When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Maine's residents facing financial difficulties often need to communicate with their credit card companies to seek lower payments. Writing a well-detailed letter to the credit card company is crucial in informing them about your situation effectively. This article will provide a comprehensive guide on how to write a Maine letter to a credit card company seeking lower payments due to financial difficulties. 1. Introduction: Begin by addressing the credit card company's customer service department or the specific representative handling your account. In the opening paragraph, state your full name, residential address, and credit card account details. Mention that you are writing to discuss your current financial situation and request assistance in lowering your monthly payments. 2. Reason for Financial Difficulties: Explain the reasons for your financial hardship. You can mention unexpected medical bills, loss of employment, reduction in income, or any other relevant circumstances that have caused your financial constraints. Be honest but avoid sharing unnecessary personal information. 3. Current Financial Situation: Provide a detailed overview of your present financial situation. Mention your current income, whether its regular employment, savings, or government assistance. List your monthly expenses, including rent/mortgage, utilities, groceries, and other essential bills. Calculate your total income and expenses to highlight the significant gap affecting your ability to make full credit card payments. 4. Efforts to Manage Finances: Describe the steps you have taken to address your financial difficulties. If you have sought additional employment, enrolled in a debt management program, or reduced unnecessary expenses, include this information. Provide evidence of your proactive approach by attaching any supporting documents such as bank statements, pay stubs, or letters from other creditors. 5. Request for Lower Payments: State your intentions clearly and politely request a reduction in your monthly payment amount. Explain why a lower payment is necessary for you to continue making regular payments. Suggest an affordable payment amount that you believe aligns with your current financial situation. It will be helpful to propose an amount based on a percentage of your income to demonstrate your commitment to resolving the debt. 6. Commitment to Repayment: Convey your commitment to repay the debt by emphasizing your determination to maintain a positive payment history. Highlight any previous record of timely payments and your genuine intention to honor your obligations once your financial situation improves. Assure the credit card company that the requested payment reduction will enable you to avoid delinquency or default. 7. Contact Information: Include all your contact information, including your phone number, email address, and mailing address. Request that the credit card company confirms receipt of your letter and provides a written response within a specific time frame. Remember to proofread your letter for clarity and accuracy, keeping it concise and to the point. By providing a well-documented and persuasive argument, a Maine letter to a credit card company seeking lower payments due to financial difficulties increases the likelihood of a positive response and a mutually beneficial resolution.Maine's residents facing financial difficulties often need to communicate with their credit card companies to seek lower payments. Writing a well-detailed letter to the credit card company is crucial in informing them about your situation effectively. This article will provide a comprehensive guide on how to write a Maine letter to a credit card company seeking lower payments due to financial difficulties. 1. Introduction: Begin by addressing the credit card company's customer service department or the specific representative handling your account. In the opening paragraph, state your full name, residential address, and credit card account details. Mention that you are writing to discuss your current financial situation and request assistance in lowering your monthly payments. 2. Reason for Financial Difficulties: Explain the reasons for your financial hardship. You can mention unexpected medical bills, loss of employment, reduction in income, or any other relevant circumstances that have caused your financial constraints. Be honest but avoid sharing unnecessary personal information. 3. Current Financial Situation: Provide a detailed overview of your present financial situation. Mention your current income, whether its regular employment, savings, or government assistance. List your monthly expenses, including rent/mortgage, utilities, groceries, and other essential bills. Calculate your total income and expenses to highlight the significant gap affecting your ability to make full credit card payments. 4. Efforts to Manage Finances: Describe the steps you have taken to address your financial difficulties. If you have sought additional employment, enrolled in a debt management program, or reduced unnecessary expenses, include this information. Provide evidence of your proactive approach by attaching any supporting documents such as bank statements, pay stubs, or letters from other creditors. 5. Request for Lower Payments: State your intentions clearly and politely request a reduction in your monthly payment amount. Explain why a lower payment is necessary for you to continue making regular payments. Suggest an affordable payment amount that you believe aligns with your current financial situation. It will be helpful to propose an amount based on a percentage of your income to demonstrate your commitment to resolving the debt. 6. Commitment to Repayment: Convey your commitment to repay the debt by emphasizing your determination to maintain a positive payment history. Highlight any previous record of timely payments and your genuine intention to honor your obligations once your financial situation improves. Assure the credit card company that the requested payment reduction will enable you to avoid delinquency or default. 7. Contact Information: Include all your contact information, including your phone number, email address, and mailing address. Request that the credit card company confirms receipt of your letter and provides a written response within a specific time frame. Remember to proofread your letter for clarity and accuracy, keeping it concise and to the point. By providing a well-documented and persuasive argument, a Maine letter to a credit card company seeking lower payments due to financial difficulties increases the likelihood of a positive response and a mutually beneficial resolution.

