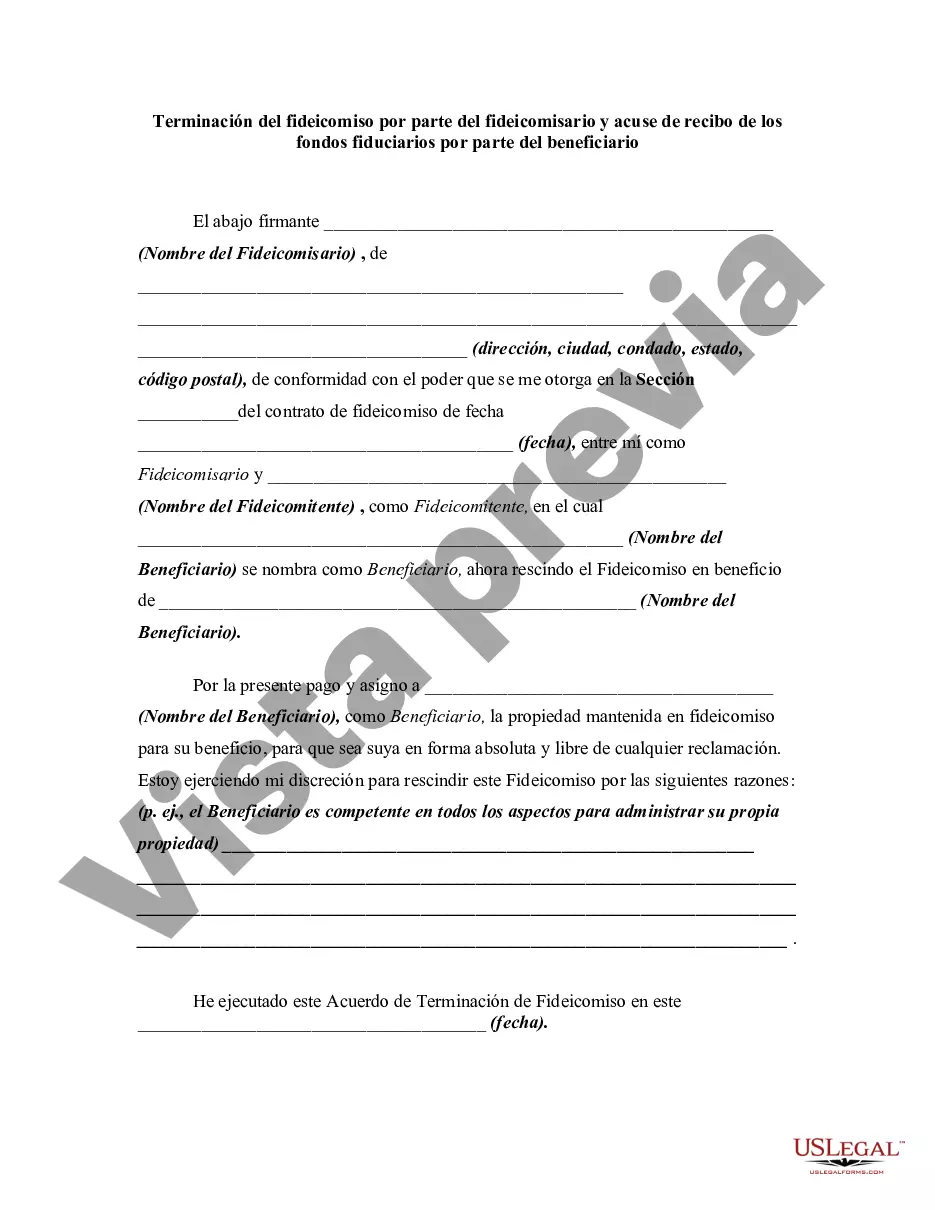

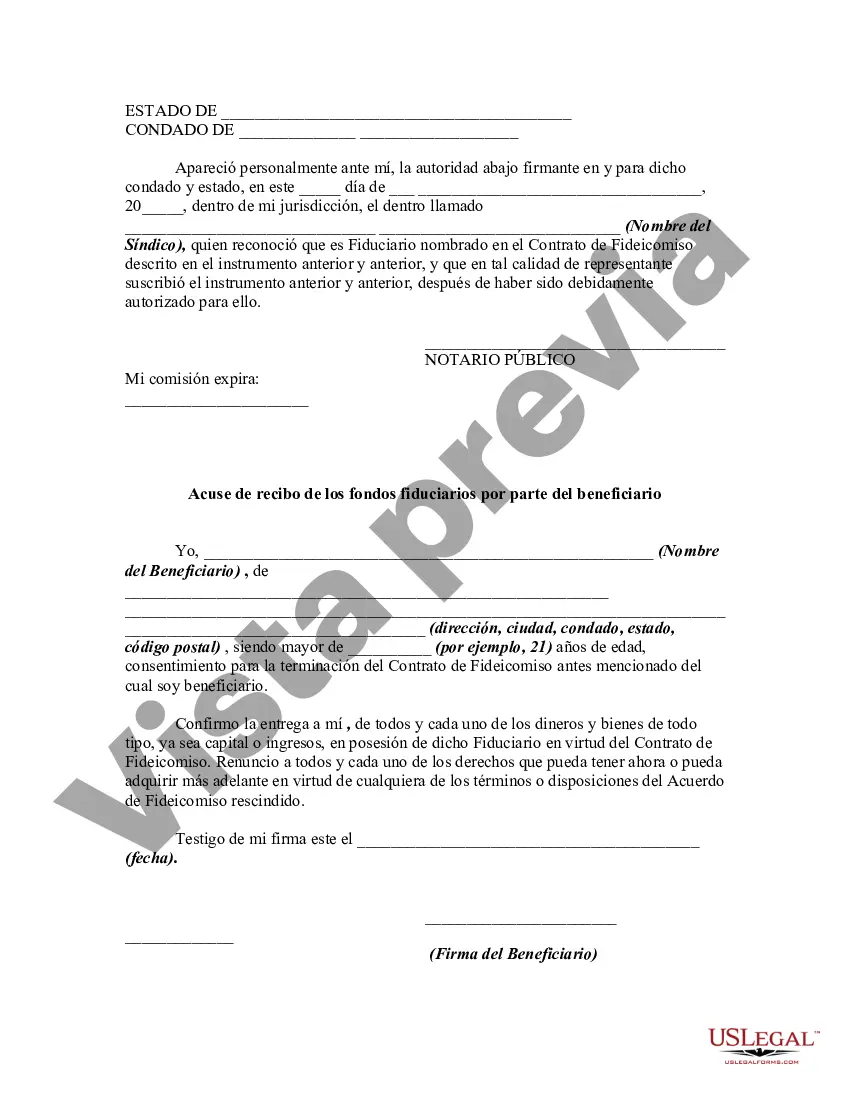

In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary are legal documents that pertain to the termination of a trust and the acknowledgment of the distribution of trust funds by the designated beneficiary. These documents are commonly used in the state of Michigan to facilitate the proper closure of a trust. The Michigan Termination of Trust By Trustee refers to a situation where the trustee responsible for managing the trust decides to terminate it. There could be various reasons for terminating a trust, such as achieving the trust's purpose, expiration of the trust term, or a change in circumstances that renders the trust unnecessary. This legal document outlines the trustee's decision to terminate the trust, ensuring that all necessary legal steps are taken in the process. The Acknowledgment of Receipt of Trust Funds By Beneficiary, on the other hand, is a document that recognizes the beneficiary's receipt of the distributed trust funds. Once the trust has been terminated and its assets have been liquidated or distributed, the beneficiary receives their respective share. This acknowledgment serves as proof that the beneficiary has received their entitlement and releases the trustee from any further obligations. Different types of Michigan Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary may include specific circumstances or terms within the trust that dictate the details of the termination and distribution. Some variations may include: 1. Termination due to fulfillment of trust purpose: In this case, the trust may specify a certain event or goal that, once achieved, triggers its termination. The document would highlight the successful completion of the trust's purpose and the subsequent distribution of the assets to the beneficiary. 2. Termination by agreement: This type of termination occurs when all parties involved in the trust mutually agree to terminate it. The document would outline the agreement between the trustee and the beneficiary regarding the termination and subsequent distribution. 