Maine Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

It is feasible to dedicate hours on the web looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a wide array of legal documents that have been assessed by experts.

You can easily acquire or print the Maine Contract for Part-Time Assistance from Independent Contractor using my help.

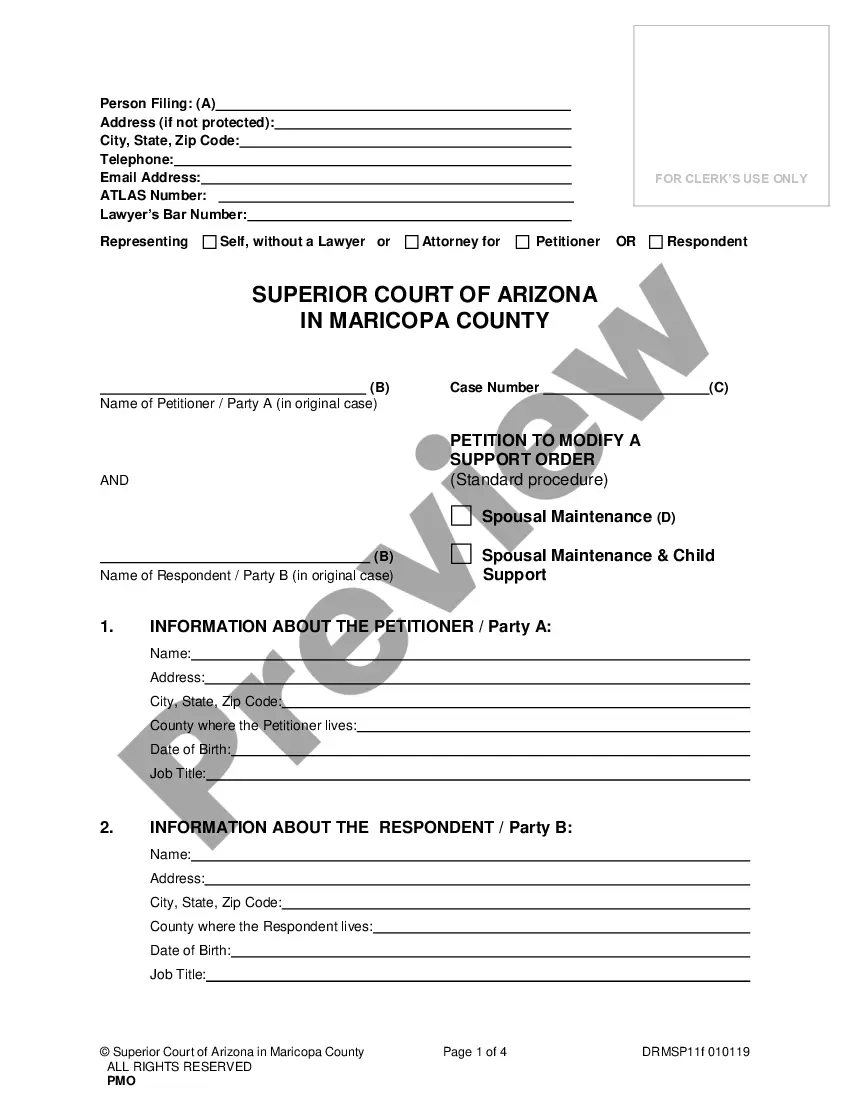

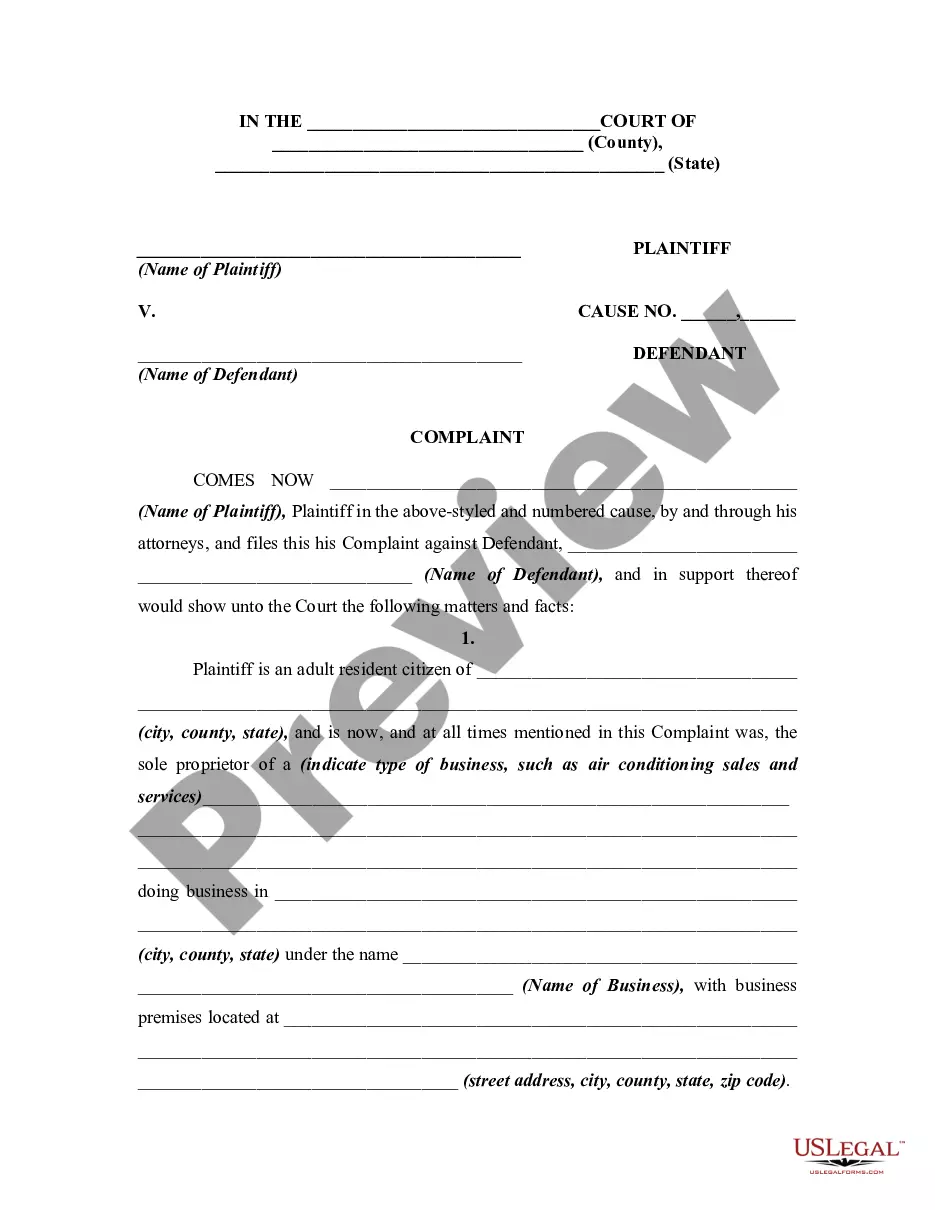

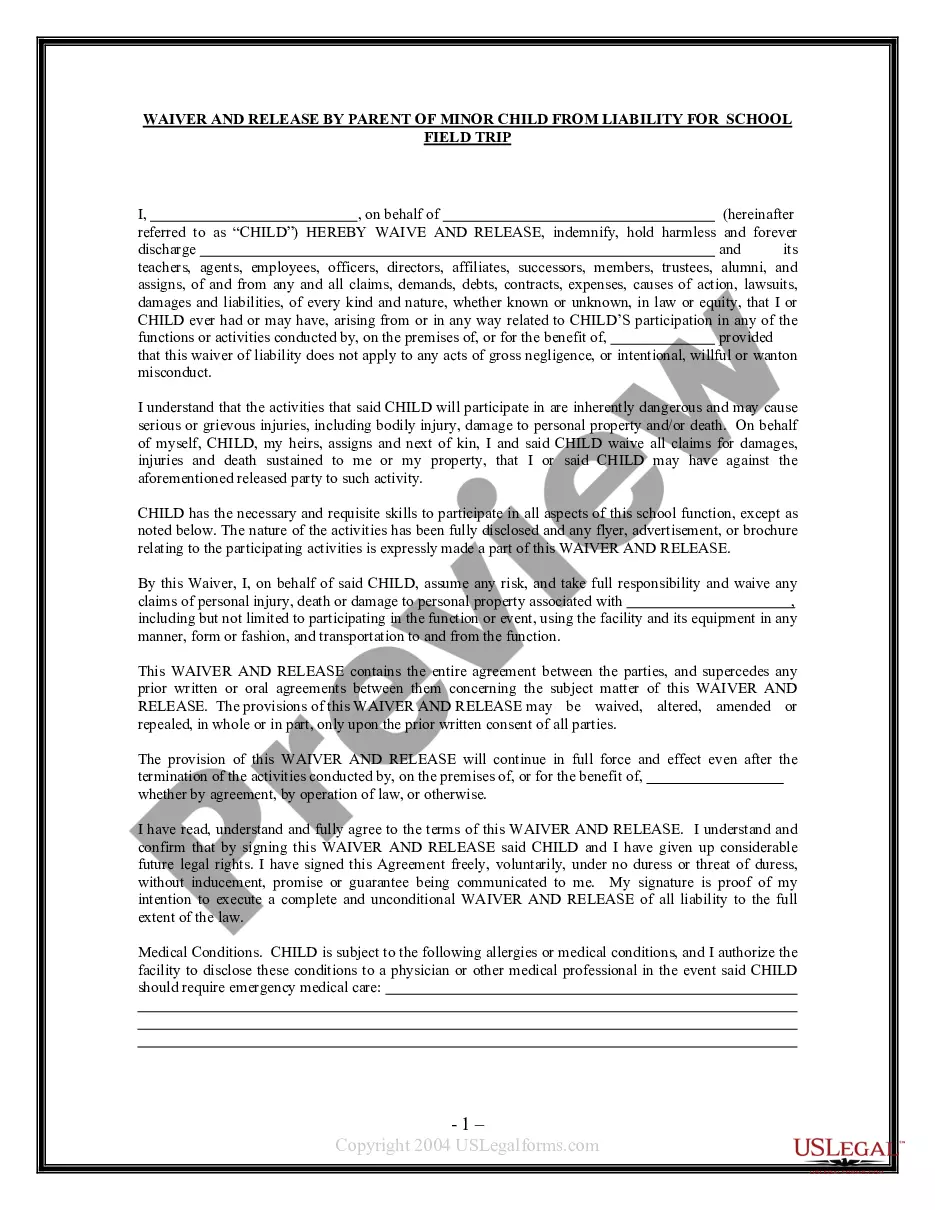

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- Then, you can fill out, alter, print, or sign the Maine Contract for Part-Time Assistance from Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the location/town of your choice.

- Review the form summary to confirm you have chosen the right document.

Form popularity

FAQ

When hiring a 1099 employee, you'll need to complete several important documents. Primarily, you should prepare a W-9 form to collect their taxpayer information. Additionally, drafting a Maine Contract for Part-Time Assistance from Independent Contractor can outline the specific duties, payment terms, and duration of the contract. Maintaining proper paperwork ensures that you are compliant with tax regulations and protects both your interests and those of the contractor.

Yes, a 1099 employee is indeed categorized as contract labor. They work under a contract rather than being part of the regular payroll system, which offers flexibility for both parties. Utilizing a Maine Contract for Part-Time Assistance from Independent Contractor enables you to formalize this relationship and define the scope of work clearly. This approach can simplify interactions while protecting the rights of both parties.

