Maine Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal paper templates that you can purchase or create.

By using the site, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of templates such as the Maine Covenant Not to Sue by the Widow of a Deceased Stockholder within seconds.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the appropriate one.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred payment plan and enter your information to create an account.

- If you have an account, Log In to download the Maine Covenant Not to Sue by Widow of Deceased Stockholder from the US Legal Forms database.

- The Download button will appear on each form you view.

- All your previously obtained forms are accessible in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these simple instructions to begin.

- Ensure you have chosen the correct form for your city/county.

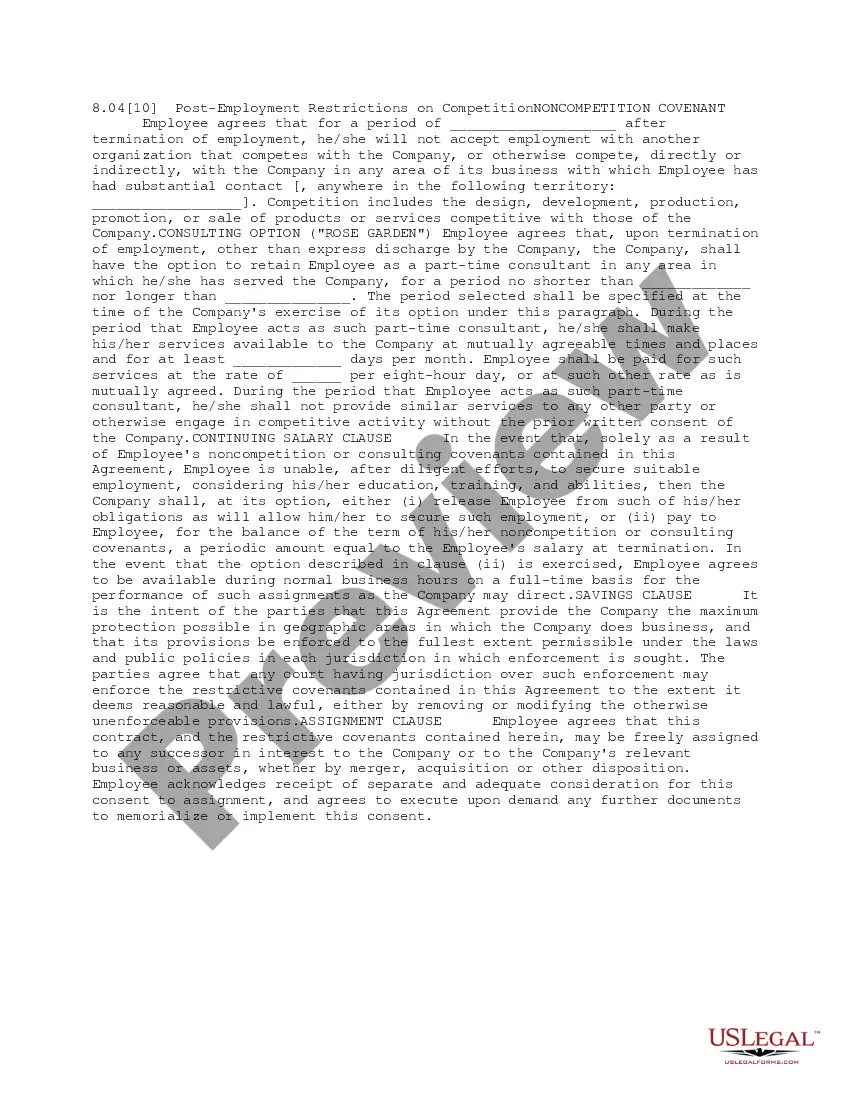

- Click the Preview button to review the form's content.

Form popularity

FAQ

Yes, you can navigate around probate through methods like joint ownership and beneficiary designations. For instance, assets titled jointly with rights of survivorship can bypass probate. Implementing a Maine Covenant Not to Sue by Widow of Deceased Stockholder may also streamline processes related to your estate. Each option comes with its nuances, so it's wise to evaluate your choices carefully.