A Maine Promissory Note and Security Agreement is a legal document that outlines the terms and conditions of a sale for an automobile between two individuals. This agreement protects both the buyer and the seller by clearly defining their rights and obligations throughout the transaction process. It serves as a binding contract and ensures that both parties are aware of their responsibilities. A Promissory Note is a written promise to repay a certain amount of money within a specified period. In the context of an automobile sale, it outlines the details of the financial arrangement between the buyer and seller. This document typically includes information such as the total purchase price, payment schedule, interest rate (if applicable), and consequences for late or missed payments. A Security Agreement, on the other hand, is a document that serves as collateral for the loan or promise of payment made in the Promissory Note. It establishes a lien on the automobile, giving the seller the right to repossess the vehicle in case the buyer fails to fulfill their payment obligations as agreed upon. In Maine, there are various types of Promissory Note and Security Agreement forms available to cater to different circumstances. Some common types include: 1. Simple Promissory Note and Security Agreement: This is the standard form used for straightforward automobile sales. It includes basic terms related to the purchase price, payment schedule, and vehicle details. 2. Conditional Sales Agreement: This type of agreement specifies certain conditions that must be met for the sale to be finalized. For instance, it may state that the buyer will assume full ownership of the vehicle only after completing all payments. 3. Installment Sale Agreement: This agreement divides the total purchase price into smaller installment payments over a specific period. It usually includes an interest component, allowing the seller to earn additional income. 4. Balloon Payment Promissory Note: In this type of agreement, the buyer makes regular installment payments for a specified period, with a larger "balloon" payment due at the end. This option is often chosen by individuals looking to lower their monthly payments and planning to pay a lump sum later. Regardless of the specific type, it is crucial to consult an attorney to ensure the Promissory Note and Security Agreement meet all legal requirements in Maine. This will help protect the interests of both the buyer and seller throughout the automobile sales transaction.

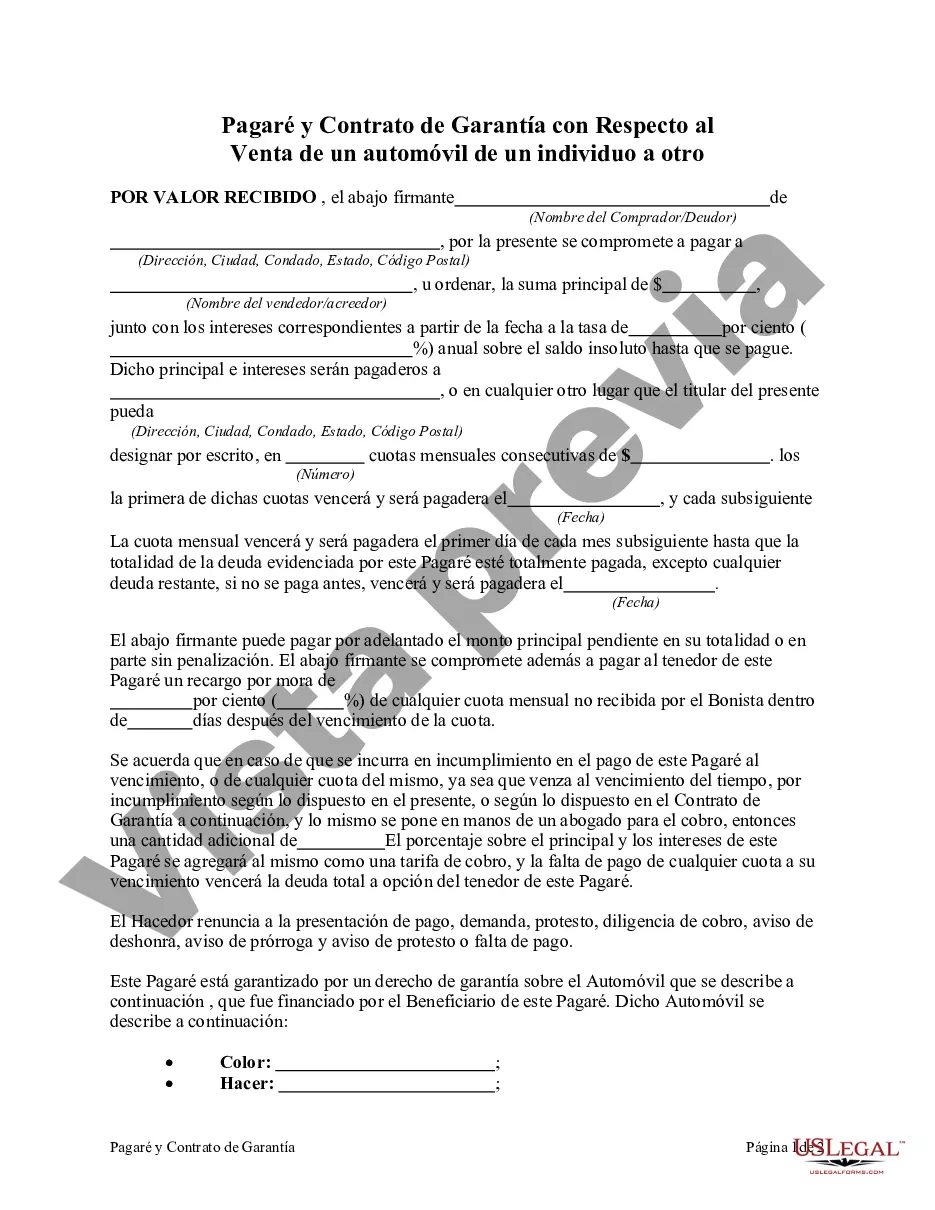

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Maine Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

Have you been within a situation that you need to have documents for possibly organization or specific uses nearly every working day? There are tons of legal papers themes available on the Internet, but getting ones you can rely on is not effortless. US Legal Forms provides thousands of develop themes, such as the Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, which are written to fulfill state and federal specifications.

Should you be previously familiar with US Legal Forms site and have a free account, basically log in. Following that, you can down load the Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another web template.

Should you not come with an bank account and want to begin using US Legal Forms, abide by these steps:

- Get the develop you require and ensure it is for your correct metropolis/county.

- Utilize the Preview button to check the shape.

- See the description to actually have selected the appropriate develop.

- When the develop is not what you`re seeking, utilize the Look for industry to get the develop that fits your needs and specifications.

- When you get the correct develop, click Purchase now.

- Choose the prices plan you desire, fill in the required info to make your bank account, and purchase the order utilizing your PayPal or bank card.

- Choose a convenient data file format and down load your version.

Find all the papers themes you possess bought in the My Forms food selection. You can obtain a extra version of Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another any time, if possible. Just click on the required develop to down load or printing the papers web template.

Use US Legal Forms, the most considerable variety of legal kinds, to save lots of efforts and steer clear of faults. The services provides appropriately manufactured legal papers themes that you can use for a selection of uses. Generate a free account on US Legal Forms and start producing your life a little easier.