Maine Nondisclosure Agreements (NDAs) Regarding Purchase of Business are legally binding contracts used to protect sensitive information during the negotiation and due diligence process of buying or selling a business. These agreements ensure that any confidential or proprietary information shared between the parties involved remains confidential and cannot be disclosed to third parties without prior consent. In Maine, there are two primary types of Nondisclosure Agreements specifically tailored for the purchase of a business: Unilateral Nondisclosure Agreement and Mutual Nondisclosure Agreement. 1. Unilateral Nondisclosure Agreement: This type of agreement is used when only one party needs to disclose confidential information to the other. For instance, if a potential buyer wants to review financial statements, customer lists, trade secrets, or other sensitive information, they would sign a Unilateral Nondisclosure Agreement. This protects the disclosing party's proprietary information from being shared or used by the receiving party for any purposes other than the intended business transaction. 2. Mutual Nondisclosure Agreement: A Mutual Nondisclosure Agreement is used when both parties will be sharing confidential information with one another. It establishes a two-way commitment to keeping the disclosed information confidential. This type of agreement is commonly used during negotiations where the buyer may also be interested in sharing their own confidential financial data, business plans, or strategic details with the seller. Maine Nondisclosure Agreements typically include several key elements: 1. Confidential Information: The agreement should clearly define what information is considered confidential. This may include financial records, customer data, trade secrets, intellectual property, marketing strategies, and any other proprietary information related to the business. 2. Purpose of Disclosure: It outlines the specific purpose for which the confidential information is being shared. For instance, due diligence for potential acquisition, evaluation of a joint venture or partnership, or discussions related to the transaction. 3. Non-Disclosure Obligations: The agreement specifies the recipient's obligations not to disclose any confidential information and further restricts them from using the information for any purpose other than the specified transaction. 4. Time Limitations: It sets forth the duration of the NDA and the period during which the confidentiality obligations apply. Typically, this period extends beyond the conclusion of the transaction to ensure long-term protection of sensitive information. 5. Remedies for Breach: The agreement details the consequences of breaching the NDA, including possible injunctions, damages, or other legal remedies. Maine Nondisclosure Agreements Regarding Purchase of Business are crucial tools to safeguard the confidentiality of information during business negotiations. They protect the parties involved and provide a legal framework to ensure that proprietary knowledge remains confidential, mitigating the risk of unauthorized use or disclosure.

