A Michigan Stock Sale and Purchase Agreement is a legally binding document outlining the terms and conditions for the sale of a corporation and all its stock from the seller (vendor) to the buyer (purchaser) in the state of Michigan. This agreement plays a critical role in facilitating the transfer of ownership and provides a framework for protecting the rights and interests of both parties involved. The Michigan Stock Sale and Purchase Agreement typically includes the following key elements: 1. Parties Involved: The agreement clearly identifies the seller (vendor) and the buyer (purchaser), along with their legal names, addresses, and contact details. It is crucial to establish the correct legal entities involved in the transaction. 2. Stock Description: This section provides a comprehensive description of the stock being sold, including the type of stock (common or preferred), the number of shares, and any associated rights or restrictions. 3. Purchase Price: The agreement outlines the agreed-upon purchase price for the stock and the corresponding payment terms. This may include the amount to be paid at closing, installment payments, or any deferred payments with interest, if applicable. 4. Representations and Warranties: Both parties make statements regarding the accuracy and completeness of the information provided, ensuring that there are no hidden liabilities or undisclosed material facts. These statements are critical for the purchaser to have confidence in the transaction. 5. Due Diligence: The agreement may provide a due diligence period, allowing the purchaser to thoroughly review the financial records, contracts, assets, and liabilities of the corporation being sold. This ensures transparency and helps avoid any surprises after the transaction is completed. 6. Conditions Precedent: The agreement may outline specific conditions that need to be met for the transaction to proceed, such as obtaining necessary approvals from regulatory authorities, third-party consents, or the absence of any material adverse changes. 7. Indemnification: The agreement usually includes provisions related to indemnification, stating that the seller will be responsible for any losses, damages, or liabilities arising from misrepresentations, breach of warranties, or undisclosed liabilities. This section safeguards the purchaser's interests. 8. Closing and Post-Closing Obligations: The agreement specifies the date and location of the closing, where the final exchange of stock certificates and payment occurs. It may also outline any post-closing obligations, such as providing transitional support or maintaining confidentiality. Some different types of Michigan Stock Sale and Purchase Agreements related to the sale of a corporation and all its stock to a purchaser may be: 1. Michigan Stock Sale and Purchase Agreement with Earn out: This agreement includes a Darn out provision where a portion of the purchase price is contingent upon the corporation achieving specific future financial targets or milestones. 2. Michigan Stock Sale and Purchase Agreement with Escrow: In this case, a portion of the purchase price is held in escrow for a defined period to cover potential indemnification claims or to secure certain obligations of the seller. 3. Michigan Stock Sale and Purchase Agreement for Merger and Acquisition: This type of agreement is specifically designed for mergers and acquisitions scenarios where a corporation is being purchased, resulting in the amalgamation of entities. It is essential to consult legal professionals and tailor the agreement to the specific needs and requirements of the parties involved in the transaction.