3. Termination due to expiration of trust term: If the trust is established for a specific period, the termination occurs automatically upon the expiration of the term. The document would include the mentioned expiration date and details of the distribution of the trust's assets. 4. Partial trust termination: In some cases, only a specific portion of the trust may be terminated, while the remaining assets continue to be managed by the trustee. This type of termination is usually outlined in the trust itself and requires the trustee to specify which assets are being terminated and distributed. Whether it's a trustee terminating the trust or a beneficiary receiving the trust funds, these Michigan legal documents help ensure that the termination process is properly executed and that all relevant parties are informed and legally protected. It is advised to consult legal professionals to understand the specific requirements and implications when dealing with the termination of a trust in Michigan.Michigan Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary are legal documents that pertain to the termination of a trust and the acknowledgment of the distribution of trust funds by the designated beneficiary. These documents are commonly used in the state of Michigan to facilitate the proper closure of a trust. The Michigan Termination of Trust By Trustee refers to a situation where the trustee responsible for managing the trust decides to terminate it. There could be various reasons for terminating a trust, such as achieving the trust's purpose, expiration of the trust term, or a change in circumstances that renders the trust unnecessary. This legal document outlines the trustee's decision to terminate the trust, ensuring that all necessary legal steps are taken in the process. The Acknowledgment of Receipt of Trust Funds By Beneficiary, on the other hand, is a document that recognizes the beneficiary's receipt of the distributed trust funds. Once the trust has been terminated and its assets have been liquidated or distributed, the