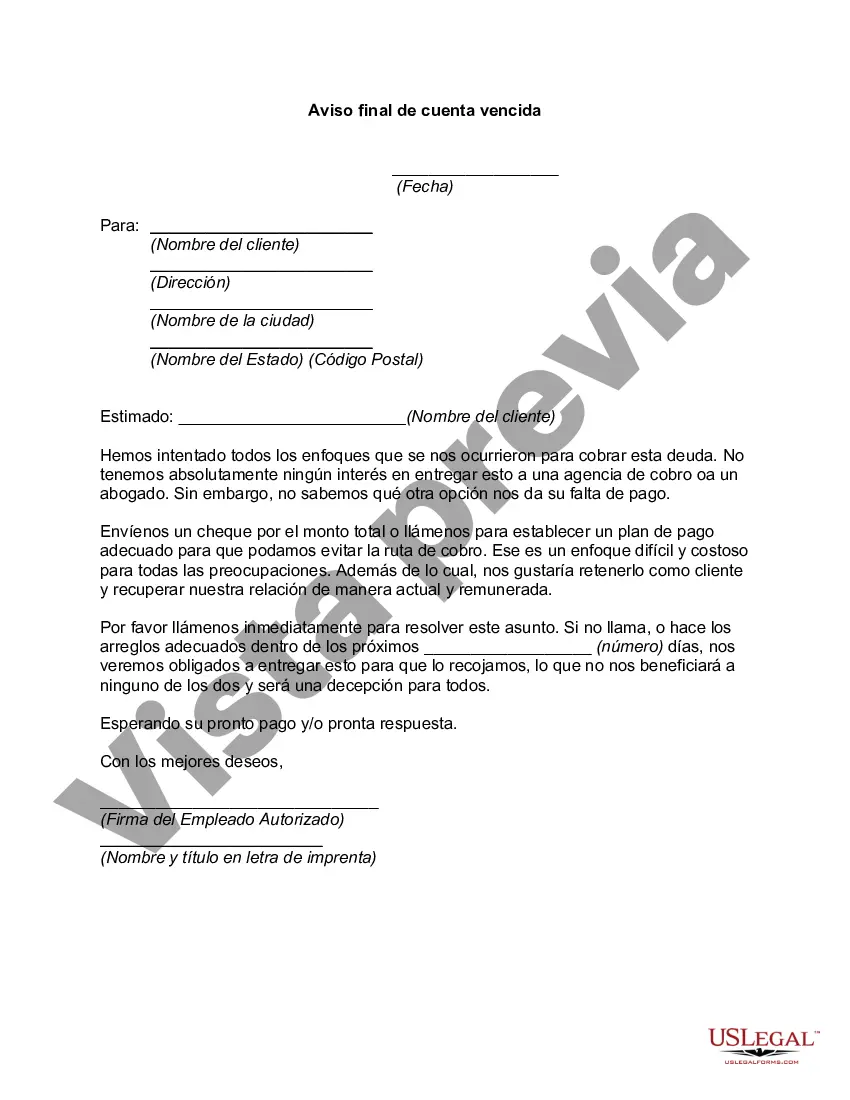

Title: Understanding the Maine Final Notice of Past Due Account: A Comprehensive Overview Keywords: Maine, Final Notice, Past Due Account, Payment Reminder, Debt Collection, Delinquency, Consequences, Due Date, Outstanding Balance. Introduction: Maine Final Notice of Past Due Account serves as a crucial communication tool between creditors and debtors in the state of Maine. It is essential to comprehend the purpose, importance, and potential consequences associated with receiving such a notice. Through this article, we delve into what the Maine Final Notice of Past Due Account entails and shed light on any different types that may exist. 1. Definition and Purpose: A Maine Final Notice of Past Due Account is an official communication sent by a creditor to a debtor. Its primary aim is to politely but firmly remind the debtor about the payment due date and the current status of their financial obligations. 2. Content of a Maine Final Notice of Past Due Account: Typically, a Maine Final Notice of Past Due Account includes the following: — Header or Subject Line: Clearly indicating the nature of the notice, including phrases like "Final Notice" and "Past Due Account." — Creditor Information: Includes the name, address, and contact details of the creditor. — Debtor Information: Comprises the debtor's name, contact information, and collection account number (if applicable). — Outstanding Balance: Highlights the exact amount owed by the debtor, inclusive of any late fees or interest charges. — Due Date Reminder: Reinforces the original due date for the payment, stressing the importance of immediate action. — Consequences: Outlines potential repercussions of non-payment, such as legal actions, credit rating impact, or additional collection fees. — Payment Options: Provides details of accepted payment methods, including online portals, over-the-phone, or mail-in instructions. — Contact Information: Offers multiple contact options for the debtor to resolve any queries, seek payment extension, or negotiate payment arrangements. 3. Importance and Consequences: Receiving a Maine Final Notice of Past Due Account implies that the debtor has failed to meet the payment deadline on their outstanding balance. Understanding and addressing this notice promptly is crucial to avoid severe consequences. These may include: — Damage to Credit Score: Non-payment can harm the debtor's credit history, making it difficult to secure future loans or credit. — Legal Actions: Continued non-payment might lead the creditor to pursue legal action against the debtor, potentially resulting in additional fines or seizure of assets. — Collection Agency Intervention: Creditors may involve third-party collection agencies to recover the outstanding balance, subjecting the debtor to increased collection fees. — Continued Communication: Ignoring the final notice could lead to further collections attempts through phone calls or follow-up letters. Types of Maine Final Notice of Past Due Account: While there may not be different types of Maine Final Notice of Past Due Account per se, creditors may modify their templates to suit their specific requirements. For instance, some businesses may choose to add urgency by using phrases like "Urgent Final Notice" or "Immediate Payment Required." Conclusion: Receiving a Maine Final Notice of Past Due Account indicates unpaid debts and emphasizes the necessity of prompt action. By understanding the content and potential consequences associated with this notice, debtors can take immediate steps to resolve their outstanding balance and maintain their financial credibility. Remember, timely communication with creditors can often lead to flexible repayment arrangements and prevent further complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Aviso final de cuenta vencida - Final Notice of Past Due Account

Description

How to fill out Maine Aviso Final De Cuenta Vencida?

Are you in the situation the place you will need papers for possibly organization or specific functions virtually every day? There are tons of lawful papers themes available on the net, but locating ones you can rely is not effortless. US Legal Forms delivers thousands of kind themes, like the Maine Final Notice of Past Due Account, that happen to be written to meet federal and state requirements.

Should you be previously knowledgeable about US Legal Forms site and possess your account, basically log in. Following that, you may acquire the Maine Final Notice of Past Due Account web template.

If you do not come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is to the right metropolis/region.

- Make use of the Preview key to analyze the form.

- Look at the explanation to actually have selected the appropriate kind.

- In the event the kind is not what you are trying to find, use the Look for industry to find the kind that meets your requirements and requirements.

- Whenever you obtain the right kind, just click Buy now.

- Opt for the prices strategy you need, complete the necessary information to make your account, and pay money for the transaction making use of your PayPal or charge card.

- Select a handy paper formatting and acquire your copy.

Find every one of the papers themes you may have purchased in the My Forms food list. You can aquire a additional copy of Maine Final Notice of Past Due Account anytime, if needed. Just select the required kind to acquire or produce the papers web template.

Use US Legal Forms, one of the most considerable assortment of lawful types, to save lots of efforts and stay away from blunders. The support delivers professionally manufactured lawful papers themes that you can use for an array of functions. Make your account on US Legal Forms and initiate making your lifestyle a little easier.