This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

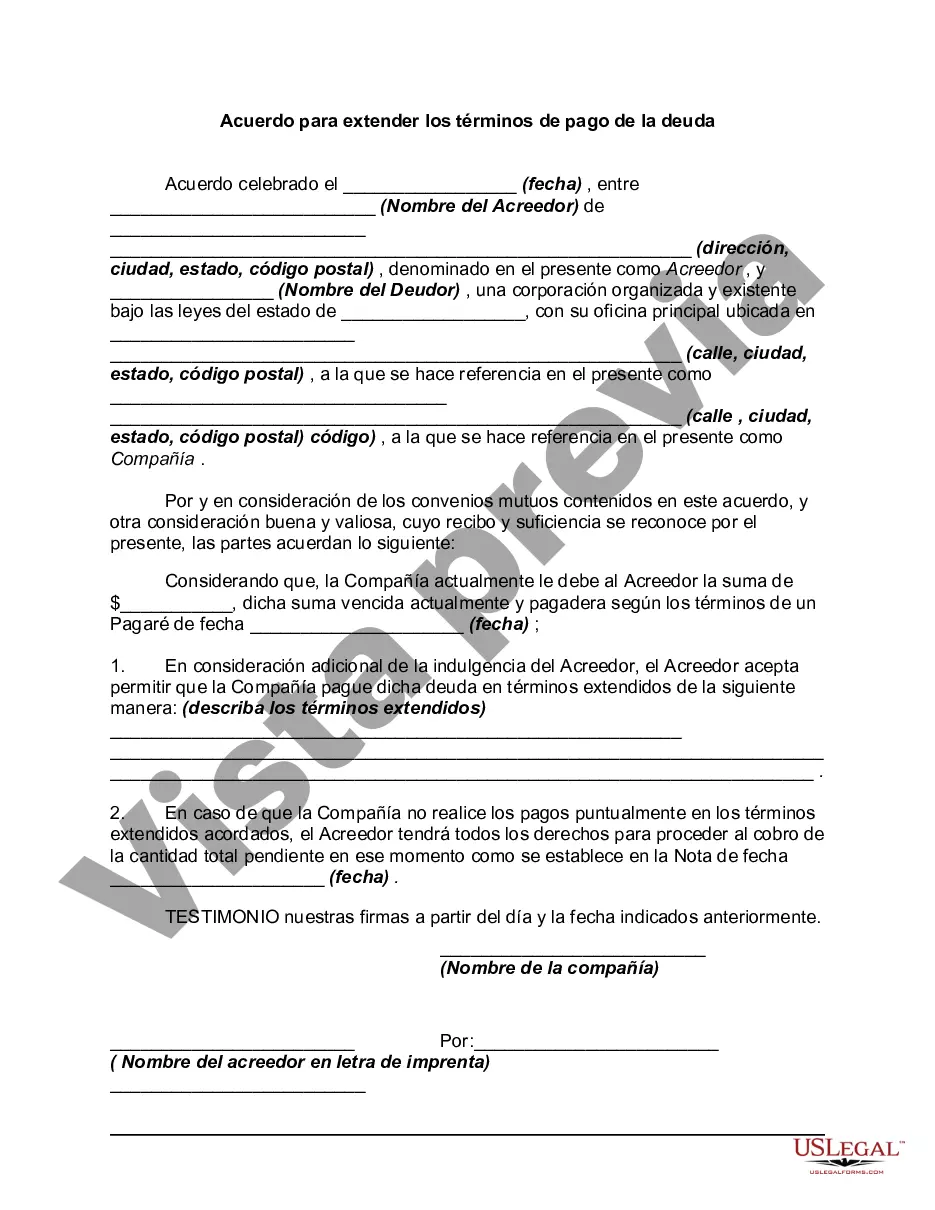

Maine Agreement to Extend Debt Payment Terms is a legally binding document that outlines the terms and conditions between a debtor and a creditor in the state of Maine, when the debtor is unable to make timely debt payments and seeks an extension to repay the debt over an extended period. This agreement is aimed at providing a structured framework for renegotiating debt terms and ensuring mutually agreeable solutions for debtors facing financial hardships. The Maine Agreement to Extend Debt Payment Terms generally outlines the following key information: 1. Parties Involved: The agreement identifies the debtor and the creditor, including their legal names and contact information. 2. Debt Details: The agreement specifies the details of the debt, such as the outstanding amount, the original terms of the debt, the due dates, and any additional fees or penalties incurred. 3. Extension Period: This section specifies the duration of the extension requested by the debtor. The agreement lists a new repayment schedule, which may include revised monthly installments or a lump-sum payment at the end of the extension. 4. Interest and Fees: The agreement may address whether any interest or fees will be charged on the extended debt. It can also mention whether the accrued interest during the extension period is added to the total amount owed or treated separately. 5. Termination and Default: The agreement defines the conditions under which the agreement may be terminated, such as non-compliance with the terms outlined. It also explains the consequences of default, including potential legal action or the acceleration of debt payment. 6. Release of Claims: This section may mention that the creditor agrees to release any legal claims against the debtor as long as the terms of the agreement are adhered to. Different types of Maine Agreement to Extend Debt Payment Terms may include: 1. Personal Loan Extension Agreement: This agreement applies when an individual borrower seeks an extension to repay a personal loan to a lending institution or an individual. 2. Credit Card Debt Extension Agreement: This agreement is specific to the extension of credit card debt, where the debtor negotiates new terms with the credit card company. 3. Business Debt Extension Agreement: This agreement is relevant when a business entity, such as a company or partnership, needs to negotiate an extension on its outstanding debts with its creditors. Overall, Maine Agreement to Extend Debt Payment Terms serves as a protective legal tool that allows debtors to address their financial struggles while providing a mechanism for creditors to recoup outstanding debt over an extended period of time. It is crucial for both parties to carefully review and assess the terms before signing the agreement to ensure fair and practical terms for debt repayment. This document helps maintain transparency and accountability in debt negotiations while assisting debtors in