Michigan Petition and Order for Assignment

Description Petition For Assignment Michigan

How to fill out Michigan Probate?

Get any template from 85,000 legal documents such as Michigan Petition and Order for Assignment on-line with US Legal Forms. Every template is drafted and updated by state-certified lawyers.

If you have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Petition and Order for Assignment you want to use.

- Read description and preview the template.

- As soon as you’re confident the sample is what you need, simply click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by bank card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the right downloadable sample. The platform will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Michigan Petition and Order for Assignment fast and easy.

Mi Petition Assignment Michigan Form popularity

Michigan Order Assignment Mi Other Form Names

Michigan Petition Probate FAQ

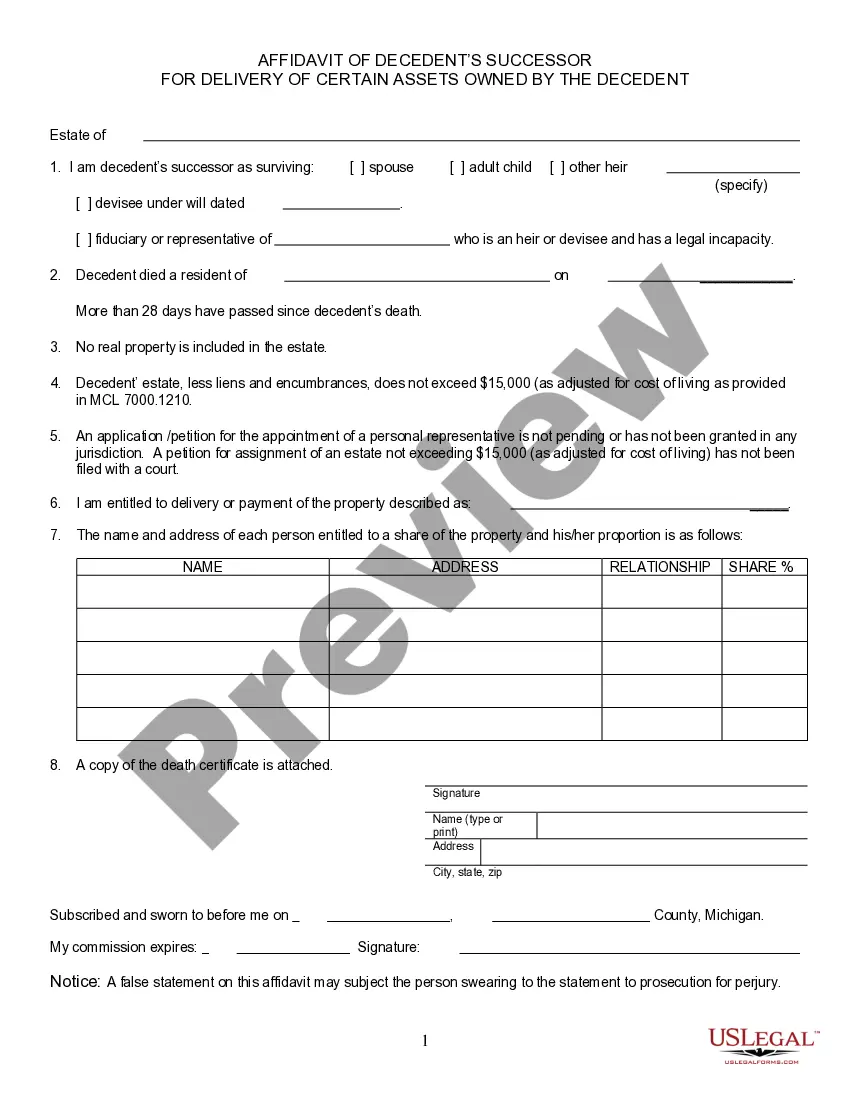

Petition and Order for Assignment: A description and gross value must be given of all property solely held by the decedent as of the date of death. For real property, determine the value by doubling the State Equalized Value (SEV) located on the tax bill. List the lien/mortgage amount, if there is one.

Probate Court In an estate of value of less than $1,000.00, $5.00 plus 1% of the amount over $500.00. In an estate of value of $1,000.00 or more, but less than $3,000.00, $25.00. In an estate of value of $3,000.00 or more, but less than $10,000.00, $25.00 plus 5/8 of 1% of the amount over $3,000.00.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

The petition must be filed in the probate court in the county where the individual resides, or in the county in Michigan where the individual's property is located if the individual does not reside in Michigan.

Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies in 2020, an estate must be valued at $24,000 or less to be small. If a person dies in 2019 or 2018, an estate must be valued at $23,000 or less.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.As of January 1, 2020, only six states have laws imposing inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.