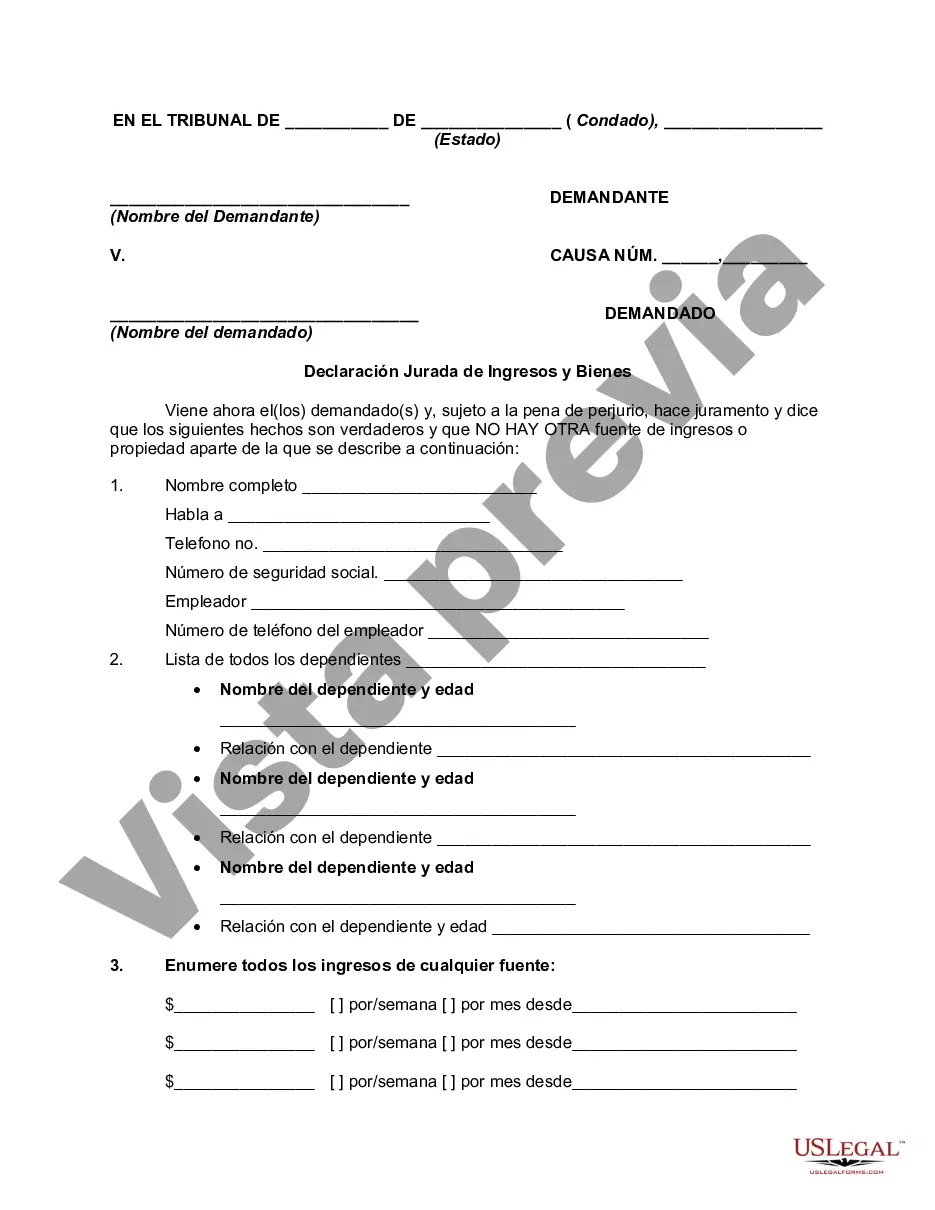

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Michigan, an Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document used to declare the financial standing and possessions of an individual or entity. This document is important in various situations such as applying for loans, requesting government benefits, and during divorce proceedings. It allows interested parties to assess the financial stability, net worth, and debt obligations of the person or organization involved. Keywords: Michigan Affidavit, Proof of Income, Property, Assets, Liabilities, Financial Standing, Net Worth, Debt Obligations, Loans, Government Benefits, Divorce Proceedings. There are several types of Michigan Affidavits or Proofs of Income and Property — Assets and Liabilities, depending on the specific purpose they serve: 1. Financial Affidavit for Loan Application: This type of affidavit is often required when applying for a loan, be it a mortgage, auto loan, or personal loan. It provides a comprehensive overview of the applicant's financial situation, including income, savings, investments, real estate properties, and outstanding debts. 2. Michigan Affidavit of Financial Worth: This document is commonly used during divorce proceedings. Each spouse is required to submit an Affidavit of Financial Worth, detailing their respective incomes, assets, liabilities, and monthly expenses. This information helps the court in determining property division, spousal support, and child support arrangements. 3. Affidavit of Financial Support: This particular affidavit is often utilized when sponsoring an immigrant relative for visa application purposes. The sponsor has to prove their ability to financially support the immigrant by providing substantial evidence of income, assets, and financial stability. 4. Michigan Affidavit of Property Ownership: This affidavit focuses primarily on documenting ownership of real estate properties. It includes details such as property addresses, current market values, outstanding mortgages, and any other relevant property-related information. 5. Affidavit of Means: This affidavit demonstrates an individual's income, assets, and liabilities in cases of criminal proceedings, especially when determining bail eligibility or court-appointed attorney requests. It assists in assessing if the accused can afford legal representation or if they qualify for a public defender. 6. Estate Planning Affidavit: This type of affidavit is used in estate planning to provide a comprehensive overview of an individual's financial situation, including income, assets, and liabilities. It aids in determining the distribution of assets and debts after the individual's death. In conclusion, a Michigan Affidavit or Proof of Income and Property — Assets and Liabilities is essential for various legal and administrative purposes. It ensures transparency and allows interested parties to evaluate the financial stability and wealth of an individual or entity in