Maine Debt Settlement Offer in Response to Creditor's Proposal: A Detailed Description and Types When facing overwhelming debt, individuals in Maine can explore debt settlement as an option to negotiate with creditors and alleviate financial burden. A debt settlement offer is a proposal made by a debtor to their creditor(s) in order to reach a mutual agreement on repayment terms that are more manageable. Maine's debt settlement offers typically involve the negotiation of a reduced and more affordable payment amount, favorable interest rates, or a lump-sum settlement. The goal is to find a compromise between the debtor's financial capabilities and the creditor's desire to recover a substantial portion of the debt owed. There are different types of debt settlement offers that individuals in Maine can consider when responding to a creditor's proposal: 1. Lump-Sum Offer: This type of settlement offer involves the debtor proposing a one-time payment to the creditor to settle the debt. Often, creditors are willing to accept a lower amount than the total owed if it means getting paid immediately. 2. Installment Plan: In some cases, debtors may propose an installment plan to creditors, outlining a structured repayment schedule where they can make regular monthly payments over an extended period of time. This option allows debtors to pay off their debt gradually while providing creditors with some assurance of repayment. 3. Reduced Balance Settlement: A debtor may offer to settle the debt by proposing a reduced overall balance as the full settlement amount. This option can be appealing to both parties, as debtors may find it more affordable, and creditors can recover a significant portion of the debt without chasing down the debtor for extended periods. 4. Interest Rate Reduction: Debtors may request a reduction in the interest rates applied to their outstanding debt through a settlement offer. By lowering the interest rates, debtors can pay off the debt more efficiently and ultimately save money in the long run. When responding to a creditor's proposal for debt settlement in Maine, it is crucial for debtors to carefully review their financial situation, assess their ability to make payments, and consult with a reputable debt settlement company or a qualified attorney. These professionals can provide guidance, negotiate on behalf of the debtor, and ensure the debtor's rights are protected throughout the settlement process. In conclusion, a Maine debt settlement offer in response to a creditor's proposal is a negotiation strategy used to reach a mutual agreement between a debtor and creditor. It aims to provide debtors with more manageable repayment terms. The different types of settlement offers include lump-sum payments, installment plans, reduced balance settlements, and interest rate reductions. Seeking professional advice is highly recommended navigating the debt settlement process effectively and ensure favorable outcomes for all parties involved.

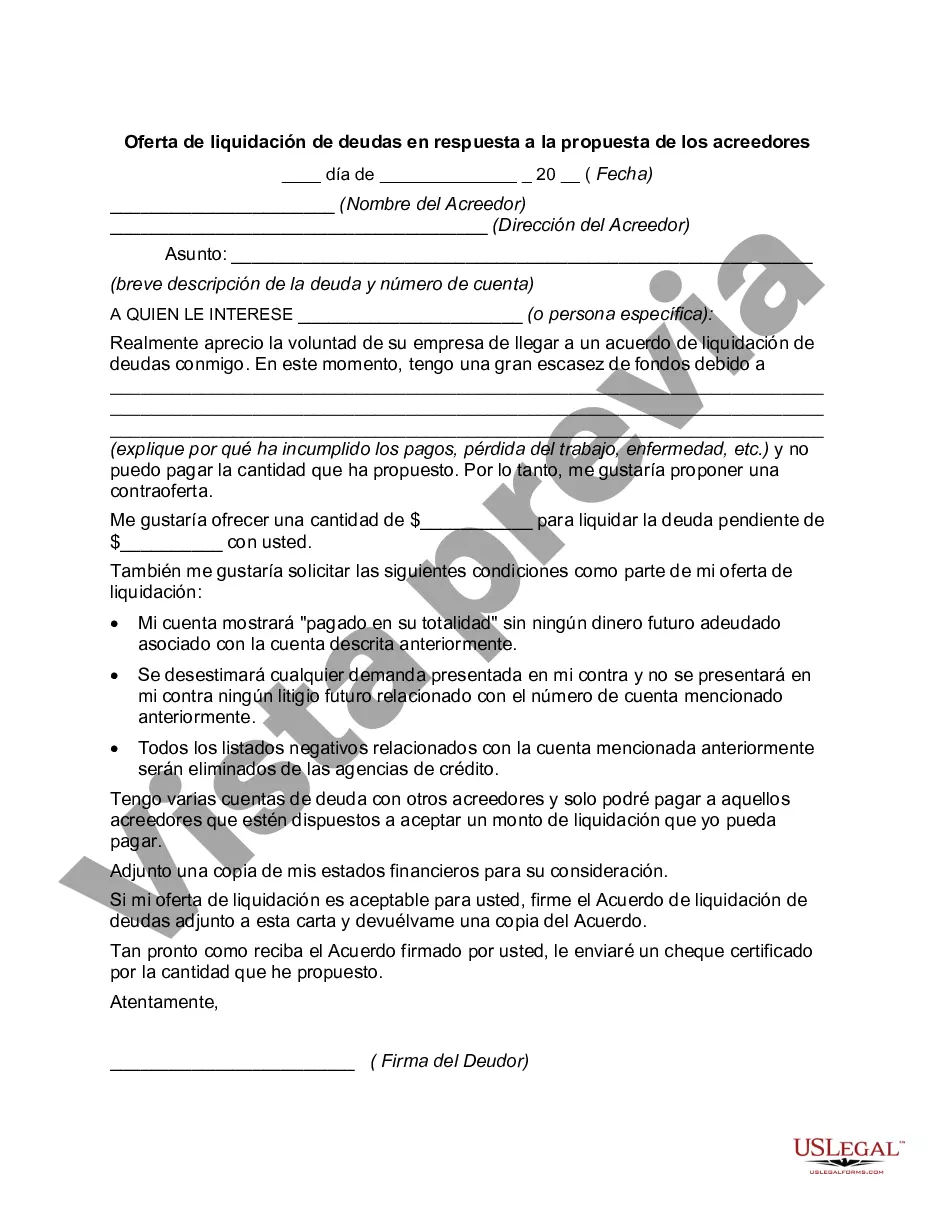

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Maine Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Are you in the place in which you need documents for both organization or specific uses nearly every day? There are tons of authorized record themes accessible on the Internet, but getting ones you can rely isn`t straightforward. US Legal Forms delivers a large number of type themes, like the Maine Debt Settlement Offer in Response to Creditor's Proposal, which can be published to fulfill federal and state needs.

Should you be presently acquainted with US Legal Forms internet site and possess a merchant account, basically log in. Next, you may down load the Maine Debt Settlement Offer in Response to Creditor's Proposal design.

Unless you come with an account and need to begin to use US Legal Forms, follow these steps:

- Obtain the type you want and make sure it is for the appropriate metropolis/area.

- Utilize the Review switch to examine the shape.

- Browse the description to ensure that you have selected the appropriate type.

- When the type isn`t what you`re looking for, make use of the Lookup industry to discover the type that suits you and needs.

- Whenever you get the appropriate type, click on Get now.

- Opt for the prices prepare you need, fill in the required details to produce your money, and pay money for the transaction using your PayPal or credit card.

- Select a convenient document file format and down load your backup.

Discover every one of the record themes you might have bought in the My Forms food selection. You can get a additional backup of Maine Debt Settlement Offer in Response to Creditor's Proposal any time, if possible. Just click the essential type to down load or printing the record design.

Use US Legal Forms, by far the most comprehensive collection of authorized kinds, to save lots of time and stay away from faults. The assistance delivers skillfully manufactured authorized record themes which can be used for a range of uses. Generate a merchant account on US Legal Forms and begin creating your daily life easier.