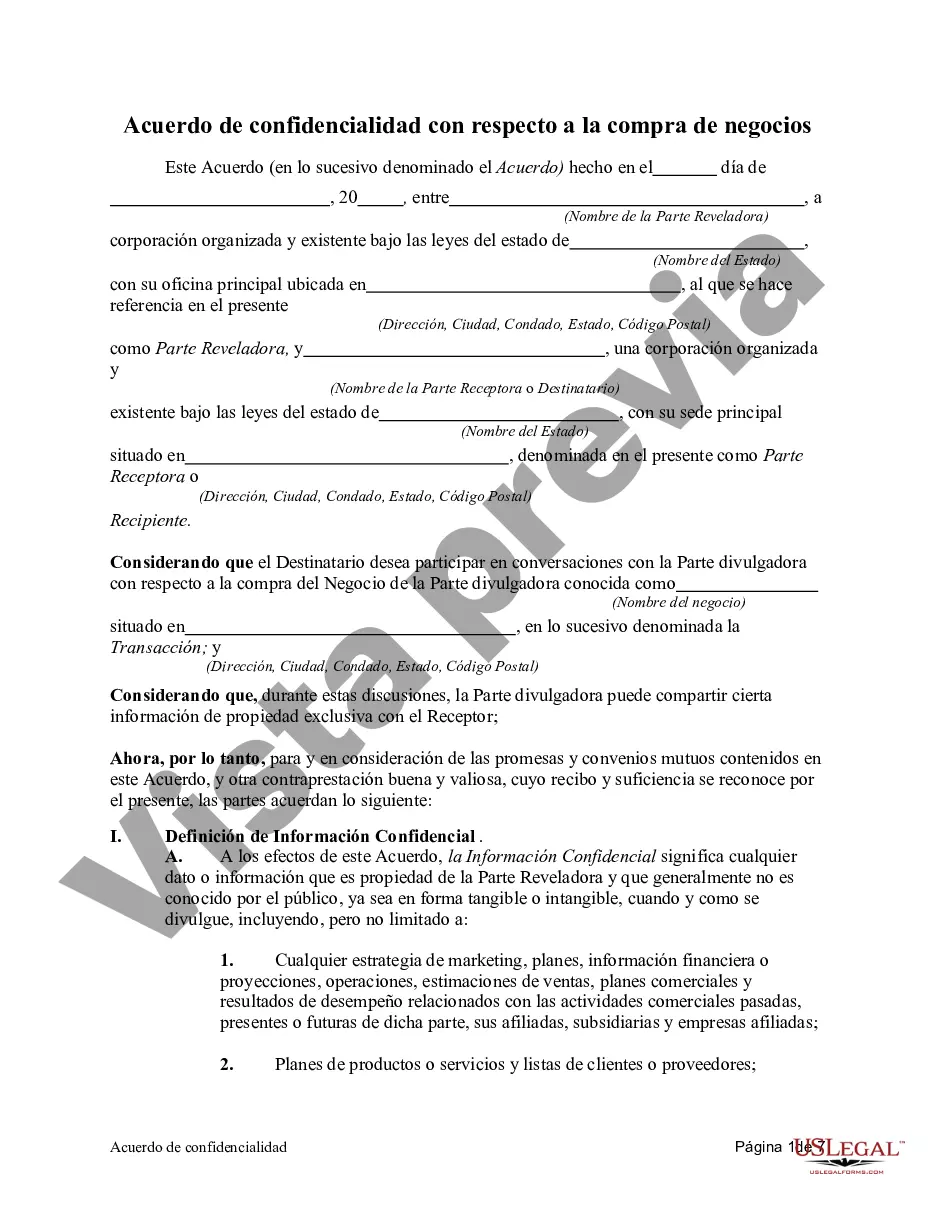

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Acuerdo de confidencialidad con respecto a la compra de negocios - Nondisclosure Agreement Regarding Purchase of Business

Description

How to fill out Maine Acuerdo De Confidencialidad Con Respecto A La Compra De Negocios?

If you need to complete, obtain, or printing legal record themes, use US Legal Forms, the greatest assortment of legal forms, which can be found on the web. Take advantage of the site`s easy and hassle-free search to find the paperwork you will need. Different themes for company and personal reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Maine Nondisclosure Agreement Regarding Purchase of Business with a handful of click throughs.

Should you be previously a US Legal Forms client, log in to your accounts and then click the Obtain button to have the Maine Nondisclosure Agreement Regarding Purchase of Business. Also you can accessibility forms you earlier acquired inside the My Forms tab of your respective accounts.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate metropolis/region.

- Step 2. Utilize the Review method to examine the form`s content material. Don`t neglect to read through the description.

- Step 3. Should you be unsatisfied with the form, make use of the Lookup discipline towards the top of the display to discover other versions of the legal form design.

- Step 4. Upon having discovered the form you will need, click on the Acquire now button. Choose the prices prepare you prefer and put your credentials to sign up for an accounts.

- Step 5. Method the deal. You can use your bank card or PayPal accounts to finish the deal.

- Step 6. Select the format of the legal form and obtain it on your device.

- Step 7. Total, change and printing or sign the Maine Nondisclosure Agreement Regarding Purchase of Business.

Every legal record design you acquire is yours forever. You might have acces to every single form you acquired inside your acccount. Select the My Forms portion and decide on a form to printing or obtain again.

Compete and obtain, and printing the Maine Nondisclosure Agreement Regarding Purchase of Business with US Legal Forms. There are many specialist and status-distinct forms you can utilize for your company or personal needs.