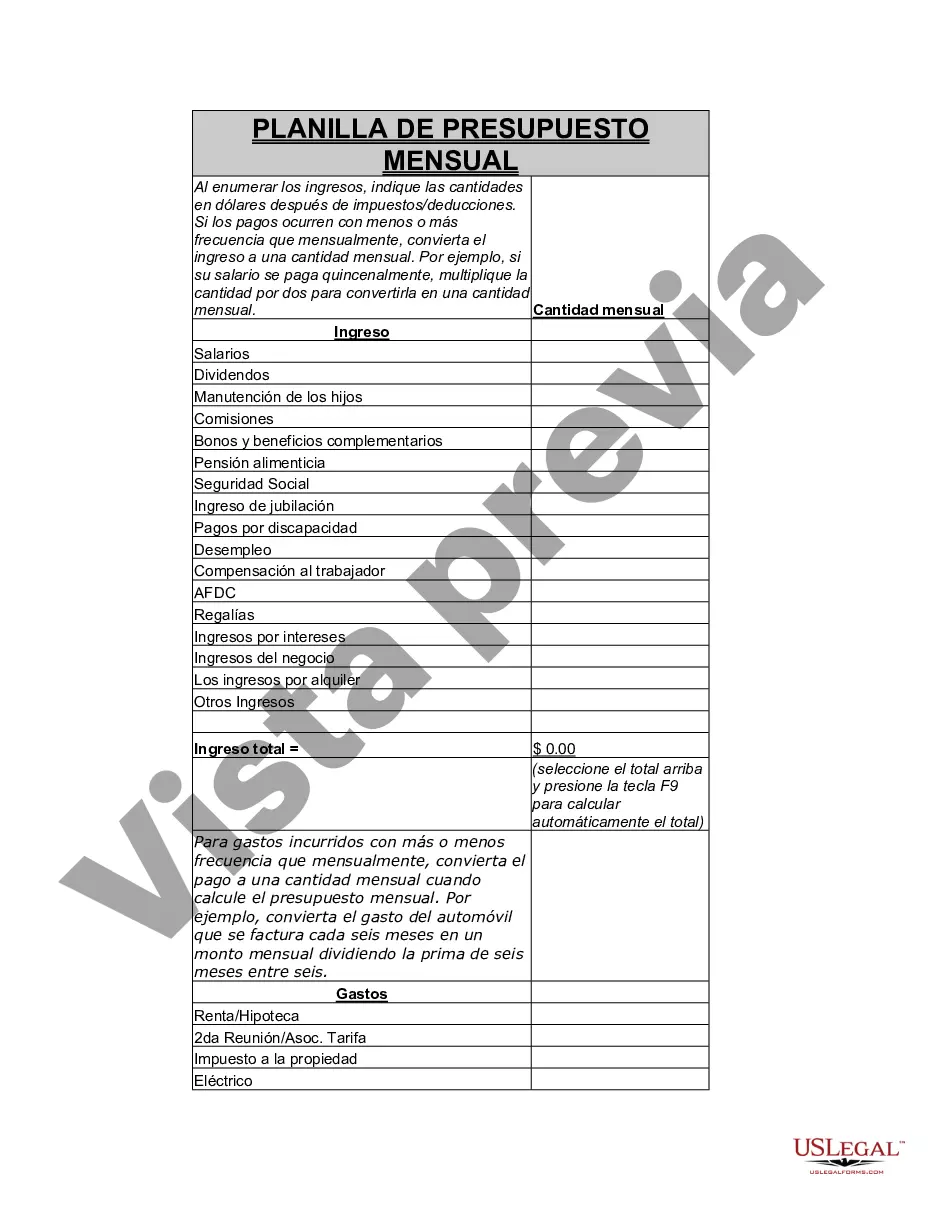

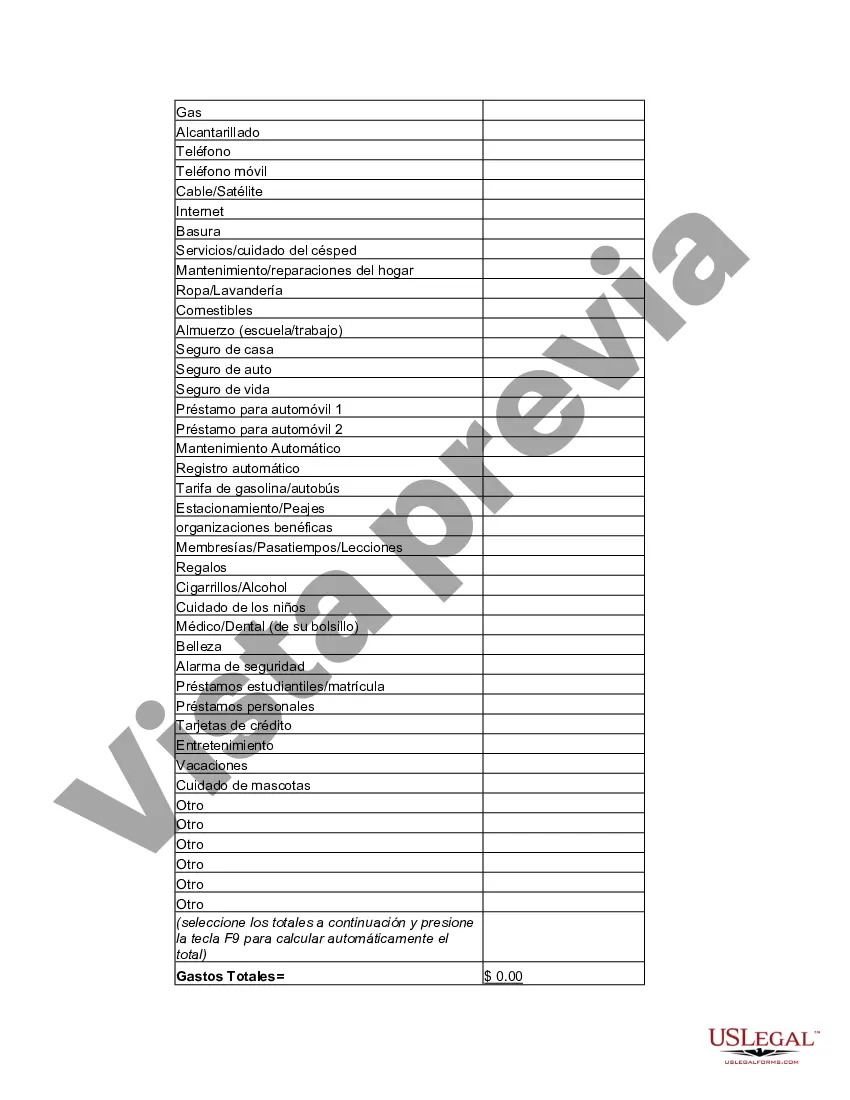

Maine Personal Monthly Budget Worksheet is a comprehensive financial tool used to track and manage personal expenses and income in the state of Maine. This worksheet assists individuals in organizing their finances, identifying spending patterns, and setting financial goals. It is designed to provide a clear overview of monthly earnings, expenses, savings, and debt payments. The Maine Personal Monthly Budget Worksheet includes various relevant categories such as: 1. Income: This section allows individuals to enter their various sources of income, including salaries, wages, tips, investments, and any other earnings. 2. Fixed Expenses: This category covers regular monthly expenses that remain constant, such as rent or mortgage payments, utilities, insurance premiums, subscriptions, and loan installments. 3. Variable Expenses: These are expenses that fluctuate from one month to another, such as groceries, transportation costs, dining out, entertainment, and shopping. 4. Savings: This section encourages individuals to prioritize saving money by allocating a specific amount to be saved each month. It may include emergency funds, retirement savings, or any other financial goals an individual wants to achieve. 5. Debt Payments: Individuals can track their debt payments, such as credit card bills, student loans, car loans, or mortgage payments in this category. 6. Other Expenses: This category allows for the inclusion of any miscellaneous or irregular expenses that may not fit under the previous sections, like medical expenses, home repairs, or personal care. Moreover, there are different types of Maine Personal Monthly Budget Worksheets available, each tailored to specific financial needs: 1. Basic Budget Worksheet: Ideal for individuals starting their budgeting journey, it provides a simplified overview of income and expenses to aid in building basic financial discipline. 2. Comprehensive Budget Worksheet: This type offers more detailed sections and subcategories to ensure a more accurate representation of an individual's financial situation. It aims to track and categorize expenses more specifically. 3. Specific Goal Budget Worksheet: Designed for individuals with specific financial goals in mind, it provides separate sections for savings related to these goals, such as down payments for a house, vacations, or college funds. 4. Debt Payoff Budget Worksheet: Ideal for individuals focusing on paying off debt, this type emphasizes tracking debt payments and creating a strategic payment plan to manage outstanding loans effectively. 