regaining financial stability.Maine Agreement to Extend Debt Payment Terms is a legally binding document that outlines the terms and conditions between a debtor and a creditor in the state of Maine, when the debtor is unable to make timely debt payments and seeks an extension to repay the debt over an extended period. This agreement is aimed at providing a structured framework for renegotiating debt terms and ensuring mutually agreeable solutions for debtors facing financial hardships. The Maine Agreement to Extend Debt Payment Terms generally outlines the following key information: 1. Parties Involved: The agreement identifies the debtor and the creditor, including their legal names and contact information. 2. Debt Details: The agreement specifies the details of the debt, such as the outstanding amount, the original terms of the debt, the due dates, and any additional fees or penalties incurred. 3. Extension Period: This section specifies the duration of the extension requested by the debtor. The agreement lists a new repayment schedule, which may include revised monthly installments or a lump-sum payment at the end of the extension. 4. Interest and Fees: The agreement may address whether any interest or fees will be charged on the extended debt. It can also mention whether the accrued interest during the extension period is added to the total amount owed or treated separately. 5. Termination and Default: The agreement defines the conditions under which the agreement may be terminated, such as non-compliance with the terms outlined. It also explains the consequences of default, including potential legal action or the acceleration of debt payment. 6. Release of Claims: This section may mention that the creditor agrees to release any legal claims against the debtor as long as the terms of the agreement are adhered to. Different types of Maine Agreement to Extend Debt Payment Terms may include: 1. Personal Loan Extension Agreement: This agreement applies when an individual borrower seeks an extension to repay a personal loan to a lending institution or an individual. 2. Credit Card Debt Extension Agreement: This agreement is specific to the extension of credit card debt, where the debtor negotiates new terms with the credit card company. 3. Business Debt Extension Agreement: This agreement is relevant when a business entity, such as a company or partnership, needs to negotiate an extension on its outstanding debts with its creditors. Overall, Maine Agreement to Extend Debt Payment Terms serves as a protective legal tool that allows debtors to address their financial struggles while providing a mechanism for creditors to recoup outstanding debt over an extended period of time. It is crucial for both parties to carefully review and assess the terms before signing the agreement to ensure fair and practical terms for debt repayment. This document helps maintain transparency and accountability in debt negotiations while assisting debtors in regaining financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.