A Michigan Buy Sell Agreement Between Shareholders and a Corporation is a legal contract that outlines the terms and conditions for the buying and selling of shares between shareholders of a corporation in the state of Michigan. This agreement helps in providing a clear and structured process for the transfer of ownership in a corporation. The agreement typically includes the following key elements: 1. Parties: It identifies the shareholders (both buyers and sellers) involved in the transaction and provides their details, including full names, addresses, and number of shares owned. 2. Purchase Price: The agreement outlines the method of determining the purchase price of the shares being sold, whether it is a fixed price, fair market value, or calculated based on a predetermined formula. 3. Restriction: It may include restrictions on the transfer of shares to ensure that the shares are not sold to outsiders or competitors without the approval of other shareholders or the corporation itself. These restrictions will help maintain control and ownership within the existing shareholders. 4. Rights of First Refusal: This provision allows existing shareholders to have the first option to purchase the shares being sold before they are offered to any third parties. This helps in maintaining the ownership structure and ensuring that shareholders have the opportunity to maintain control in the corporation. 5. Triggering Events: The agreement will specify the triggering events that can activate the buy-sell provision, such as death, disability, retirement, bankruptcy, divorce, or termination of employment. These events are essential as they serve as a mechanism to determine when a shareholder can or must sell their shares. 6. Payment Terms: It outlines the payment terms, such as the timing and method of payment, including options for cash, promissory notes, or installment payments. 7. Dispute Resolution: The agreement may include a provision for resolving any disputes arising from the agreement, such as mediation, arbitration, or litigation. This helps ensure a fair and efficient resolution process in case of conflicts between shareholders. 8. Successors and Assigns: This section clarifies whether the agreement will be binding upon the successors and assigns of the shareholders, allowing for a smooth transition of ownership in the event of death or transfer of shares. Some different types of Michigan Buy Sell Agreements Between Shareholders and a Corporation include: 1. Cross-Purchase Agreement: In this agreement, each shareholder has an individual agreement with every other shareholder, and upon the occurrence of a triggering event, the remaining shareholders will purchase the shares of the departing shareholder directly from them. 2. Entity Purchase Agreement: In this agreement, the corporation itself is a party to the agreement. The corporation buys the shares from the departing shareholder. 3. Wait-and-See Agreement: This agreement allows the surviving shareholders or the corporation to choose between a cross-purchase or entity purchase agreement when a triggering event occurs. These various types of agreements provide flexibility and allow shareholders to choose the structure that best suits their needs and circumstances. It is recommended to consult with legal professionals to ensure the agreement accurately reflects the intentions and requirements of the shareholders and complies with Michigan corporation laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Acuerdo de compra venta entre accionistas y una corporación - Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Michigan Acuerdo De Compra Venta Entre Accionistas Y Una Corporación?

Are you in the placement that you will need paperwork for sometimes enterprise or personal functions almost every day? There are a variety of legal document web templates available online, but locating kinds you can rely on is not effortless. US Legal Forms provides 1000s of type web templates, such as the Michigan Buy Sell Agreement Between Shareholders and a Corporation, which are published to meet federal and state needs.

If you are previously familiar with US Legal Forms site and get an account, just log in. Following that, you are able to down load the Michigan Buy Sell Agreement Between Shareholders and a Corporation web template.

Unless you come with an account and wish to start using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for the right metropolis/state.