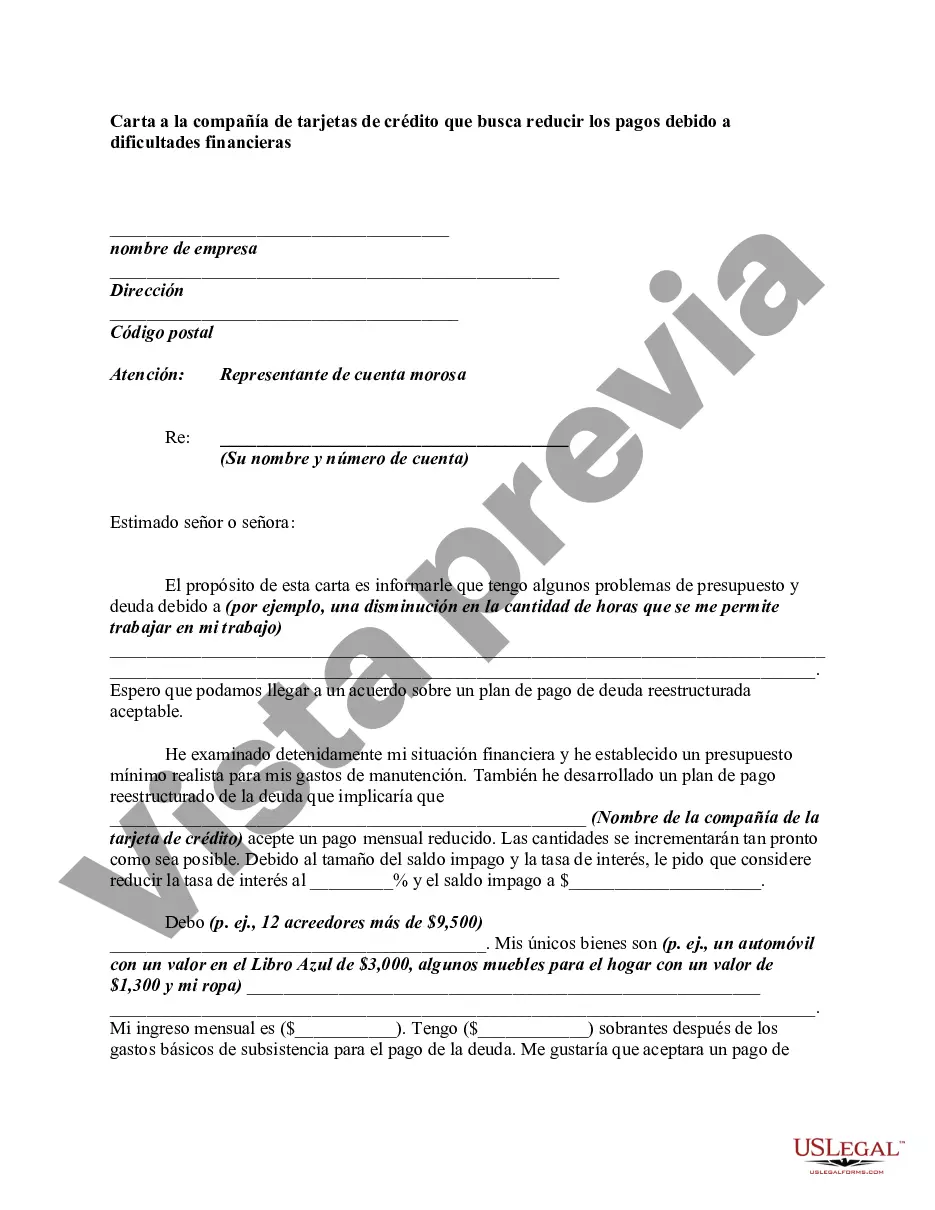

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.