beneficiary receives their respective share. This acknowledgment serves as proof that the beneficiary has received their entitlement and releases the trustee from any further obligations. Different types of Michigan Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary may include specific circumstances or terms within the trust that dictate the details of the termination and distribution. Some variations may include: 1. Termination due to fulfillment of trust purpose: In this case, the trust may specify a certain event or goal that, once achieved, triggers its termination. The document would highlight the successful completion of the trust's purpose and the subsequent distribution of the assets to the beneficiary. 2. Termination by agreement: This type of termination occurs when all parties involved in the trust mutually agree to terminate it. The document would outline the agreement between the trustee and the beneficiary regarding the termination and subsequent distribution. 3. Termination due to expiration of trust term: If the trust is established for a specific period, the termination occurs automatically upon the expiration of the term. The document would include the mentioned expiration date and details of the distribution of the trust's assets. 4. Partial trust termination: In some cases, only a specific portion of the trust may be terminated, while the remaining assets continue to be managed by the trustee. This type of termination is usually outlined in the trust itself and requires the trustee to specify which assets are being terminated and distributed. Whether it's a trustee terminating the trust or a beneficiary receiving the trust funds, these Michigan legal documents help ensure that the termination process is properly executed and that all relevant parties are informed and legally protected. It is advised to consult legal professionals to understand the specific requirements and implications when dealing with the termination of a trust in Michigan.

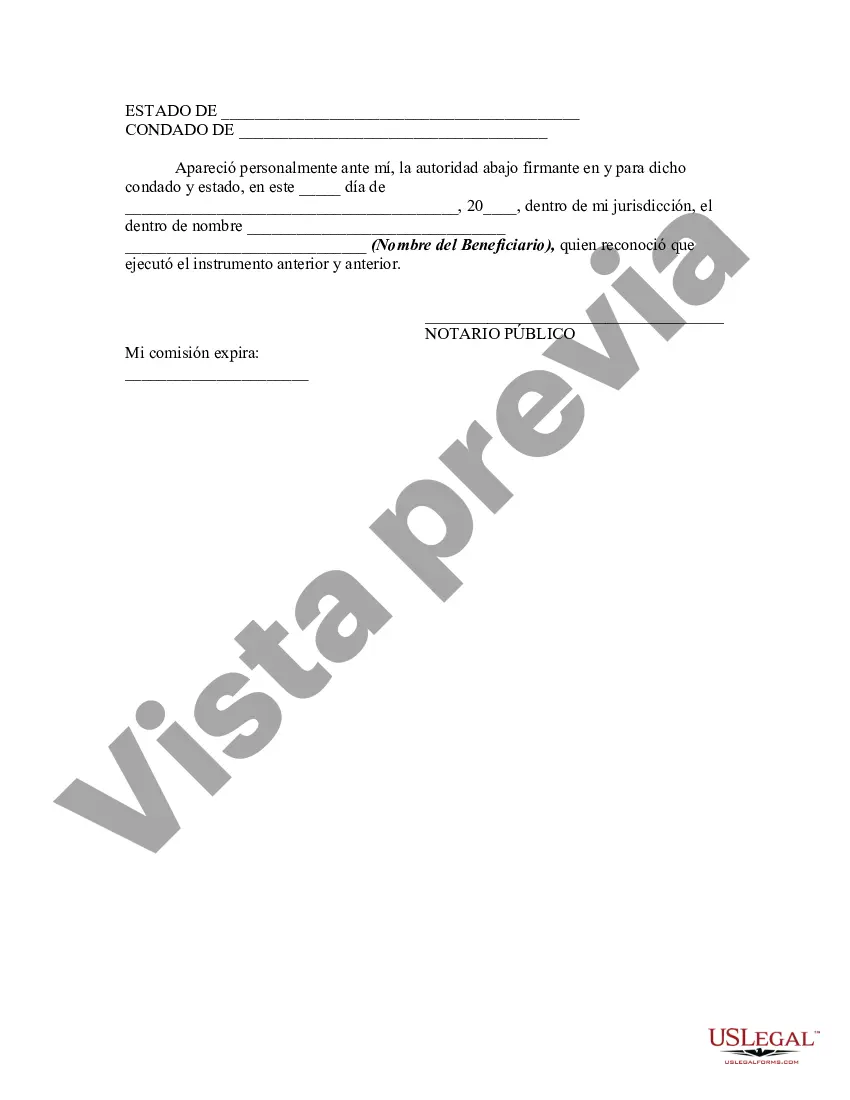

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.