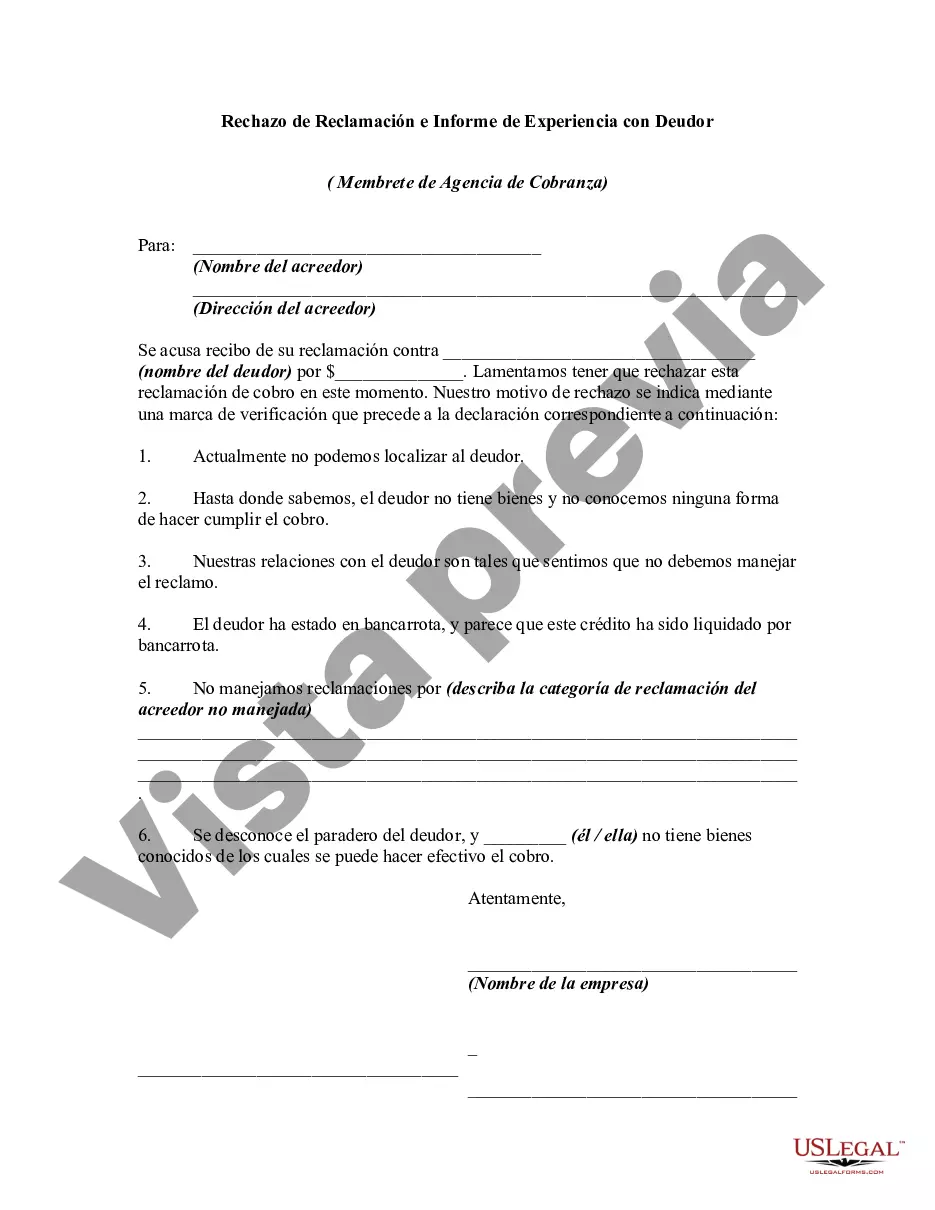

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Maine Rejection of Claim and Report of Experience with Debtor: A Detailed Description Introduction: Maine Rejection of Claim and Report of Experience with Debtor is a legal process that allows creditors or debtors to formally reject a claim or report their experience related to a debtor in the state of Maine. This process ensures transparency and fairness in debt settlement and helps protect the rights and interests of both parties involved. By utilizing the Maine Rejection of Claim and Report of Experience with Debtor, creditors and debtors can resolve disputes, clarify debts, and establish accurate records of their financial interactions. Maine Rejection of Claim: Maine Rejection of Claim is a legal mechanism employed by a debtor to dispute and reject a particular claim asserted against them by a creditor. This process is typically initiated when a debtor believes that the claim is invalid, inaccurate, or being wrongly pursued. By formally rejecting the claim, the debtor raises an objection and compels the creditor to provide further evidence or negotiate a settlement. The Maine Rejection of Claim offers a platform where debtors can protect their rights, prevent unwarranted debt collection efforts, and seek fair resolutions. Report of Experience with Debtor: The Report of Experience with Debtor is a component of the Maine Rejection of Claim process that enables creditors to report their experiences and maintain accurate records of their interactions with a particular debtor. Creditors can submit detailed reports outlining their experience, including any history of late payments, defaulting on loans, or other relevant information. The Report of Experience provides a comprehensive overview of a debtor's financial behavior, helping other creditors make informed decisions while considering extending credit or engaging in a financial relationship. Types of Maine Rejection of Claim and Report of Experience with Debtor: 1. Individual Maine Rejection of Claim and Report of Experience with Debtor: Applies when an individual debtor disputes a particular claim or when an individual creditor wishes to report their experience with a debtor. This category covers debt situations involving personal loans, credit cards, mortgages, etc. 2. Business Maine Rejection of Claim and Report of Experience with Debtor: Pertains to businesses involved in disputing claims or reporting experiences with other businesses. These situations can involve commercial loans, supplier debts, unpaid invoices, etc. 3. Legal Maine Rejection of Claim and Report of Experience with Debtor: This type refers to Maine rejection of claims or reports of experience that are a part of a legal process, such as bankruptcy proceedings, litigation, or court-ordered debt settlements. This category ensures that the rejection or reporting complies with legal requirements and aims to resolve disputes within the legal framework. Conclusion: Maine Rejection of Claim and Report of Experience with Debtor is an essential tool for resolving disputes and maintaining accurate financial records between creditors and debtors in Maine. These processes promote fairness, transparency, and accountability in debt settlements and help create a more informed lending environment. Understanding and utilizing the various types of Maine Rejection of Claim and Report of Experience with Debtor can empower both parties to protect their rights and reach mutually