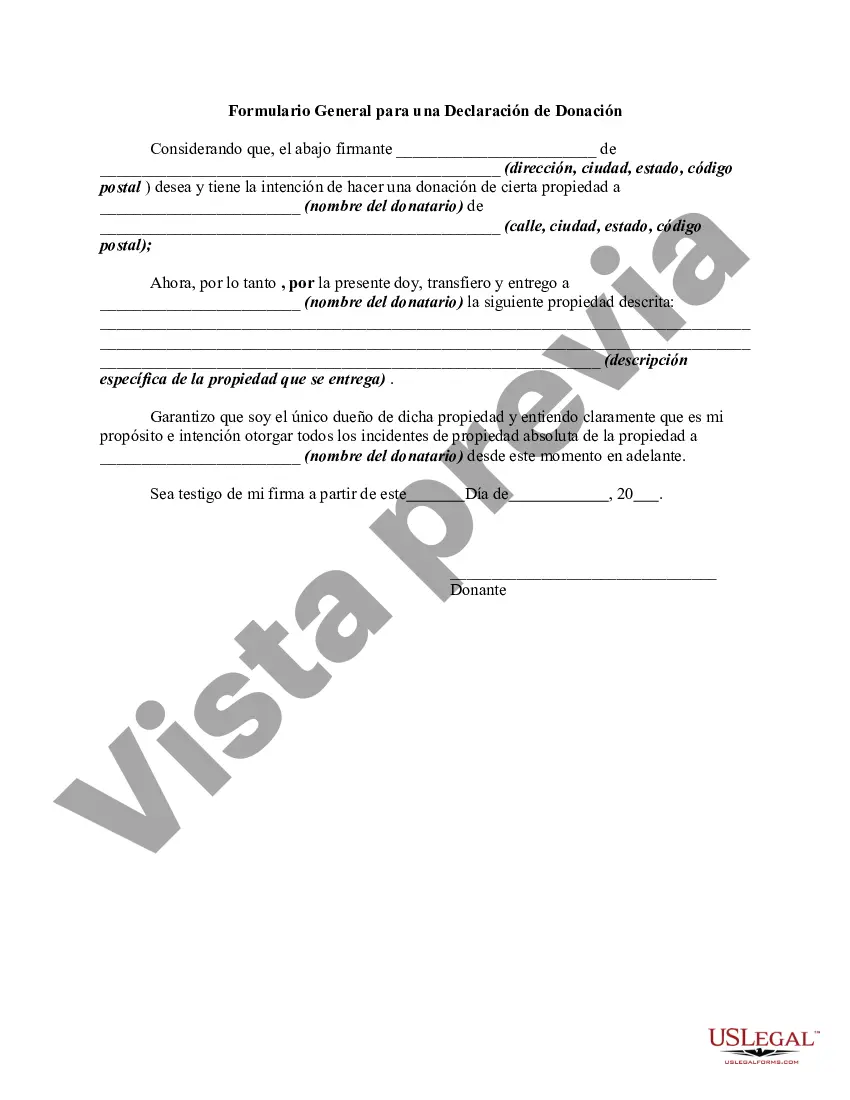

The following form is a general form for a declaration of a gift of property.

The Michigan Declaration of Gift is a legal document that allows individuals to donate or gift their property or assets to another person or organization. It serves as an official record of the transfer of ownership and ensures that all necessary legal requirements are met. Key aspects covered in the Michigan Declaration of Gift include the identification of the donor (person making the gift) and the recipient (person or entity receiving the gift), a detailed description of the property being gifted, and any conditions or restrictions placed upon the gift. This document is essential for both the donor and the recipient as it provides evidence of the gift and protects the interests of both parties. Different types of Michigan Declaration of Gift can include: 1. Real Estate Gift Declaration: This type of declaration is used when the gift involves the transfer of real property, such as land, houses, or commercial buildings. It outlines the specific details of the property being gifted and any legal obligations associated with the transfer, such as taxes or liens. 2. Financial Gift Declaration: This type of declaration is used for gifts involving money or financial assets. It specifies the amount of money being gifted and may detail any conditions or terms that the donor imposes on the use of the funds. 3. Personal Property Gift Declaration: This type of declaration is used when the gift involves personal belongings, such as artwork, jewelry, vehicles, or other valuables. It provides a comprehensive description of the items being gifted, along with their estimated value. 4. Charitable Gift Declaration: This type of declaration is used when the gift is made to a charitable organization or foundation. It may include the organization's tax-exempt status and any specific requirements or conditions set by the donor. In conclusion, the Michigan Declaration of Gift is a crucial legal document that facilitates the transfer of property or assets from one party to another. By carefully drafting and executing this document, both parties can ensure that the gift is properly documented, and their rights and obligations are protected.The Michigan Declaration of Gift is a legal document that allows individuals to donate or gift their property or assets to another person or organization. It serves as an official record of the transfer of ownership and ensures that all necessary legal requirements are met. Key aspects covered in the Michigan Declaration of Gift include the identification of the donor (person making the gift) and the recipient (person or entity receiving the gift), a detailed description of the property being gifted, and any conditions or restrictions placed upon the gift. This document is essential for both the donor and the recipient as it provides evidence of the gift and protects the interests of both parties. Different types of Michigan Declaration of Gift can include: 1. Real Estate Gift Declaration: This type of declaration is used when the gift involves the transfer of real property, such as land, houses, or commercial buildings. It outlines the specific details of the property being gifted and any legal obligations associated with the transfer, such as taxes or liens. 2. Financial Gift Declaration: This type of declaration is used for gifts involving money or financial assets. It specifies the amount of money being gifted and may detail any conditions or terms that the donor imposes on the use of the funds. 3. Personal Property Gift Declaration: This type of declaration is used when the gift involves personal belongings, such as artwork, jewelry, vehicles, or other valuables. It provides a comprehensive description of the items being gifted, along with their estimated value. 4. Charitable Gift Declaration: This type of declaration is used when the gift is made to a charitable organization or foundation. It may include the organization's tax-exempt status and any specific requirements or conditions set by the donor. In conclusion, the Michigan Declaration of Gift is a crucial legal document that facilitates the transfer of property or assets from one party to another. By carefully drafting and executing this document, both parties can ensure that the gift is properly documented, and their rights and obligations are protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.