5. Family Budget Worksheet: This variant caters to families and includes categories such as childcare expenses, education costs, and family-related activities or events. Maine Personal Monthly Budget Worksheet is an invaluable tool for anyone looking to achieve financial stability, manage their expenses wisely, and work towards their financial goals. By utilizing such a worksheet, individuals can gain a clearer understanding of their cash flow, make informed financial decisions, and improve their overall financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out Maine Hoja De Trabajo De Presupuesto Mensual Personal?

US Legal Forms - among the biggest libraries of legal varieties in the States - gives an array of legal papers templates you can acquire or produce. While using internet site, you may get a large number of varieties for organization and specific functions, categorized by types, claims, or keywords and phrases.You will find the newest types of varieties much like the Maine Personal Monthly Budget Worksheet within minutes.

If you have a monthly subscription, log in and acquire Maine Personal Monthly Budget Worksheet through the US Legal Forms local library. The Down load switch can look on every single type you perspective. You have accessibility to all formerly downloaded varieties in the My Forms tab of your own accounts.

In order to use US Legal Forms initially, allow me to share straightforward guidelines to obtain started:

- Make sure you have picked out the best type for your personal area/county. Go through the Review switch to analyze the form`s information. Browse the type description to ensure that you have selected the correct type.

- In the event the type doesn`t suit your requirements, use the Look for area on top of the screen to discover the the one that does.

- If you are content with the shape, affirm your decision by clicking the Purchase now switch. Then, select the costs prepare you prefer and provide your references to register to have an accounts.

- Procedure the transaction. Utilize your charge card or PayPal accounts to finish the transaction.

- Select the file format and acquire the shape on your device.

- Make changes. Complete, modify and produce and signal the downloaded Maine Personal Monthly Budget Worksheet.

Each web template you included in your money lacks an expiry day which is the one you have for a long time. So, in order to acquire or produce another duplicate, just proceed to the My Forms segment and then click in the type you will need.

Gain access to the Maine Personal Monthly Budget Worksheet with US Legal Forms, the most comprehensive local library of legal papers templates. Use a large number of skilled and express-distinct templates that meet up with your business or specific needs and requirements.