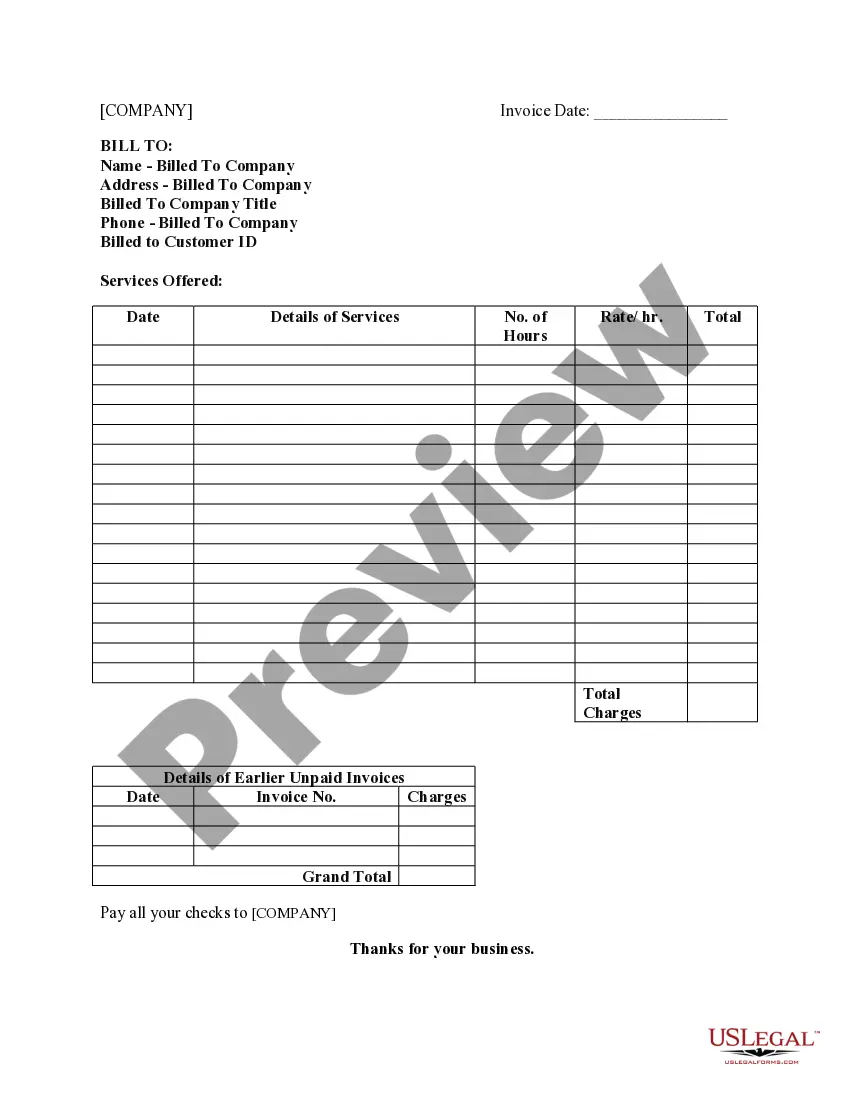

How to fill out Triple Net Lease?

Are you currently in a scenario where you require paperwork for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the Maine Triple Net Lease, designed to meet state and federal regulations.

When you have the correct form, click Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and process the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Maine Triple Net Lease template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is suitable for the correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that matches your needs.

Form popularity

FAQ

net lease, also known as a double net lease, requires tenants to cover property taxes and insurance in addition to rent. This type of lease provides landlords with additional security, as tenants are more directly involved in property costs. By understanding the nuances of netnet leases, you can make more informed decisions when exploring Maine Triple Net Lease opportunities.

Netstreit focuses on acquiring and managing properties leased under triple net lease agreements. Their portfolio includes retail and commercial assets with tenants that have strong credit backgrounds. By promoting the benefits of Maine Triple Net Lease arrangements, Netstreit aims to ensure both stability and growth for their investors.

Real Estate Investment Trusts (REITs) primarily come in three types: equity REITs, mortgage REITs, and hybrid REITs. Equity REITs invest directly in properties, collecting rental income, while mortgage REITs invest in property mortgages and generate income from interest. Maine Triple Net Lease properties often fall within the focus of equity REITs, as they provide stable rent and income streams.

Investing in a triple net (NNN) lease can be an effective strategy for generating steady income. Maine Triple Net Leases typically attract long-term tenants with established businesses, lowering vacancy risks. However, potential investors should conduct thorough research to ensure the property and location align with their financial goals.

The opposite of a triple net lease is a gross lease. In a gross lease, the landlord covers all property expenses, including taxes, insurance, and maintenance costs. This arrangement provides tenants with predictable monthly payments, while landlords retain responsibility for property management. Understanding these differences is crucial when considering a Maine Triple Net Lease.

The most typical lease used in residential rentals is the year-long lease. This lease type lends stability to the arrangement, making it favorable in multiple housing markets. It sets clear guidelines and terms for both landlords and tenants. To further enhance your understanding of leasing options, you may also want to consider the Maine Triple Net Lease, especially when looking into investment opportunities.

The lease most frequently used for residential property is the fixed-term lease. This type of agreement generally spans six months to a year, providing security for both tenants and landlords. It clearly defines the rental period and terms, which helps avoid misunderstandings. If you are interested in a predictable leasing structure, you might also explore options like the Maine Triple Net Lease for various advantages.

The most popular type of lease for residential properties is the month-to-month lease, which allows for flexibility in rental agreements. Tenants can stay beyond the initial rental period as long as they give proper notice to terminate. This lease type is particularly appealing in dynamic markets. Additionally, if you are seeking a more structured arrangement, the Maine Triple Net Lease is worth considering, especially for commercial properties.

The most common residential lease is a one-year lease, which provides stability for both landlords and tenants. This type of agreement outlines the expectations and responsibilities for each party over a set period. However, shorter-term leases are also popular, especially in markets with high demand. Whether you’re considering a one-year lease or exploring a Maine Triple Net Lease, knowing the options available can help you make informed choices.

In Maine, landlords must provide tenants with at least 30 days' written notice before the end of the lease term if they choose not to renew the lease. This is important to ensure that both parties have sufficient time to prepare for the transition. It is advisable to communicate clearly and promptly, as this helps maintain a good relationship. Understanding the notice requirements can help landlords and tenants navigate leases, including options like the Maine Triple Net Lease.