The Michigan Assumption Agreement of SBA Loan is a legal document that outlines the terms and conditions under which someone can assume responsibility for an existing Small Business Administration (SBA) loan in the state of Michigan. This agreement typically comes into play when a borrower wants to transfer their loan obligations to a new party or entity. Keywords: Michigan, assumption agreement, SBA loan, terms and conditions, transfer, borrower, loan obligations. The Michigan Assumption Agreement of SBA Loan is an important document as it ensures that all parties involved, including the original borrower, assumed borrower, and the SBA, are aware of their rights and responsibilities regarding the loan. There are different types of Michigan Assumption Agreement of SBA Loans: 1. Full Assumption Agreement: This type of agreement allows the assumed borrower to take over the entire loan, including all outstanding balances, interest rates, repayment terms, and any restrictive covenants or conditions set forth in the original loan agreement. 2. Partial Assumption Agreement: In some cases, the original borrower may want to transfer only a portion of the loan to a new party. This could involve a specific percentage or amount of the loan, depending on the agreement between the parties involved. 3. Assumption and Novation Agreement: This agreement not only transfers the loan obligations but also releases the original borrower from any further liability or responsibility for the loan. It effectively replaces the original borrower with the assumed borrower as the sole party responsible for repayment. 4. Collateral Assignment Agreement: If the SBA loan is secured by collateral (such as real estate or equipment), this type of agreement allows the assumed borrower to take over ownership and control of the collateral while assuming the loan obligations. 5. Guaranty Agreement: In some cases, a guarantor may be involved in the assumption process. This agreement outlines the agreement between the original borrower, the guarantor, and the assumed borrower regarding the guarantor's liability for repayment in case the assumed borrower defaults on the loan. It is important to note that the specific terms and conditions of a Michigan Assumption Agreement of SBA Loan may vary depending on the unique circumstances of each loan and the negotiations between the parties involved. It is crucial for all parties to carefully review and understand the agreement before signing to ensure compliance with state and federal laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Acuerdo de Asunción de Préstamo SBA - Assumption Agreement of SBA Loan

Description

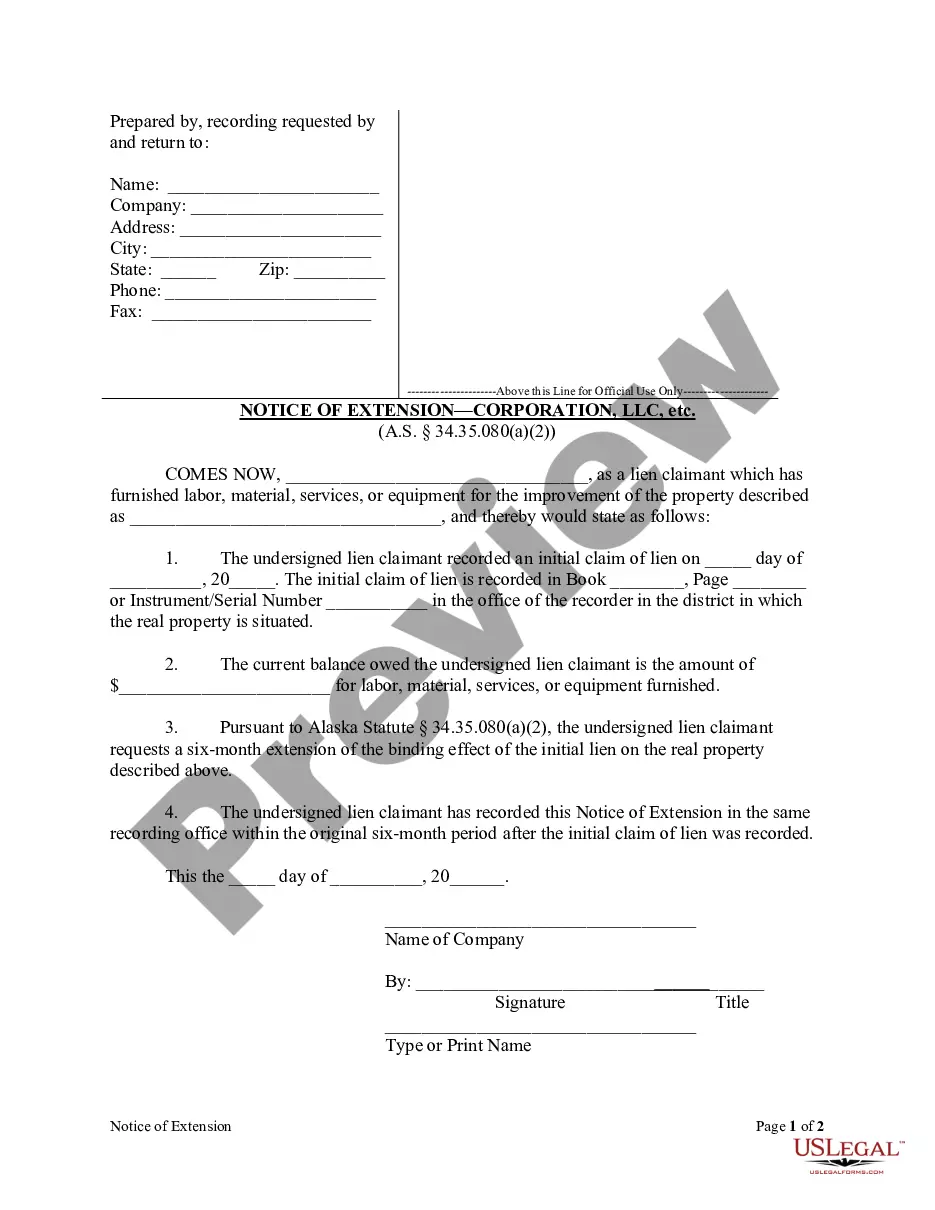

How to fill out Michigan Acuerdo De Asunción De Préstamo SBA?

US Legal Forms - among the largest libraries of lawful kinds in the United States - offers a wide range of lawful file web templates you are able to download or print. Using the website, you can get thousands of kinds for company and personal functions, categorized by classes, states, or keywords.You can find the newest variations of kinds such as the Michigan Assumption Agreement of SBA Loan in seconds.

If you have a subscription, log in and download Michigan Assumption Agreement of SBA Loan from the US Legal Forms library. The Acquire key can look on each and every form you perspective. You have accessibility to all in the past acquired kinds in the My Forms tab of your bank account.

In order to use US Legal Forms the first time, here are easy guidelines to obtain started:

- Ensure you have picked the best form to your city/region. Click on the Preview key to analyze the form`s content. Browse the form information to actually have chosen the proper form.

- In the event the form does not satisfy your needs, utilize the Lookup industry on top of the display to find the the one that does.

- If you are content with the form, verify your option by clicking on the Acquire now key. Then, select the costs plan you like and provide your references to register for an bank account.

- Procedure the purchase. Make use of your bank card or PayPal bank account to complete the purchase.

- Pick the formatting and download the form on your own product.

- Make alterations. Complete, edit and print and signal the acquired Michigan Assumption Agreement of SBA Loan.

Each and every format you included in your money lacks an expiry day and is your own property forever. So, if you wish to download or print one more copy, just visit the My Forms area and then click about the form you require.

Gain access to the Michigan Assumption Agreement of SBA Loan with US Legal Forms, by far the most extensive library of lawful file web templates. Use thousands of skilled and state-certain web templates that meet up with your company or personal requirements and needs.