question.In Michigan, an Affidavit or Proof of Income and Property — Assets and Liabilities is a legal document used to declare the financial standing and possessions of an individual or entity. This document is important in various situations such as applying for loans, requesting government benefits, and during divorce proceedings. It allows interested parties to assess the financial stability, net worth, and debt obligations of the person or organization involved. Keywords: Michigan Affidavit, Proof of Income, Property, Assets, Liabilities, Financial Standing, Net Worth, Debt Obligations, Loans, Government Benefits, Divorce Proceedings. There are several types of Michigan Affidavits or Proofs of Income and Property — Assets and Liabilities, depending on the specific purpose they serve: 1. Financial Affidavit for Loan Application: This type of affidavit is often required when applying for a loan, be it a mortgage, auto loan, or personal loan. It provides a comprehensive overview of the applicant's financial situation, including income, savings, investments, real estate properties, and outstanding debts. 2. Michigan Affidavit of Financial Worth: This document is commonly used during divorce proceedings. Each spouse is required to submit an Affidavit of Financial Worth, detailing their respective incomes, assets, liabilities, and monthly expenses. This information helps the court in determining property division, spousal support, and child support arrangements. 3. Affidavit of Financial Support: This particular affidavit is often utilized when sponsoring an immigrant relative for visa application purposes. The sponsor has to prove their ability to financially support the immigrant by providing substantial evidence of income, assets, and financial stability. 4. Michigan Affidavit of Property Ownership: This affidavit focuses primarily on documenting ownership of real estate properties. It includes details such as property addresses, current market values, outstanding mortgages, and any other relevant property-related information. 5. Affidavit of Means: This affidavit demonstrates an individual's income, assets, and liabilities in cases of criminal proceedings, especially when determining bail eligibility or court-appointed attorney requests. It assists in assessing if the accused can afford legal representation or if they qualify for a public defender. 6. Estate Planning Affidavit: This type of affidavit is used in estate planning to provide a comprehensive overview of an individual's financial situation, including income, assets, and liabilities. It aids in determining the distribution of assets and debts after the individual's death. In conclusion, a Michigan Affidavit or Proof of Income and Property — Assets and Liabilities is essential for various legal and administrative purposes. It ensures transparency and allows interested parties to evaluate the financial stability and wealth of an individual or entity in question.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.