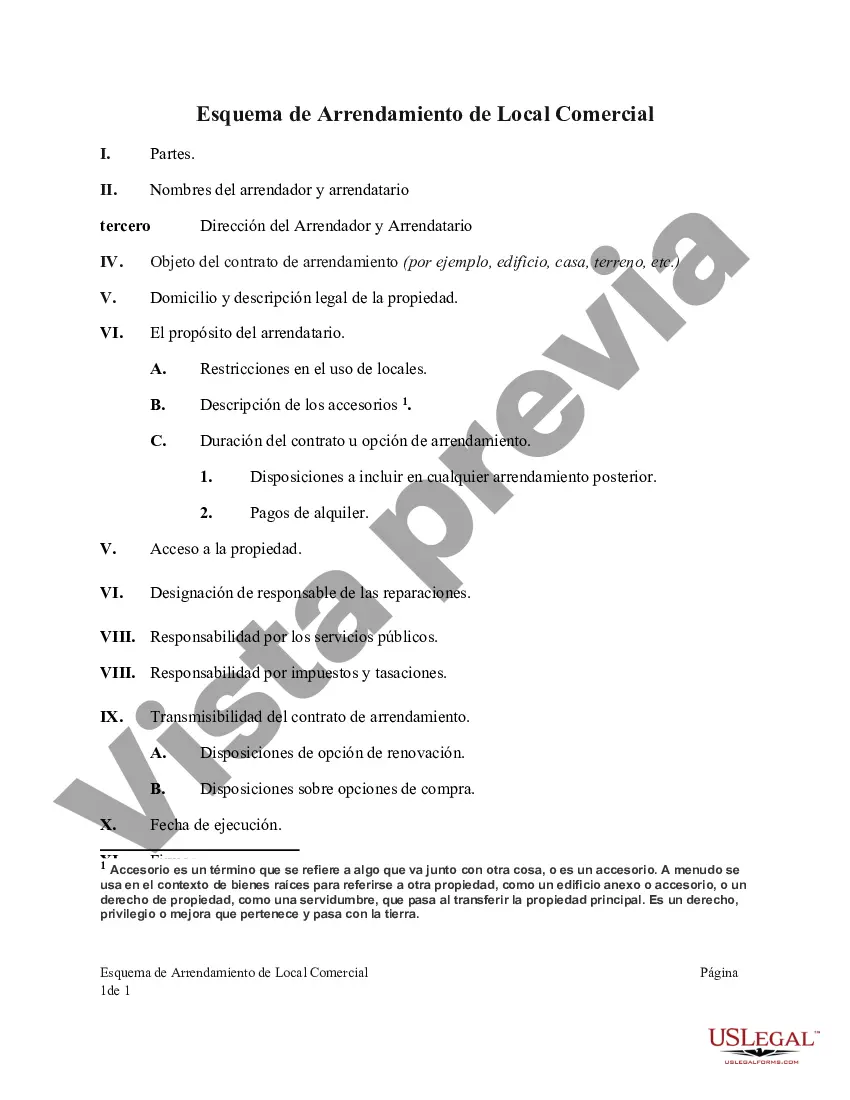

Maine Outline of Lease of Business Premises: A Comprehensive Guide to Commercial Property Rental Agreements Introduction: The Maine Outline of Lease of Business Premises is a vital document that outlines the terms and conditions for renting commercial properties within the state of Maine. It serves as a legal agreement between the landlord and the tenant, highlighting their responsibilities and rights throughout the lease term. This detailed description will provide insights into the key elements and types of lease agreements commonly used in Maine. Key Elements of a Maine Lease of Business Premises: 1. Parties: Clearly identifies the landlord and the tenant involved in the lease agreement, including their legal names and addresses. 2. Premises Description: Provides a detailed description of the commercial property, including its address, square footage, and any additional amenities or facilities available. 3. Lease Term: Specifies the duration of the lease, whether it is a fixed-term lease (e.g., one year) or a periodic lease (e.g., month-to-month). 4. Rent and Additional Fees: Outlines the annual base rent amount, due dates, acceptable payment methods, and any additional fees or charges like common area maintenance (CAM) fees or utilities. 5. Security Deposit: States the amount of the security deposit required, the terms of its refund or application, and any interest earned on the deposit. 6. Permitted Use: Defines the allowable commercial activities or purposes that the tenant can conduct on the premises. 7. Maintenance and Repairs: Specifies the responsibilities of both the landlord and the tenant concerning property maintenance, repairs, and who bears associated costs. 8. Alterations and Improvements: Outlines the procedures and permissions required for the tenant to make alterations or improvements to the premises during the lease term. 9. Insurance: Highlights the insurance requirements for both parties, including liability insurance, property insurance, and any other specific coverage necessary. 10. Default and Termination: Covers the consequences of default by either party, including the right to cure defaults, termination rights, and potential penalties. 11. Renewal and Assignment: Explores the options for lease renewal, whether automatic or negotiable, and the conditions for assigning or subletting the premises. 12. Governing Law: Specifies that the lease agreement is subject to the laws of the state of Maine. Types of Maine Lease of Business Premises: 1. Gross Lease: In this type of lease, the tenant typically pays a single fixed amount of rent, and the landlord is responsible for covering operating expenses such as property taxes, insurance, and maintenance. 2. Net Lease: With a net lease, the tenant pays a base rent along with additional charges for a share of property taxes, insurance, and maintenance expenses. 