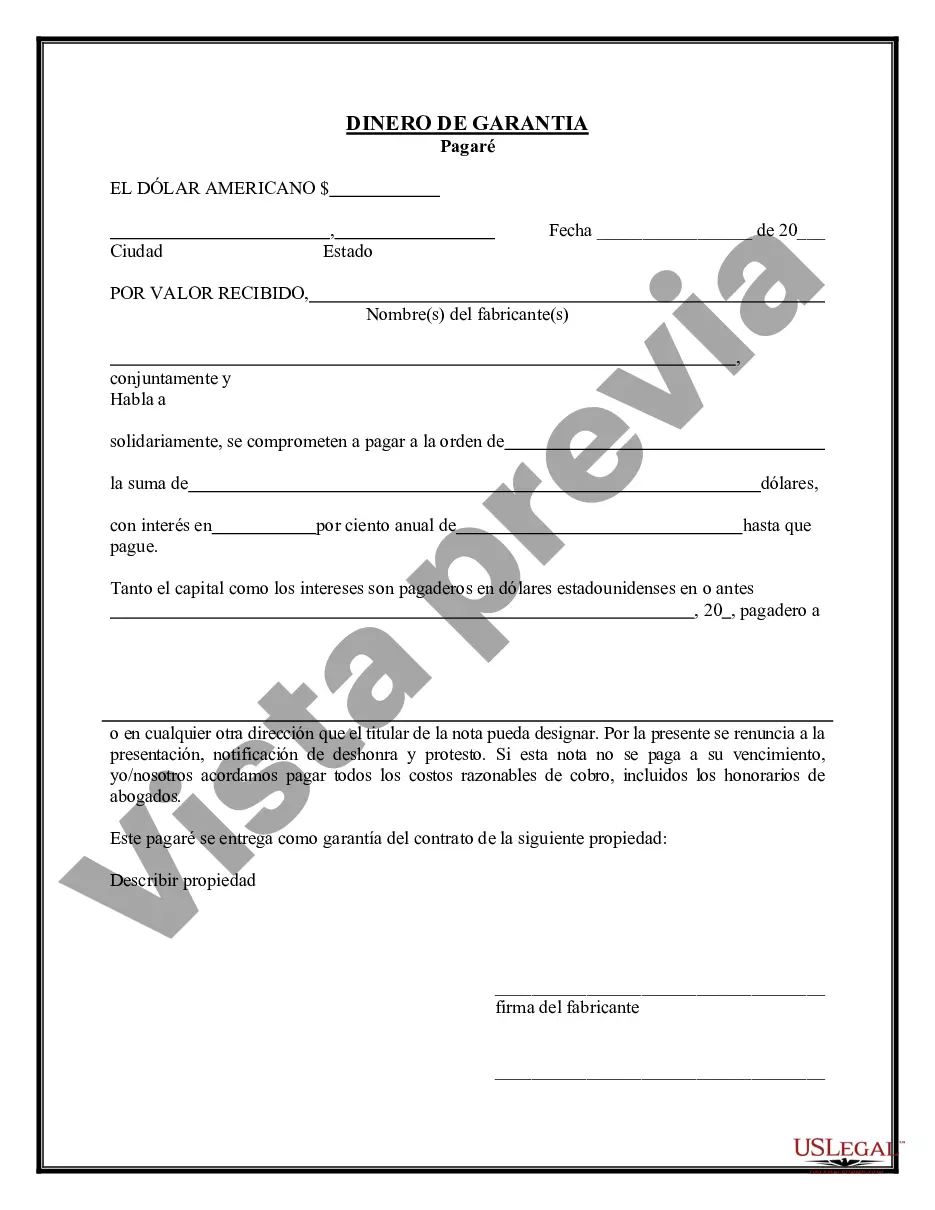

The Michigan Earnest Money Promissory Note is a legal agreement commonly used in real estate transactions in the state of Michigan. It serves as a binding contract between the buyer, seller, and any other parties involved in the transaction. This note demonstrates the buyer's intent to purchase a property and provides assurance to the seller that the buyer is serious about the transaction. Keywords: Michigan, Earnest Money, Promissory Note, real estate, transactions, binding contract, buyer, seller, intent, property, assurance. The purpose of the Michigan Earnest Money Promissory Note is to protect both parties in a real estate transaction. The buyer is required to submit a specified amount of earnest money, which is a deposit, to the seller as a show of good faith that the buyer intends to proceed with the purchase. This amount is typically a percentage of the agreed-upon purchase price and can vary depending on the terms negotiated by both parties. The earnest money serves as a form of security or compensation to the seller in the event that the buyer fails to fulfill their obligations as outlined in the purchase agreement. There may be different types of Michigan Earnest Money Promissory Notes based on the terms negotiated by the parties involved. Some common types include: 1. Contingency-Based Earnest Money Promissory Note: This type of note includes specific contingencies that must be met for the transaction to proceed. For example, if the buyer's financing falls through or if certain repairs are not completed satisfactorily, the buyer may be entitled to a refund of the earnest money. 2. Non-Contingency-Based Earnest Money Promissory Note: In this type of note, there are no specific contingencies outlined. The buyer is required to fulfill their obligations regardless of any unforeseen circumstances. If the buyer fails to meet these obligations, the seller is entitled to keep the earnest money as compensation for the breach of contract. 3. Escrow-Based Earnest Money Promissory Note: This type of note involves the use of a neutral third party, such as an escrow agent or attorney, who holds the earnest money in a secure account until the transaction is completed or terminated. The escrow agent ensures that the funds are disbursed according to the agreed-upon terms and conditions. It is important for both buyers and sellers to carefully review and understand the terms and conditions outlined in the Michigan Earnest Money Promissory Note. Any specific provisions or additional conditions should be clearly stated to avoid misunderstandings or disputes. Consulting with a real estate attorney or professional is recommended to ensure compliance with Michigan state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Pagaré de arras - Earnest Money Promissory Note

Description

How to fill out Michigan Pagaré De Arras?

Finding the right legitimate papers web template might be a have a problem. Of course, there are a lot of layouts available on the net, but how can you find the legitimate kind you need? Make use of the US Legal Forms website. The services provides 1000s of layouts, including the Michigan Earnest Money Promissory Note, that you can use for business and private demands. All the kinds are checked out by specialists and meet up with federal and state requirements.

When you are currently listed, log in to the profile and then click the Download button to obtain the Michigan Earnest Money Promissory Note. Utilize your profile to appear with the legitimate kinds you have bought previously. Check out the My Forms tab of your own profile and acquire yet another copy in the papers you need.

When you are a fresh customer of US Legal Forms, listed below are straightforward guidelines that you should stick to:

- Very first, be sure you have selected the correct kind to your metropolis/area. You can examine the shape making use of the Preview button and study the shape information to make certain it will be the right one for you.

- In case the kind does not meet up with your needs, use the Seach area to find the right kind.

- When you are positive that the shape is suitable, go through the Purchase now button to obtain the kind.

- Pick the pricing strategy you want and enter in the required information and facts. Create your profile and purchase the order using your PayPal profile or Visa or Mastercard.

- Opt for the document format and acquire the legitimate papers web template to the device.

- Complete, change and print and indicator the obtained Michigan Earnest Money Promissory Note.

US Legal Forms is the largest collection of legitimate kinds for which you will find different papers layouts. Make use of the company to acquire skillfully-manufactured paperwork that stick to status requirements.