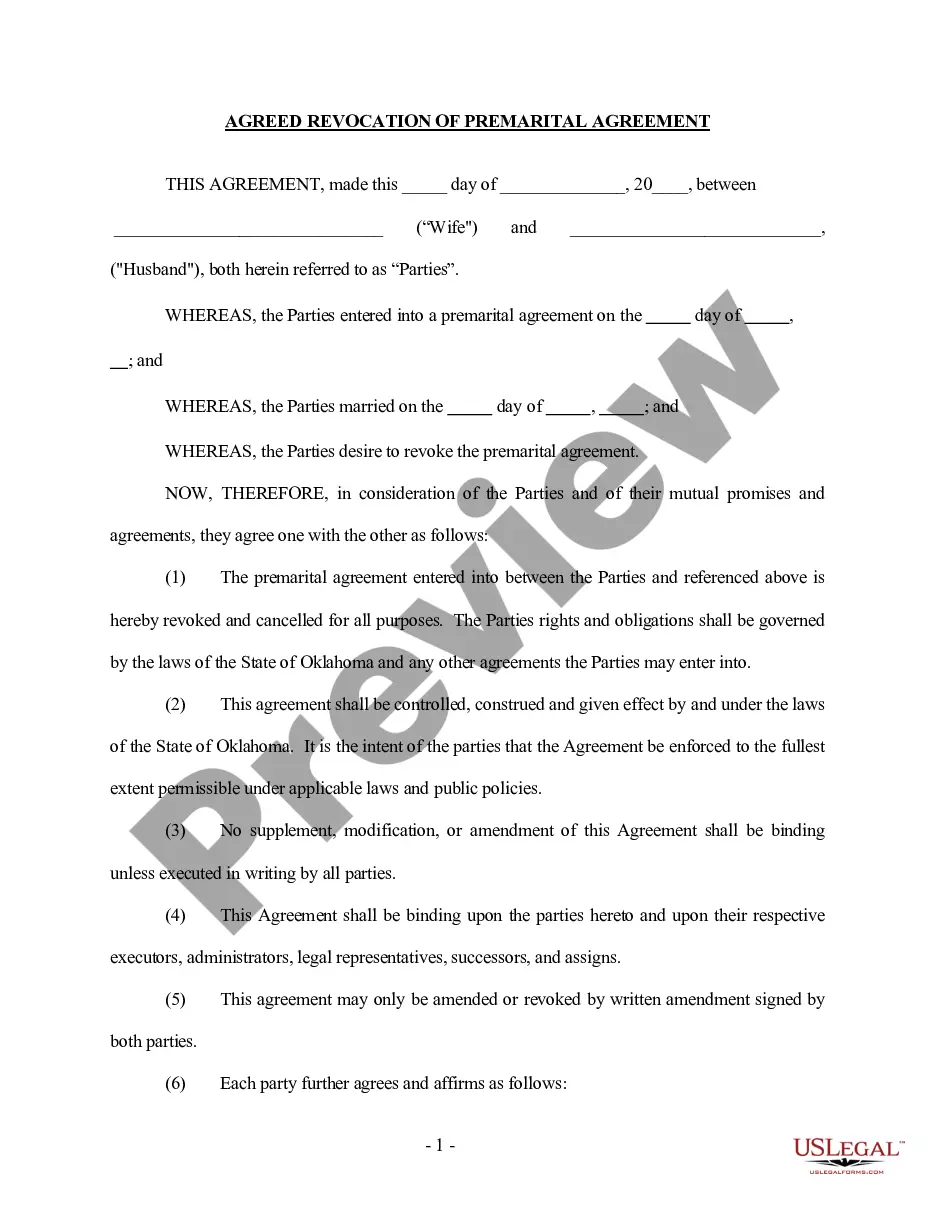

- Make use of the Review switch to examine the shape.

- Browse the outline to actually have selected the proper type.

- In case the type is not what you are looking for, make use of the Search area to discover the type that fits your needs and needs.

- When you find the right type, simply click Purchase now.

- Select the prices plan you would like, fill out the required details to generate your account, and pay for an order using your PayPal or Visa or Mastercard.

- Select a practical paper formatting and down load your version.

Find all of the document web templates you might have bought in the My Forms menus. You can get a additional version of Michigan Buy Sell Agreement Between Shareholders and a Corporation any time, if required. Just click on the needed type to down load or print the document web template.

Use US Legal Forms, by far the most substantial variety of legal kinds, to save time as well as avoid mistakes. The support provides appropriately produced legal document web templates which you can use for a variety of functions. Make an account on US Legal Forms and begin generating your lifestyle a little easier.