Maine Debt Adjustment Agreement with Creditor is a legally binding agreement entered into by an individual or business that is struggling with debt and their creditor(s). This agreement aims to establish a structured repayment plan for the debts owed, providing the debtor with an opportunity to regain financial stability. The Maine Debt Adjustment Agreement with Creditor typically involves negotiations between the debtor and creditor(s) to reach a mutually acceptable agreement on payment terms, interest rates, and timeline for repayment. This agreement helps prevent the debtor from facing more severe consequences such as bankruptcy or legal action by the creditor(s). There are different types of Maine Debt Adjustment Agreements with Creditor, based on the specific circumstances and the needs of the debtor. Some common types include: 1. Lump-Sum Payment Agreement: This type of agreement involves the debtor paying a predetermined lump sum amount to the creditor(s), typically as a settlement of the outstanding debt. This option is often used when the debtor is able to secure a significant amount of funds to expedite debt repayment. 2. Installment Payment Agreement: With an installment payment agreement, the debtor and creditor(s) agree upon a fixed monthly payment amount to be made over an agreed-upon period. This allows the debtor to repay the debt gradually, without causing additional financial strain. 3. Reduced Interest Rate Agreement: In this type of agreement, the creditor(s) agrees to lower the interest rate on the debt owed, making it more manageable for the debtor to repay. This can significantly reduce the overall repayment amount and accelerate debt clearance. 4. Debt Consolidation Agreement: A debt consolidation agreement involves combining multiple debts into a single, more manageable loan or line of credit. This allows the debtor to streamline their repayment process, often with a lower interest rate and extended repayment term. 5. Debt Settlement Agreement: A debt settlement agreement is reached when the debtor negotiates with the creditor(s) to settle the debt for a lesser amount than what is originally owed. This option is typically pursued when the debtor is experiencing extreme financial hardship and is unable to repay the full debt. It is essential for debtors considering a Maine Debt Adjustment Agreement with Creditor to consult with a qualified debt counselor or legal professional. These experts can provide guidance, negotiate on behalf of the debtor, and ensure that the agreement is fair and suitable for the debtor's financial circumstances.

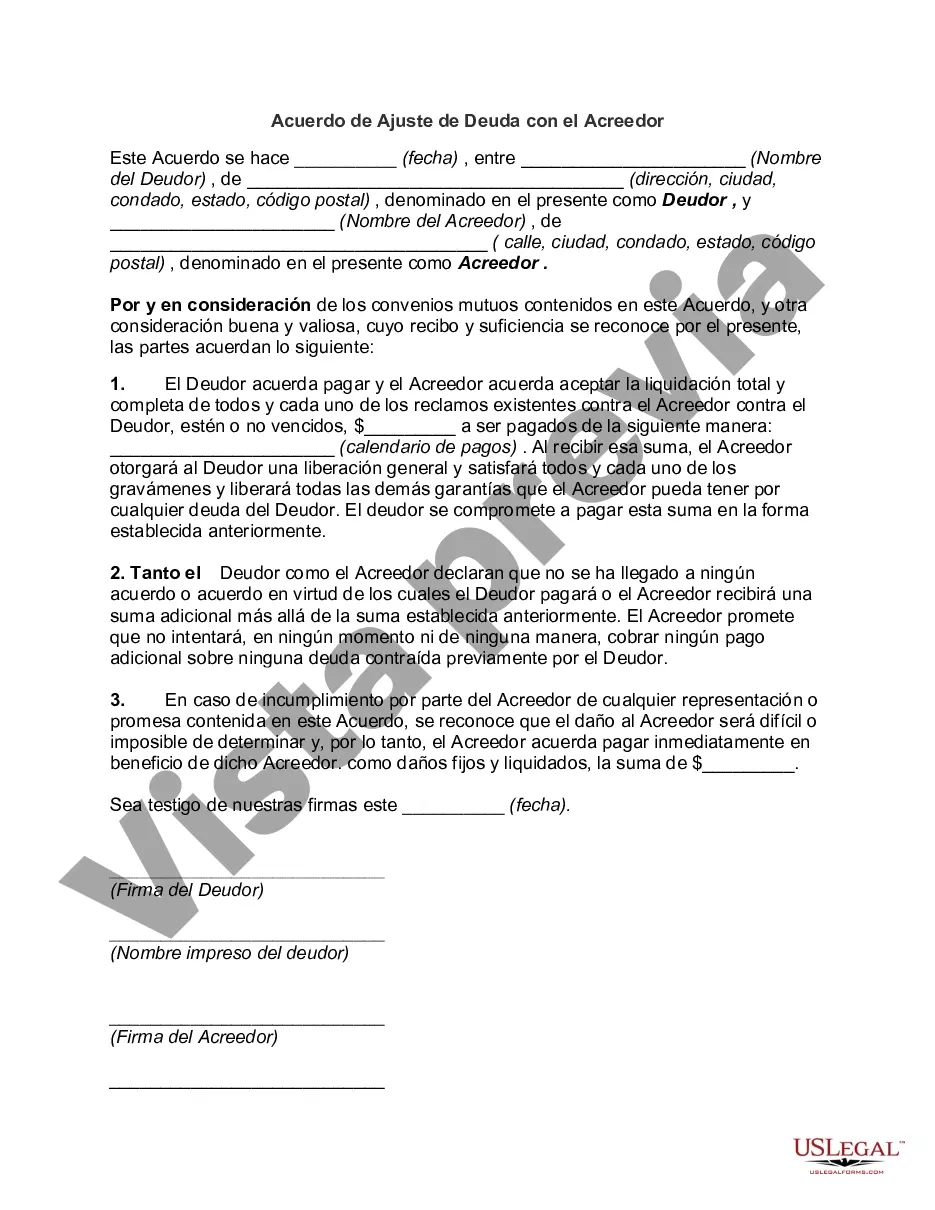

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Maine Acuerdo De Ajuste De Deuda Con El Acreedor?

Are you presently inside a position the place you require papers for possibly organization or person purposes virtually every day? There are tons of legitimate record layouts accessible on the Internet, but discovering types you can trust is not effortless. US Legal Forms gives a huge number of form layouts, much like the Maine Debt Adjustment Agreement with Creditor, that are composed in order to meet state and federal requirements.

When you are previously informed about US Legal Forms web site and possess your account, simply log in. After that, you can acquire the Maine Debt Adjustment Agreement with Creditor format.

If you do not provide an accounts and want to start using US Legal Forms, abide by these steps:

- Get the form you will need and make sure it is for the right metropolis/area.

- Use the Preview button to examine the form.

- Browse the information to actually have chosen the right form.

- In case the form is not what you`re trying to find, utilize the Lookup discipline to obtain the form that meets your requirements and requirements.

- Once you discover the right form, simply click Acquire now.

- Pick the rates strategy you need, complete the necessary information to make your bank account, and pay money for the order utilizing your PayPal or charge card.

- Choose a practical document file format and acquire your copy.

Discover all the record layouts you may have purchased in the My Forms food selection. You can get a further copy of Maine Debt Adjustment Agreement with Creditor whenever, if necessary. Just go through the necessary form to acquire or print out the record format.

Use US Legal Forms, the most extensive variety of legitimate types, to save lots of efforts and steer clear of mistakes. The assistance gives professionally created legitimate record layouts which can be used for an array of purposes. Generate your account on US Legal Forms and initiate producing your way of life easier.