3. Modified Gross Lease: This lease type combines features of both gross and net leases, where the landlord and the tenant negotiate and agree upon a sharing arrangement for expenses. 4. Triple Net Lease: In a triple net lease, the tenant is responsible for paying the base rent along with all operating expenses, including property taxes, insurance premiums, and costs of maintenance. 5. Percentage Lease: This type of lease is commonly used for retail properties, where the tenant pays a base rent along with a specified percentage of their sales revenue. Conclusion: Understanding the intricacies of a Maine Outline of Lease of Business Premises is crucial for both landlords and tenants in order to protect their interests and ensure a mutually beneficial relationship. It is recommended to consult with legal professionals familiar with Maine's specific laws and regulations to draft or review the lease agreement accurately and comprehensively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Esquema de Arrendamiento de Local Comercial - Outline of Lease of Business Premises

Description

How to fill out Maine Esquema De Arrendamiento De Local Comercial?

If you have to complete, acquire, or produce legal document web templates, use US Legal Forms, the largest collection of legal kinds, that can be found online. Use the site`s easy and practical look for to obtain the paperwork you will need. Different web templates for business and individual purposes are sorted by categories and claims, or search phrases. Use US Legal Forms to obtain the Maine Outline of Lease of Business Premises within a few clicks.

Should you be presently a US Legal Forms consumer, log in to your profile and click the Down load switch to have the Maine Outline of Lease of Business Premises. You can even access kinds you earlier saved from the My Forms tab of your profile.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the correct metropolis/land.

- Step 2. Make use of the Preview choice to look over the form`s content. Do not overlook to read the information.

- Step 3. Should you be not satisfied with all the type, use the Look for industry near the top of the screen to locate other types from the legal type web template.

- Step 4. After you have found the shape you will need, click on the Buy now switch. Pick the pricing prepare you choose and add your qualifications to sign up for the profile.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Choose the file format from the legal type and acquire it in your device.

- Step 7. Total, edit and produce or sign the Maine Outline of Lease of Business Premises.

Each and every legal document web template you buy is the one you have for a long time. You might have acces to every single type you saved with your acccount. Select the My Forms area and decide on a type to produce or acquire once more.

Compete and acquire, and produce the Maine Outline of Lease of Business Premises with US Legal Forms. There are many professional and state-certain kinds you can use for the business or individual needs.