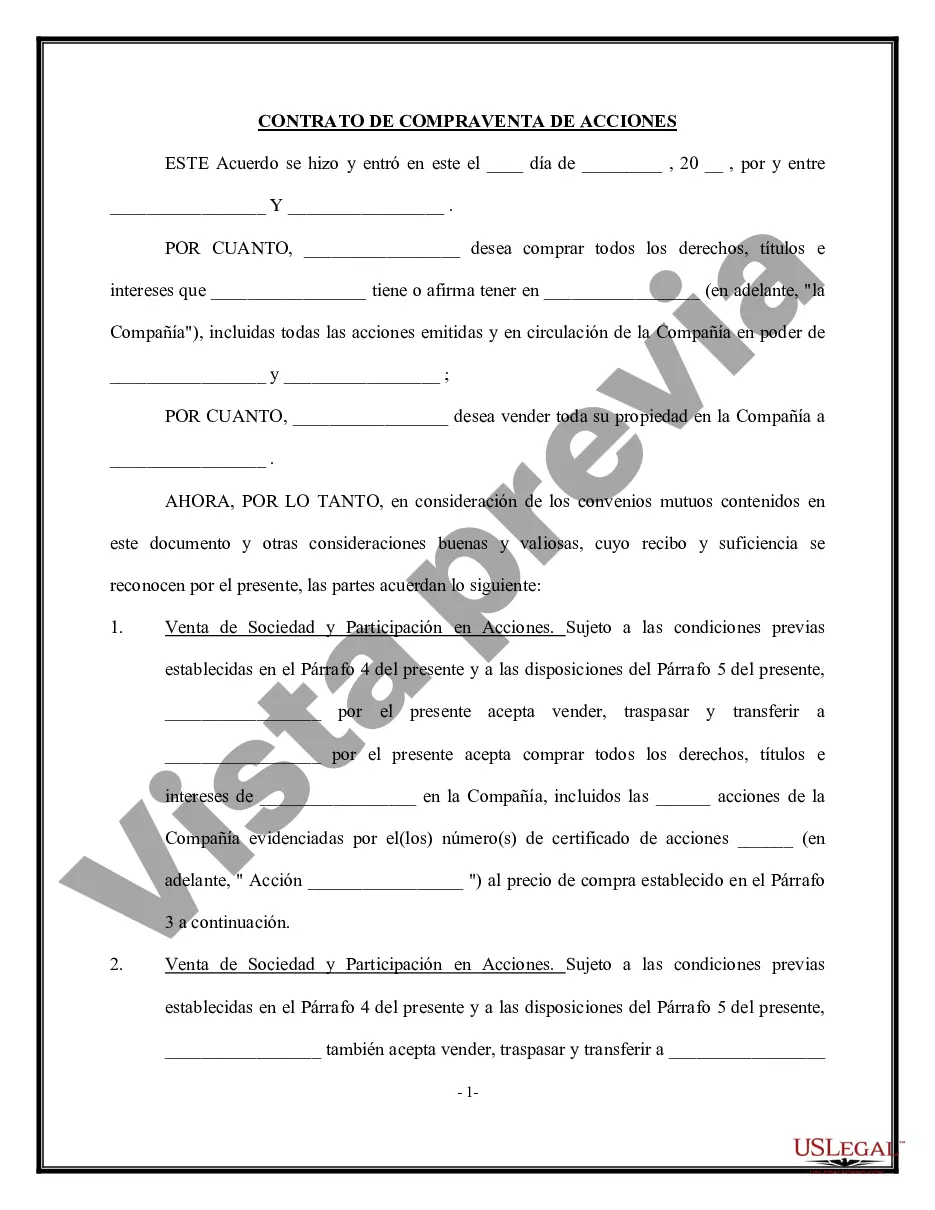

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Michigan Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a comprehensive selection of legal templates that you can download or create.

By utilizing the website, you can access numerous forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents like the Michigan Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser in just a few moments.

If you already hold a membership, sign in and download the Michigan Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser from the US Legal Forms library. The Download option will be available on every document you view.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your computer.Edit. Complete, modify, print, and sign the downloaded Michigan Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or create another version, simply navigate to the My documents section and click on the form you desire.

Access the Michigan Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- To get started with US Legal Forms, follow these simple guidelines.

- Ensure you have selected the appropriate document for your city/state.

- Use the Preview function to review the contents of the document.

- Examine the document details to confirm you have chosen the correct one.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount.

In a sale of shares between two parties, a draft SPA is normally drawn up by the buyer's legal representatives, as it's the buyer who is most concerned that the SPA protects them against post-sale liabilities.

Seller's perspective: Sellers often prefer selling the shares of the company as opposed to the assets for the following reasons: Taxes: Only half of the company's capital gains is considered taxable income. The other half of the gains can be included in income free of tax.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

Stock Purchase Agreement: Everything You Need to KnowName of company.Purchaser's name.Par value of shares.Number of shares being sold.When/where the transaction takes place.Representations and warranties made by purchaser and seller.Potential employee issues, such as bonuses and benefits.More items...?

More info

Health Care Directive Estate Vault Share Purchase Agreement STOCK PURCHASE AGREEMENT This Stock Purchase Agreement this Agreement made this June among Housemates Washington corporation Buyer David Suzanne Huey Shareholders Soar Solutions Illinois corporation Company RECITALS Shareholders presently outstanding shares capital stock Company Shares desire intend sell Shares Buyer price terms subject conditions forth below Buyer desires acquire Shares from Shareholders price terms subject conditions forth below AGREEMENT THEREFORE consideration covenants conditions herein parties agree follows Subject terms conditions this Agreement Closing defined Section this Agreement Shareholders shall sell convey transfer assign upon terms conditions hereinafter forth Buyer free clear liens pledges claims In the event of any error or omissions in these documents, including for any errors, inaccuracies or delays in the contents of this agreement, the parties acknowledge that, in the absence of such