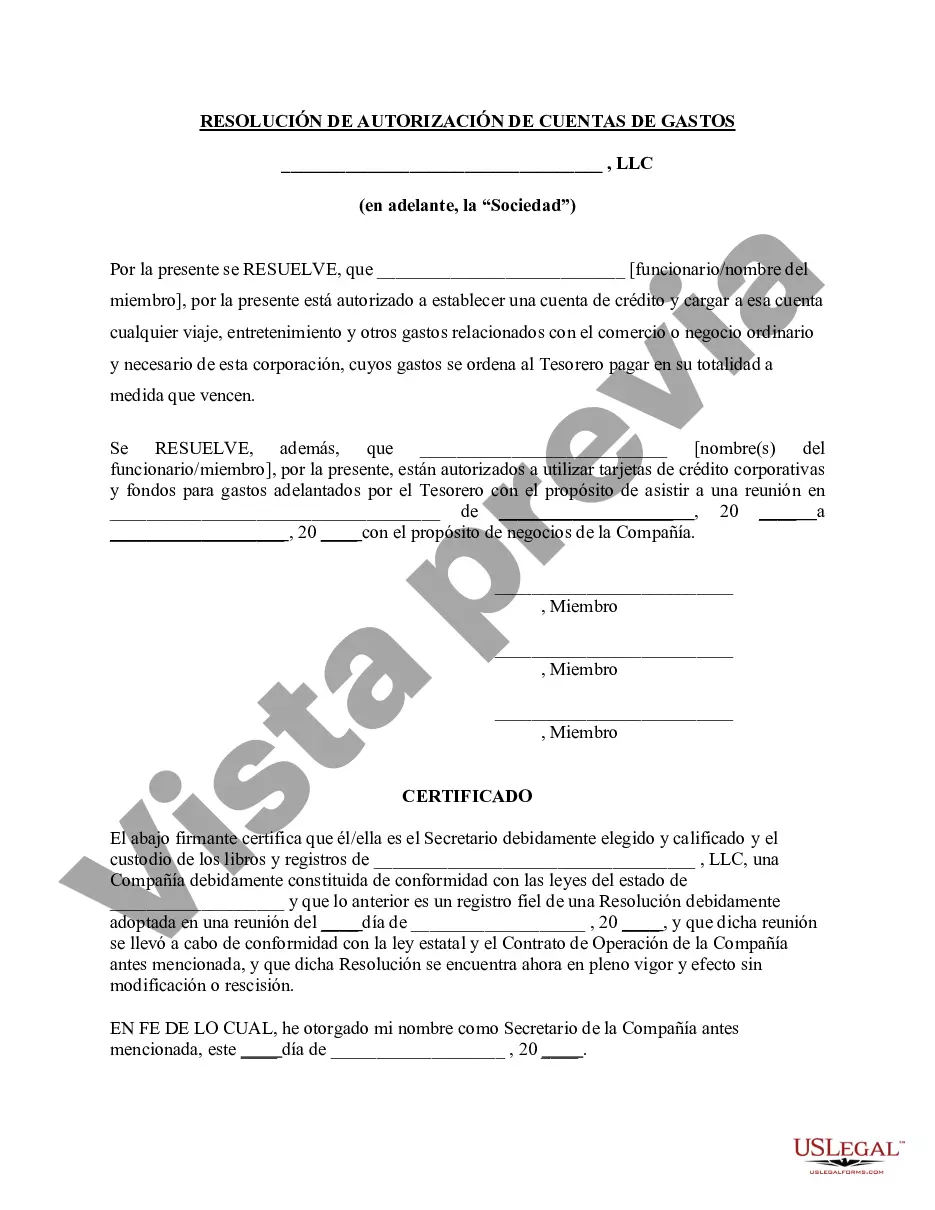

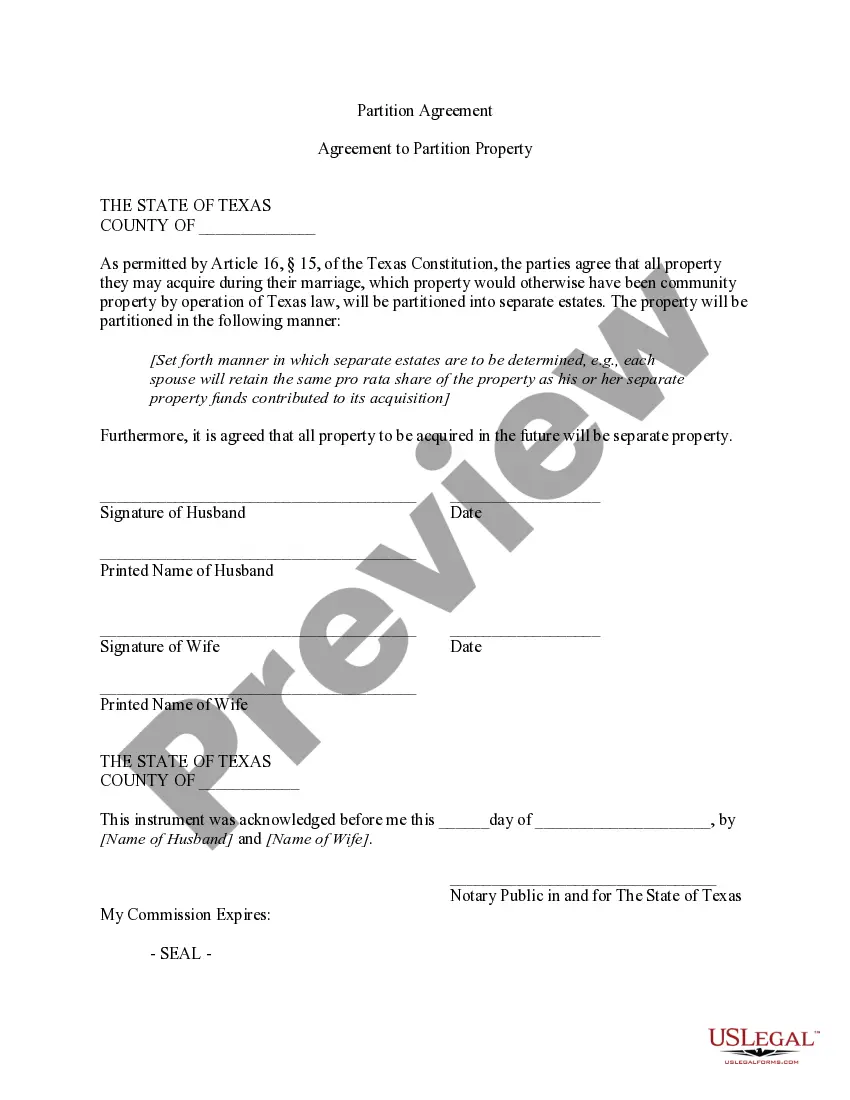

Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts is a legal document that is used by Limited Liability Companies (LCS) based in Maine to authorize the creation and usage of expense accounts for its members. This resolution is crucial as it sets the guidelines and procedures for the reimbursement of business-related expenses incurred by LLC members. The purpose of this resolution is to formally grant authority to the members of an LLC to establish expense accounts and delineate the terms and conditions under which these accounts can be utilized. The resolution typically outlines specific details such as the maximum amount allowed for expense reimbursement, the types of expenses eligible for reimbursement, and the submission and approval processes for reimbursement requests. Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts ensures that LLC members can carry out their roles effectively without incurring personal financial burdens. By creating and authorizing expense accounts, members can incur necessary business expenses and submit them for reimbursement. Different types of Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts may include: 1. General Expense Account Resolution: This type of resolution covers a broad spectrum of expenses such as travel costs, business supplies, professional development, and other ordinary business expenditures necessary for LLC operations. 2. Travel Expense Account Resolution: This resolution focuses specifically on travel-related expenses incurred by LLC members. It may include provisions for reimbursement of airfare, accommodation, meals, ground transportation, and other eligible travel-related expenditures. 3. Entertainment Expense Account Resolution: This resolution pertains to expenses associated with client entertainment, business meetings, and networking events. It may outline the conditions and limits regarding reimbursement for entertainment expenses incurred by LLC members. 4. Business Development Expense Account Resolution: This type of resolution concentrates on expenses related to business development and expansion. It may cover costs associated with market research, advertising, marketing campaigns, conference attendance, and other strategic initiatives aimed at business growth. 