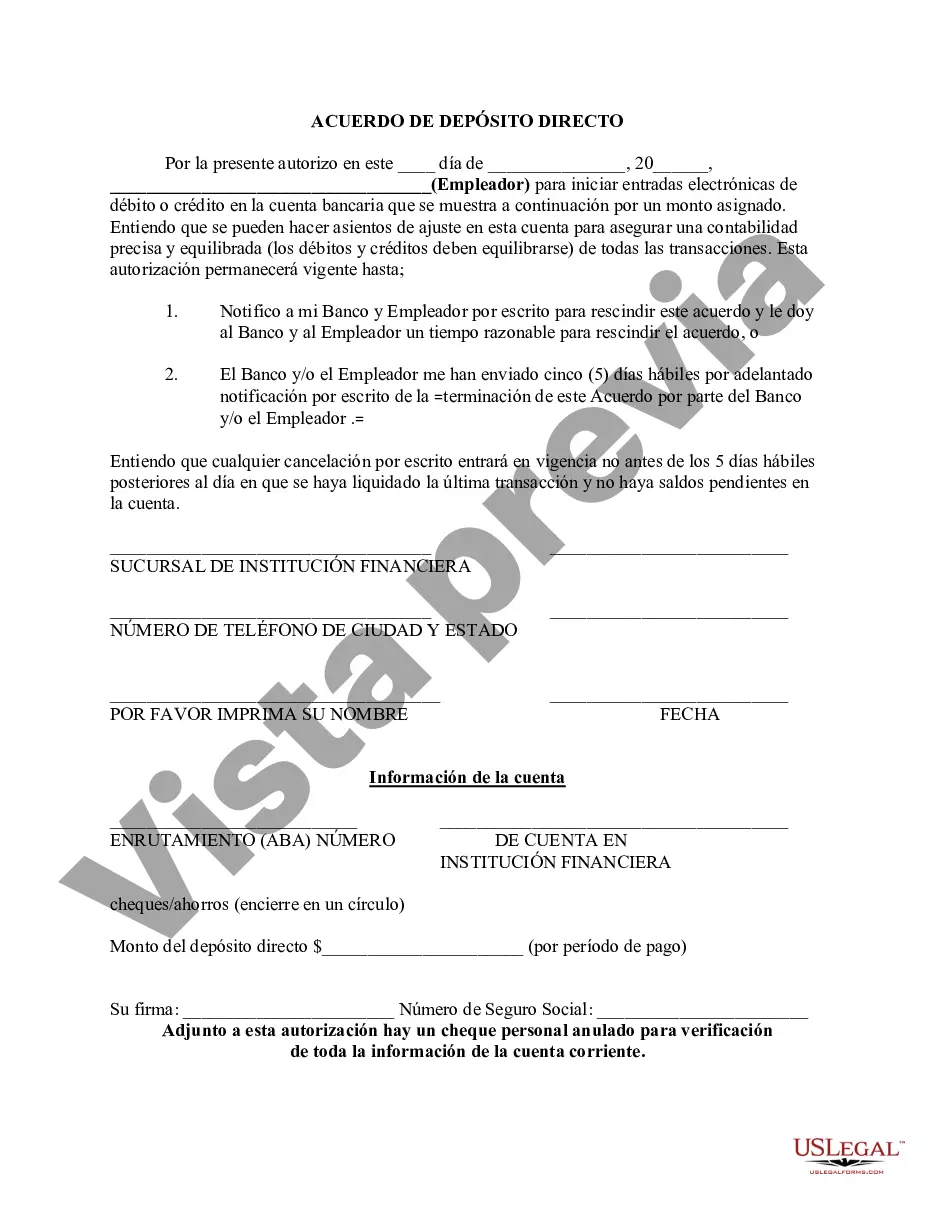

The Michigan Direct Deposit Form for Bank of America is a document used to set up direct deposit of funds into a Bank of America account in the state of Michigan. It allows individuals or businesses to authorize the electronic transfer of funds from a payer directly into their Bank of America account, eliminating the need for physical checks or cash. This form is specifically designed for Bank of America customers residing in Michigan, ensuring that the direct deposit process is compliant with the state's regulations and meets the specific banking requirements of Michigan residents. The Michigan Direct Deposit Form for Bank of America typically includes the following sections: 1. Personal Information: This section requires the individual's name, address, and contact details. It may also include space for the account holder's social security number or taxpayer identification number. 2. Bank Account Information: This section requires the account holder to provide the bank account details, such as the account number and the Bank of America routing number. It may also include space to specify the type of account, such as checking or savings. 3. Payer Information: This section requests information about the entity or organization responsible for making the direct deposit. It may require the payer's name, address, contact details, and identification information. 4. Direct Deposit Authorization: This section is where the account holder authorizes the payer to initiate the direct deposit and agrees to the terms and conditions of the direct deposit service. It may outline the account holder's rights and responsibilities regarding direct deposits and may provide information on how to cancel or modify the direct deposit arrangement. 5. Additional Requirements: Depending on the specific type of direct deposit being set up, there may be additional sections or requirements. For example, if the direct deposit is for a business or employer, the form may request additional information such as the company's name, address, and employer identification number (EIN). In contrast, if the direct deposit is for government benefits, the form may require the account holder's Social Security number and information about the benefits program. Different variations or versions of the Michigan Direct Deposit Form for Bank of America may exist to cater to different direct deposit scenarios or to accommodate changes in banking regulations or internal processes. However, these variations usually share the same basic sections and purpose — to enable Bank of America customers in Michigan to receive funds directly into their accounts electronically, providing convenience, security, and efficiency in financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Formulario de depósito directo para Bank America - Direct Deposit Form for Bank America

Description

How to fill out Michigan Formulario De Depósito Directo Para Bank America?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Michigan Direct Deposit Form for Bank America, which can be used for both business and personal purposes.

