Maine Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

Are you presently in the placement where you require documents for either enterprise or specific reasons nearly every working day? There are a lot of legitimate document themes accessible on the Internet, but finding ones you can rely on is not easy. US Legal Forms provides thousands of kind themes, like the Maine Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement, that happen to be composed to fulfill state and federal needs.

Should you be previously informed about US Legal Forms web site and have a free account, simply log in. Afterward, you can down load the Maine Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement design.

Should you not offer an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for that appropriate area/county.

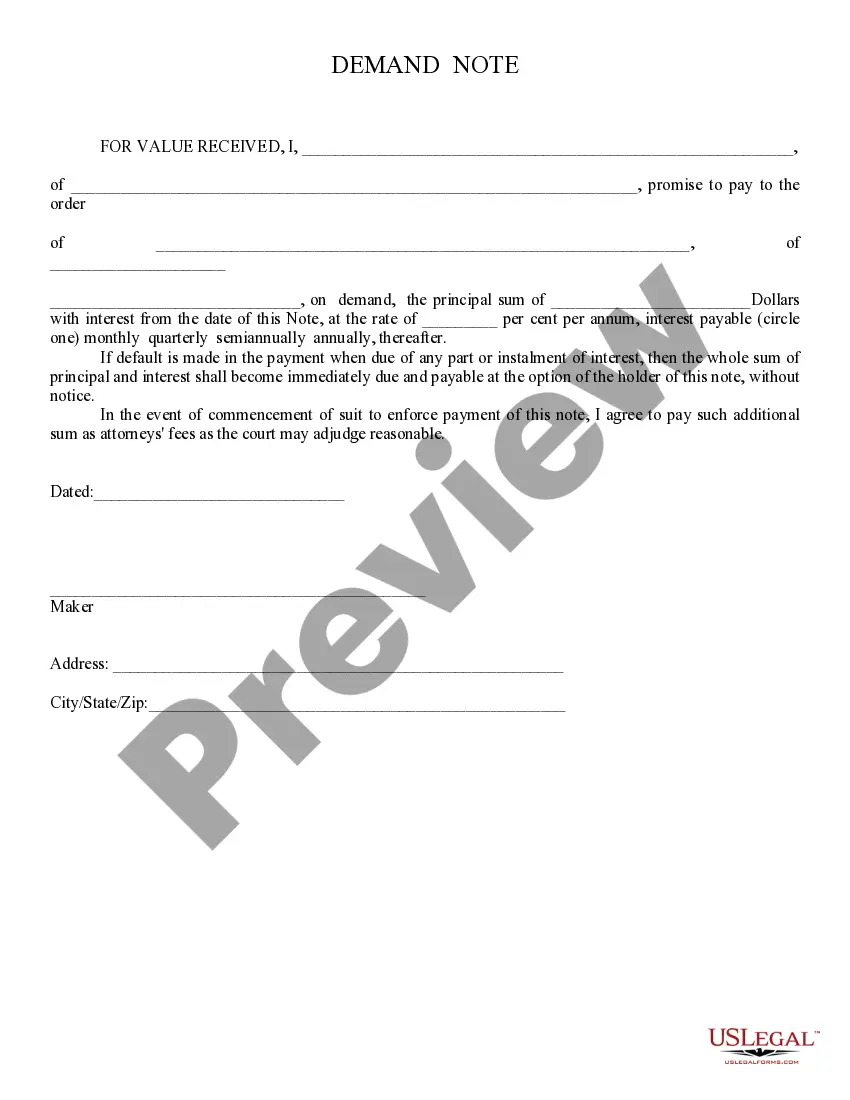

- Take advantage of the Preview switch to examine the shape.

- Look at the information to ensure that you have chosen the appropriate kind.

- In case the kind is not what you are trying to find, utilize the Search field to find the kind that fits your needs and needs.

- If you discover the appropriate kind, simply click Get now.

- Pick the prices prepare you desire, fill in the required info to create your money, and purchase the transaction with your PayPal or charge card.

- Pick a handy paper file format and down load your duplicate.

Find all the document themes you may have bought in the My Forms food selection. You can obtain a further duplicate of Maine Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement anytime, if required. Just click on the needed kind to down load or printing the document design.

Use US Legal Forms, the most substantial selection of legitimate types, to save time and stay away from errors. The service provides professionally manufactured legitimate document themes that can be used for an array of reasons. Generate a free account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

The Liquidating Trust is classified under IRS regulations as a Grantor Trust, which is why the BDO letter is addressed to you as a Grantor. The attached form to the Grantor Trust Letter reports your pro rata share of Liquidating Trust income, net of Liquidating Trust expenses, for the year ended December 31, 2022.

A: "Grantor trust" is a term used in the Internal Revenue Code to describe any trust over which the grantor or other owner retains the power to control or direct the trust's income or assets.

Liquidating trusts are funded with assets held for the benefit of creditors who may have a claim against the debtor. These trusts can exist from several months to several years, depending on how long it takes to liquidate the assets and work through various claims and settlements.

Trust will be classified for federal income tax purposes as a liquidating trust under section 301.7701-4(d) of the regulations. 2. Trust will be a grantor trust and the Beneficiaries of Trust will be treated as the owners of Trust under sections 671 and 677 of the Code.

An organization will be considered a liquidating trust if it is organized for the primary purpose of liquidating and distributing the assets transferred to it, and if its activities are all reasonably necessary to, and consistent with, the accomplishment of that purpose.

Any trust that is not a grantor trust is considered a non-grantor trust. In this case, the person who set up the trust has no rights, interests, or powers over trust assets. Because they are taxed as a separate entity, non-grantor trusts are required to have their own TIN.