5. Office Supplies and Equipment Expense Account Resolution: This resolution specifies the conditions under which LLC members can avail reimbursement for office supplies, equipment purchases, repairs, and maintenance essential to maintain the smooth operations of the company. In conclusion, Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts is a necessary legal document for LCS based in Maine. It enables LLC members to create expense accounts that facilitate the reimbursement of business-related expenses. By utilizing various types of expense account resolutions, LCS can ensure proper financial management and support their members in carrying out their duties effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maine Resolución de Reunión de Miembros de LLC para Autorizar Cuentas de Gastos - Resolution of Meeting of LLC Members to Authorize Expense Accounts

Description

How to fill out Maine Resolución De Reunión De Miembros De LLC Para Autorizar Cuentas De Gastos?

Are you currently in the situation that you need paperwork for both organization or individual functions almost every day time? There are plenty of legitimate record themes available on the Internet, but getting versions you can rely isn`t easy. US Legal Forms delivers a huge number of develop themes, like the Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts, that are published to meet federal and state requirements.

In case you are previously familiar with US Legal Forms internet site and get an account, basically log in. Next, it is possible to down load the Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts design.

If you do not have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and make sure it is to the appropriate city/area.

- Use the Preview key to examine the shape.

- Read the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you are seeking, utilize the Search field to obtain the develop that fits your needs and requirements.

- Whenever you obtain the appropriate develop, just click Buy now.

- Select the rates plan you want, fill in the required information to generate your account, and pay money for the order with your PayPal or credit card.

- Select a hassle-free document file format and down load your copy.

Get every one of the record themes you might have bought in the My Forms food selection. You may get a more copy of Maine Resolution of Meeting of LLC Members to Authorize Expense Accounts at any time, if possible. Just click on the needed develop to down load or printing the record design.

Use US Legal Forms, probably the most comprehensive selection of legitimate varieties, in order to save time as well as avoid faults. The service delivers professionally made legitimate record themes that can be used for a selection of functions. Generate an account on US Legal Forms and start making your lifestyle a little easier.