First, ensure you have selected the correct form for your area/state. You can review the document using the Preview button and read the document details to make sure this is suitable for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to find the Michigan Direct Deposit Form for Bank America.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

Proof of Income & Direct DepositPaychecks and Stubs. Even paychecks that are direct-deposited to your bank generate a pay stub.Government Checks.Bank Statements.Federal Tax Forms.

Sign In to Online Banking. Click on any of your accounts. Select View and Print Payroll Direct Deposit from the right navigation. Select the account you want to deposit your payroll to from the dropdown, then click on View and Print and your customized form will be presented to you.

Click the Direct Deposit Form (PDF) link on your account page. The information will be displayed in a new window with the ability to print or save it on your computer.

You can find this form on Bank of America's website. Alternatively, you can sign in to Online Banking and download a preprinted Bank of America direct deposit form. This form takes the place of a Bank of America voided check. Give the direct deposit form to your employer for processing.

Bank of America offers direct deposit for its customers. Here's how to set up direct deposit for your Bank of America checking or savings account.

Step 1: Choose an account. On EasyWeb, go to the Accounts page.Step 2: Select the direct deposit form. On the Account Activity page, select Direct deposit form (PDF) to download and open a copy of your form.Step 3: Access the form. If you're using Adobe Reader, the form will open in a new window.

Get a direct deposit form from your employer Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

Sign In to Online Banking. Click on any of your accounts. Select View and Print Payroll Direct Deposit from the right navigation. Select the account you want to deposit your payroll to from the dropdown, then click on View and Print and your customized form will be presented to you.

Use our pre-filled form Or you can download a blank Direct Deposit/Automatic Payments Set-up Guide (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you'll need.

Interesting Questions

More info

What the First 30 Days of my Bank of America Account Look Like Your first 30 days with your new checking or checking account are usually very busy. It is normal to receive several inquiries about your account and to receive some calls on your behalf from a customer service representative, but do not be stressed if this happens. Bank of America Online customers are not required to call if they are not comfortable contacting a customer service representative for information about their own account or any issues that may have occurred. You should always get a hold of a customer service representative to answer any questions you have regarding your account. If you find yourself making unnecessary calls to an agent to get the information you need, you may be able to reduce the time that you spend on these phone calls by reducing or eliminating unnecessary accounts or fees from your checking or savings account.