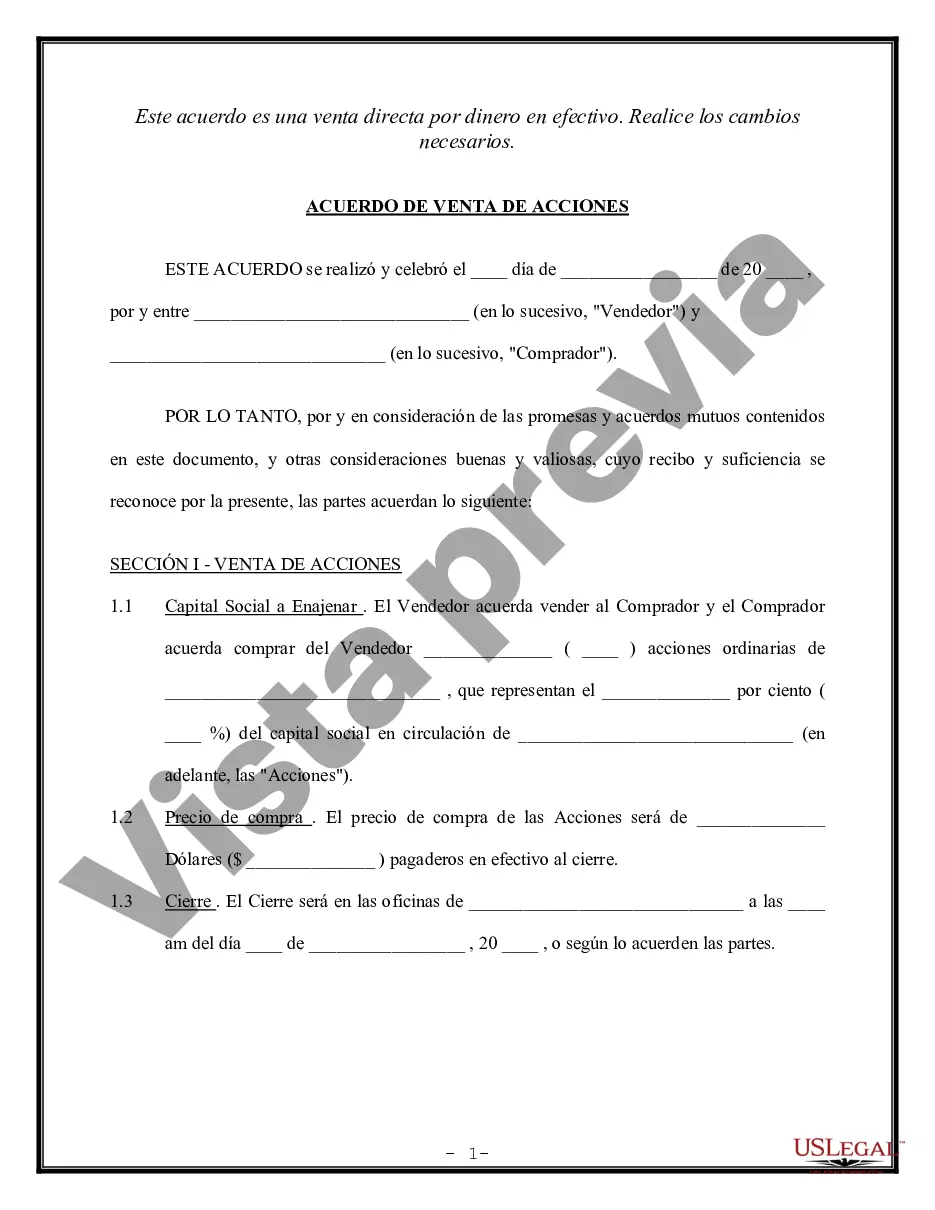

A Michigan Shareholder Agreement to Sell Stock to Other Shareholder is a legal contract that outlines the terms and conditions for the sale and transfer of stock ownership from one shareholder to another within a company incorporated in Michigan. This agreement is commonly utilized when existing shareholders want to buy or sell their shares to fellow shareholders, ensuring a smooth and regulated process. The agreement typically specifies important details such as the names of the shareholders involved, the number of shares being sold, the purchase price per share, and the payment method agreed upon. Additionally, it may include any restrictions or conditions that need to be met prior to the sale, such as obtaining necessary regulatory approvals or adhering to any pre-existing buy-sell provisions within the company's bylaws. Different types of Michigan Shareholder Agreement to Sell Stock to Other Shareholder may exist depending on specific circumstances and considerations. Some common variations include: 1. One-Way Agreement: This agreement allows a shareholder to sell their stock to another shareholder without providing reciprocal rights for the buying shareholder to sell their shares in return. It is often used when a shareholder wants to exit the company while maintaining control over who becomes their successor. 2. Two-Way Agreement: In contrast to the one-way agreement, the two-way agreement allows shareholders to buy and sell stock to one another with equal rights. This type of agreement provides greater flexibility and liquidity for shareholders by facilitating the possibility of multiple sales and purchases among the shareholders. 3. Right of First Refusal Agreement: This agreement grants existing shareholders the first opportunity to purchase the shares offered for sale before they can be sold to any external parties. It ensures that existing shareholders have the option to maintain a controlling interest in the company and protect its shareholder structure. 4. Preemptive Rights Agreement: A preemptive rights' agreement gives existing shareholders the priority to purchase newly issued shares before they are offered to any third party. This type of agreement helps protect existing shareholders' proportional ownership and prevent dilution of their shares. To create a Michigan Shareholder Agreement to Sell Stock to Other Shareholder, it is advisable to seek the assistance of a qualified attorney who specializes in corporate law and understands Michigan-specific regulations. This ensures that the agreement effectively addresses the shareholders' intentions and protects their rights while complying with relevant legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Michigan Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

Choosing the right authorized file format might be a have difficulties. Needless to say, there are tons of templates available on the net, but how would you discover the authorized kind you need? Take advantage of the US Legal Forms site. The services gives a huge number of templates, like the Michigan Shareholder Agreement to Sell Stock to Other Shareholder, which can be used for business and private requires. All of the types are inspected by pros and meet up with state and federal requirements.

When you are presently signed up, log in for your accounts and click the Acquire switch to have the Michigan Shareholder Agreement to Sell Stock to Other Shareholder. Make use of your accounts to search throughout the authorized types you may have purchased previously. Go to the My Forms tab of the accounts and acquire one more backup from the file you need.

When you are a whole new customer of US Legal Forms, listed here are simple directions that you can adhere to:

- Very first, make certain you have chosen the correct kind for your city/county. It is possible to look through the shape using the Preview switch and browse the shape explanation to guarantee it is the right one for you.

- In case the kind will not meet up with your needs, use the Seach area to obtain the appropriate kind.

- Once you are sure that the shape is suitable, click the Buy now switch to have the kind.

- Select the costs strategy you want and type in the necessary information and facts. Build your accounts and buy the transaction using your PayPal accounts or credit card.

- Pick the document structure and acquire the authorized file format for your device.

- Full, modify and printing and indicator the acquired Michigan Shareholder Agreement to Sell Stock to Other Shareholder.

US Legal Forms is definitely the greatest collection of authorized types for which you can discover numerous file templates. Take advantage of the company to acquire professionally-manufactured paperwork that adhere to express requirements.