A 1099 employee operates under specific rules that distinguish them from W-2 employees. They typically manage their own taxes and are responsible for ensuring compliance with regulations. The Maine Contract for Part-Time Assistance from Independent Contractor can help clarify the terms of your agreement, including payment structure and obligations. It's vital to outline expectations in advance to avoid misunderstandings.

Yes, as an independent contractor working under a Maine Contract for Part-Time Assistance from Independent Contractor, you typically have the freedom to set your own hours. This flexibility allows you to manage your time effectively and balance various responsibilities. However, it is important to communicate your schedule with the contracting company to ensure alignment on project timelines and expectations.

The 2 year contractor rule allows businesses to classify workers as independent contractors under specific conditions. In Maine, if a contractor has been on a project for longer than two years and continues to work under the same contract, they may be reclassified depending on the nature of their work. It's essential to understand these nuances when drafting a Maine Contract for Part-Time Assistance from Independent Contractor to ensure compliance and avoid potential legal issues.

Yes, independent contractors should always have a contract, especially in a Maine Contract for Part-Time Assistance from Independent Contractor. A contract clarifies responsibilities, establishes payment terms, and protects both parties’ interests. By using platforms like US Legal Forms, you can easily draft a comprehensive contract that meets your specific needs and legal requirements.

You can technically be classified as a 1099 employee under a Maine Contract for Part-Time Assistance from Independent Contractor without a formal contract, but it is risky. Without clear documentation, proving the terms of your relationship can be challenging. A contract provides essential legal protections and outlines expectations for both parties.

Not having a contract for your Maine Contract for Part-Time Assistance from Independent Contractor can lead to significant risks. Without a written agreement, you may face disputes regarding payments, project scope, and timelines. Legal protections are limited without a contract, which may result in costly misunderstandings or even lawsuits.

A Maine Contract for Part-Time Assistance from Independent Contractor should clearly outline the scope of work, payment terms, and deadlines. Additionally, it should specify the rights and responsibilities of each party, including confidentiality agreements and termination conditions. Having these details in writing helps prevent misunderstandings and ensures both parties are aligned.

Yes, a part-time employee can be classified as a 1099 contractor. This status allows them to work on a flexible basis without the same obligations as full-time employees. It's important to draft a Maine Contract for Part-Time Assistance from Independent Contractor to establish the terms of this relationship clearly, outlining services, payment, and responsibilities.