Maine Credit Agreement is a legal contract entered into by Southwest Royalties, Inc., an energy company based in Texas, and Bank One Texas, a financial institution. This agreement outlines the terms and conditions for credit facilities extended by Bank One Texas to Southwest Royalties, Inc. for various purposes related to their business operations. The Maine Credit Agreement aims to establish a mutually beneficial relationship between the two parties, ensuring smooth financial transactions and providing a framework for managing credit requirements. It serves as a valuable tool for Southwest Royalties, Inc. to access funds and meet their working capital needs, while Bank One Texas benefits from the interest income generated through the credit facilities. Key provisions typically found in a Maine Credit Agreement include: 1. Definitions: Clearly defines terms used throughout the agreement, such as "credit facilities," "borrowings," "interest rates," and others, to avoid any ambiguity or misunderstanding. 2. Credit Facilities: Specifies the types and amount of credit facilities available to Southwest Royalties, Inc., which may include revolving lines of credit, term loans, letters of credit, or other financing arrangements. 3. Term and Termination: Outlines the duration of the credit agreement and the circumstances under which it may be terminated, such as breach of terms, bankruptcy, or mutual agreement between the parties. 4. Interest Rates and Fees: Details the applicable interest rates on borrowings, payment terms, fees, and commissions charged by Bank One Texas for extending credit facilities to Southwest Royalties, Inc. 5. Representations and Warranties: Contains statements made by Southwest Royalties, Inc. regarding their financial condition, solvency, and legal compliance to assure Bank One Texas of their ability to meet their obligations under the agreement. 6. Collateral and Security: Describes any collateral or security that Southwest Royalties, Inc. may provide to secure their borrowings, such as pledges on assets, liens on properties, or personal guarantees by the company's principals. 7. Conditions Precedent: Lists conditions that must be fulfilled before credit facilities are made available to Southwest Royalties, Inc., such as the submission of financial statements, insurance coverage, and compliance with regulatory requirements. 8. Events of Default: Specifies events that, if triggered, would allow Bank One Texas to declare Southwest Royalties, Inc. in default, enabling them to demand immediate repayment or take necessary legal actions to recover the outstanding debt. It is important to note that the term "Maine Credit Agreement" is not commonly used. Instead, the reference might be to a "Texas Credit Agreement" or specific types of credit agreements, such as "Revolving Credit Agreement," "Term Loan Credit Agreement," or "Letter of Credit Agreement," depending on the specific credit facility being utilized between Southwest Royalties, Inc. and Bank One Texas.

Maine Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

How to fill out Maine Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

Are you currently within a placement where you require files for sometimes enterprise or individual functions virtually every time? There are tons of lawful file web templates accessible on the Internet, but discovering types you can rely on is not effortless. US Legal Forms delivers thousands of develop web templates, just like the Maine Credit Agreement between Southwest Royalties, Inc. and Bank One Texas, which can be composed in order to meet federal and state needs.

If you are currently acquainted with US Legal Forms website and have an account, simply log in. Next, it is possible to download the Maine Credit Agreement between Southwest Royalties, Inc. and Bank One Texas design.

If you do not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is to the right metropolis/county.