beneficial outcomes.Maine Rejection of Claim and Report of Experience with Debtor: A Detailed Description Introduction: Maine Rejection of Claim and Report of Experience with Debtor is a legal process that allows creditors or debtors to formally reject a claim or report their experience related to a debtor in the state of Maine. This process ensures transparency and fairness in debt settlement and helps protect the rights and interests of both parties involved. By utilizing the Maine Rejection of Claim and Report of Experience with Debtor, creditors and debtors can resolve disputes, clarify debts, and establish accurate records of their financial interactions. Maine Rejection of Claim: Maine Rejection of Claim is a legal mechanism employed by a debtor to dispute and reject a particular claim asserted against them by a creditor. This process is typically initiated when a debtor believes that the claim is invalid, inaccurate, or being wrongly pursued. By formally rejecting the claim, the debtor raises an objection and compels the creditor to provide further evidence or negotiate a settlement. The Maine Rejection of Claim offers a platform where debtors can protect their rights, prevent unwarranted debt collection efforts, and seek fair resolutions. Report of Experience with Debtor: The Report of Experience with Debtor is a component of the Maine Rejection of Claim process that enables creditors to report their experiences and maintain accurate records of their interactions with a particular debtor. Creditors can submit detailed reports outlining their experience, including any history of late payments, defaulting on loans, or other relevant information. The Report of Experience provides a comprehensive overview of a debtor's financial behavior, helping other creditors make informed decisions while considering extending credit or engaging in a financial relationship. Types of Maine Rejection of Claim and Report of Experience with Debtor: 1. Individual Maine Rejection of Claim and Report of Experience with Debtor: Applies when an individual debtor disputes a particular claim or when an individual creditor wishes to report their experience with a debtor. This category covers debt situations involving personal loans, credit cards, mortgages, etc. 2. Business Maine Rejection of Claim and Report of Experience with Debtor: Pertains to businesses involved in disputing claims or reporting experiences with other businesses. These situations can involve commercial loans, supplier debts, unpaid invoices, etc. 3. Legal Maine Rejection of Claim and Report of Experience with Debtor: This type refers to Maine rejection of claims or reports of experience that are a part of a legal process, such as bankruptcy proceedings, litigation, or court-ordered debt settlements. This category ensures that the rejection or reporting complies with legal requirements and aims to resolve disputes within the legal framework. Conclusion: Maine Rejection of Claim and Report of Experience with Debtor is an essential tool for resolving disputes and maintaining accurate financial records between creditors and debtors in Maine. These processes promote fairness, transparency, and accountability in debt settlements and help create a more informed lending environment. Understanding and utilizing the various types of Maine Rejection of Claim and Report of Experience with Debtor can empower both parties to protect their rights and reach mutually beneficial outcomes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.