This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

A Michigan Notice of Default in Payment Due on Promissory Note is a legal document issued to a borrower when they fail to make payments as agreed upon in a promissory note. This notice serves as a formal warning indicating that the borrower is in default and has a specified time to rectify the situation before further legal actions may be taken. The main purpose of a Michigan Notice of Default in Payment Due on Promissory Note is to provide the borrower with an opportunity to cure the default and reinstate the loan agreement. It outlines the specific amount overdue, the due date, and the consequences of continued non-payment. There are different types of Michigan Notice of Default in Payment Due on Promissory Note, depending on the nature and severity of the default: 1. Notice of Late Payment: This type of notice is typically issued when the borrower fails to make a payment by the specified due date, but the delay is considered minor. It informs the borrower about the missed payment and requests immediate payment to avoid further action. 2. Notice of Acceleration: When a borrower consistently fails to make multiple payments on time or breaches other terms of the promissory note, a Notice of Acceleration may be issued. This notice demands the immediate payment of the full outstanding balance, along with any accrued interest, penalties, or additional charges. It accelerates the loan, making the entire amount due and payable. 3. Notice of Foreclosure: If a borrower fails to respond or rectify the default within the given timeframe provided in the Notice of Default, the lender may proceed with initiating foreclosure proceedings. A Notice of Foreclosure is sent to the borrower, notifying them of the lender's intention to sell the property secured by the promissory note to recover the outstanding debt. It is essential for borrowers to take immediate action upon receiving a Michigan Notice of Default in Payment Due on Promissory Note. They should communicate with their lender, assess their financial situation, and try to negotiate a repayment plan or seek legal counsel if necessary to protect their rights and avoid foreclosure.A Michigan Notice of Default in Payment Due on Promissory Note is a legal document issued to a borrower when they fail to make payments as agreed upon in a promissory note. This notice serves as a formal warning indicating that the borrower is in default and has a specified time to rectify the situation before further legal actions may be taken. The main purpose of a Michigan Notice of Default in Payment Due on Promissory Note is to provide the borrower with an opportunity to cure the default and reinstate the loan agreement. It outlines the specific amount overdue, the due date, and the consequences of continued non-payment. There are different types of Michigan Notice of Default in Payment Due on Promissory Note, depending on the nature and severity of the default: 1. Notice of Late Payment: This type of notice is typically issued when the borrower fails to make a payment by the specified due date, but the delay is considered minor. It informs the borrower about the missed payment and requests immediate payment to avoid further action. 2. Notice of Acceleration: When a borrower consistently fails to make multiple payments on time or breaches other terms of the promissory note, a Notice of Acceleration may be issued. This notice demands the immediate payment of the full outstanding balance, along with any accrued interest, penalties, or additional charges. It accelerates the loan, making the entire amount due and payable. 3. Notice of Foreclosure: If a borrower fails to respond or rectify the default within the given timeframe provided in the Notice of Default, the lender may proceed with initiating foreclosure proceedings. A Notice of Foreclosure is sent to the borrower, notifying them of the lender's intention to sell the property secured by the promissory note to recover the outstanding debt. It is essential for borrowers to take immediate action upon receiving a Michigan Notice of Default in Payment Due on Promissory Note. They should communicate with their lender, assess their financial situation, and try to negotiate a repayment plan or seek legal counsel if necessary to protect their rights and avoid foreclosure.

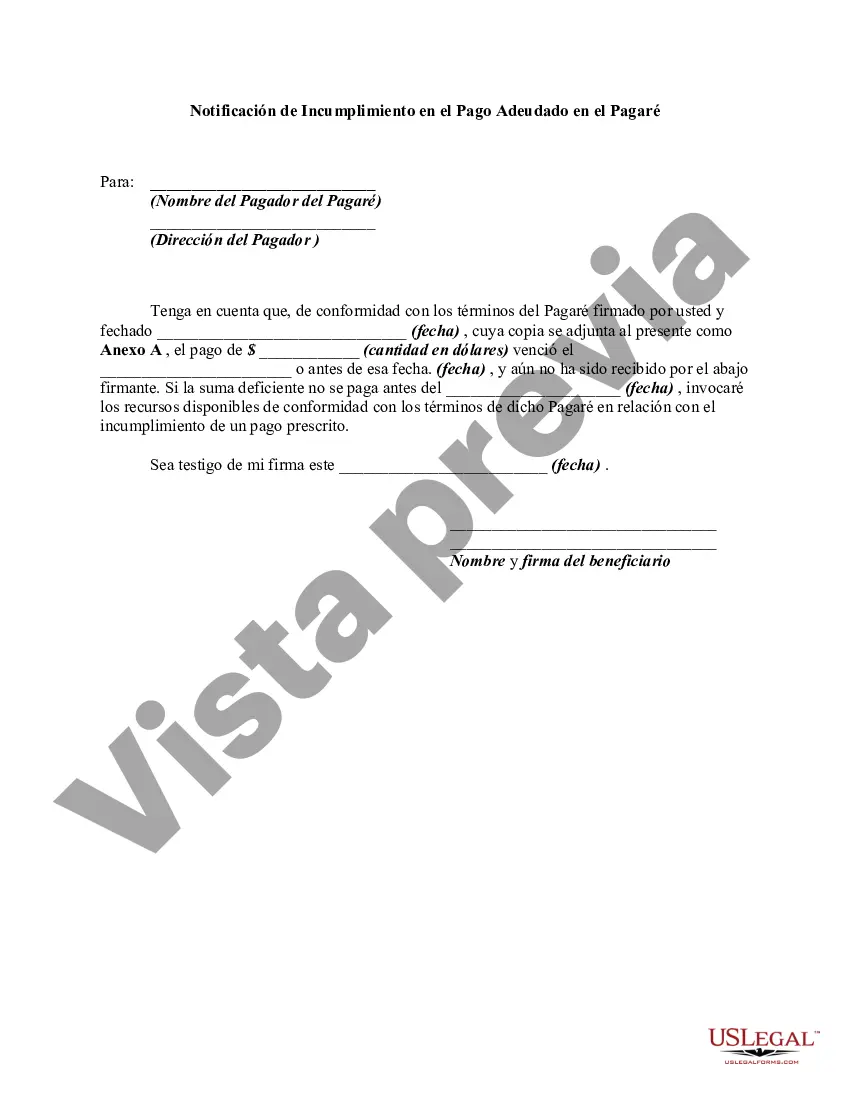

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.