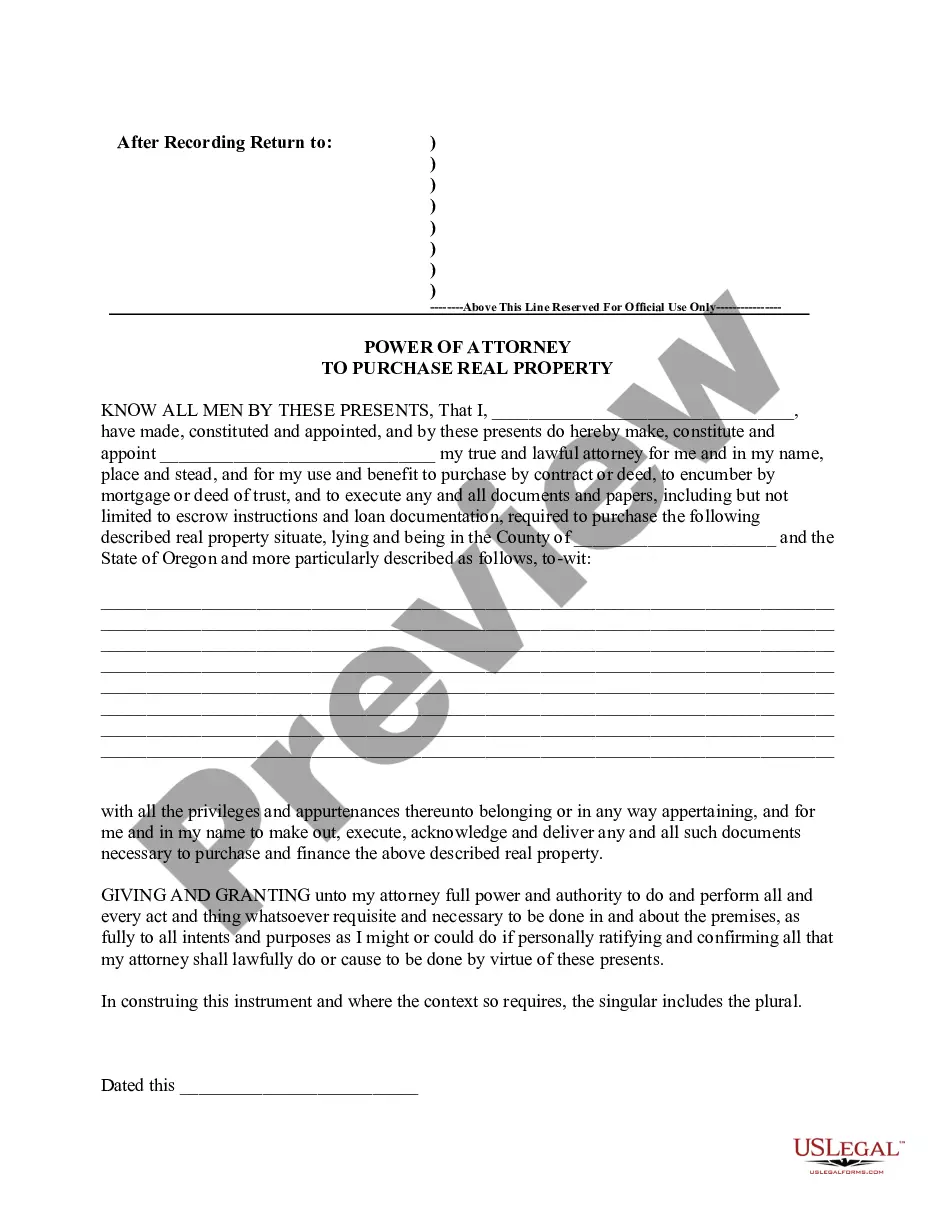

- Utilize the Preview button to examine the shape.

- Look at the information to ensure that you have chosen the correct develop.

- In the event the develop is not what you`re searching for, use the Lookup discipline to obtain the develop that fits your needs and needs.

- Once you discover the right develop, just click Buy now.

- Choose the pricing program you need, submit the specified information to make your bank account, and buy your order using your PayPal or Visa or Mastercard.

- Select a practical document file format and download your backup.

Locate all of the file web templates you possess bought in the My Forms food list. You can get a more backup of Maine Credit Agreement between Southwest Royalties, Inc. and Bank One Texas whenever, if possible. Just click on the required develop to download or print out the file design.

Use US Legal Forms, one of the most extensive collection of lawful varieties, to conserve time as well as stay away from mistakes. The services delivers professionally made lawful file web templates which you can use for a range of functions. Make an account on US Legal Forms and begin creating your daily life a little easier.