A Michigan Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a loan agreement between two parties. It is a written promise to repay a specific amount of money borrowed from a lender by a borrower within a certain time frame, along with any interest and other agreed-upon terms. Keywords: Michigan, Simple Promissory Note, Personal Loan, legal document, loan agreement, terms and conditions, repay, borrowed, lender, borrower, time frame, interest, agreed-upon. There are various types of Michigan Simple Promissory Notes for Personal Loans, including: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral or security from the borrower. It solely depends on the borrower's creditworthiness and ability to repay the loan. 2. Secured Promissory Note: Unlike an unsecured promissory note, a secured promissory note requires the borrower to provide collateral or security for the loan. If the borrower fails to repay the loan, the lender can claim the collateral to recover the outstanding amount. 3. Installment Promissory Note: An installment promissory note allows the borrower to repay the loan in predetermined, periodic installments. This note specifies the exact amounts and dates of each installment. 4. Demand Promissory Note: A demand promissory note is a type of promissory note that allows the lender to demand repayment of the loan whenever they choose. There is no specific maturity date mentioned in this note, giving the lender more flexibility. 5. Balloon Promissory Note: In a balloon promissory note, the borrower agrees to make smaller periodic payments towards interest and principal during the loan term, with a large "balloon" payment due at the end of the loan term. 6. Renewable Promissory Note: A renewable promissory note provides the borrower with an option to extend the loan term upon agreement with the lender. This type of note offers flexibility for the borrower in case they need additional time to repay the loan. 7. Fixed-Rate Promissory Note: A fixed-rate promissory note specifies a fixed interest rate for the entire loan term. This means the interest rate remains constant throughout the repayment period, providing certainty for both the lender and borrower. 8. Variable-Rate Promissory Note: A variable-rate promissory note includes an interest rate that fluctuates based on changes in an underlying market index. The interest rate can increase or decrease during the loan term, which may impact the borrower's repayment amounts. These different types of Michigan Simple Promissory Notes for Personal Loans cater to varying borrower needs and financial situations. It is crucial for both lenders and borrowers to carefully review and understand the terms and conditions outlined in these legal documents to ensure a smooth loan process and mitigate any potential conflicts or disputes.

Michigan Simple Promissory Note for Personal Loan

Description

How to fill out Simple Promissory Note For Personal Loan?

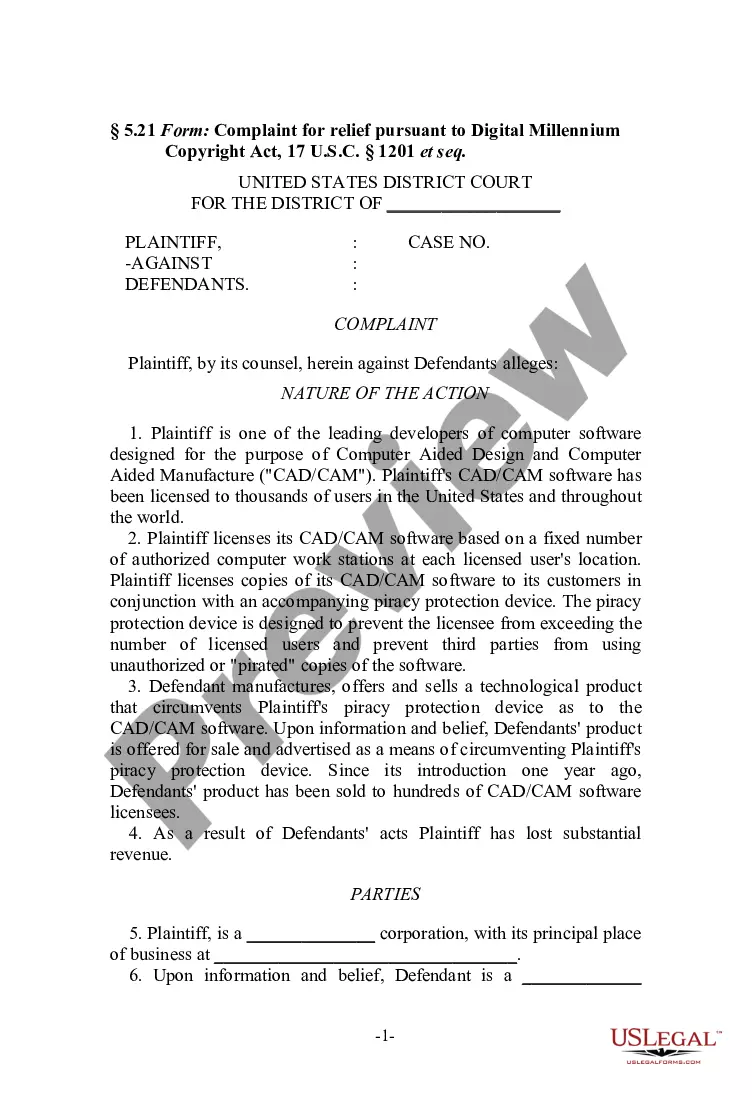

It is feasible to spend hours online trying to locate the valid document template that meets your state and federal standards. US Legal Forms offers thousands of valid forms which can be reviewed by experts.

You can download or print the Michigan Simple Promissory Note for Personal Loan from my services.

If you already possess a US Legal Forms account, you may Log In and click on the Download option. Afterwards, you may complete, modify, print, or sign the Michigan Simple Promissory Note for Personal Loan. Each valid document template you purchase is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to pay for the valid document. Select the format of the document and download it to your device. Make edits to your document if necessary. You can complete, modify, and sign and print the Michigan Simple Promissory Note for Personal Loan. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of valid forms. Use professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased form, navigate to the My documents tab and click on the relevant option.

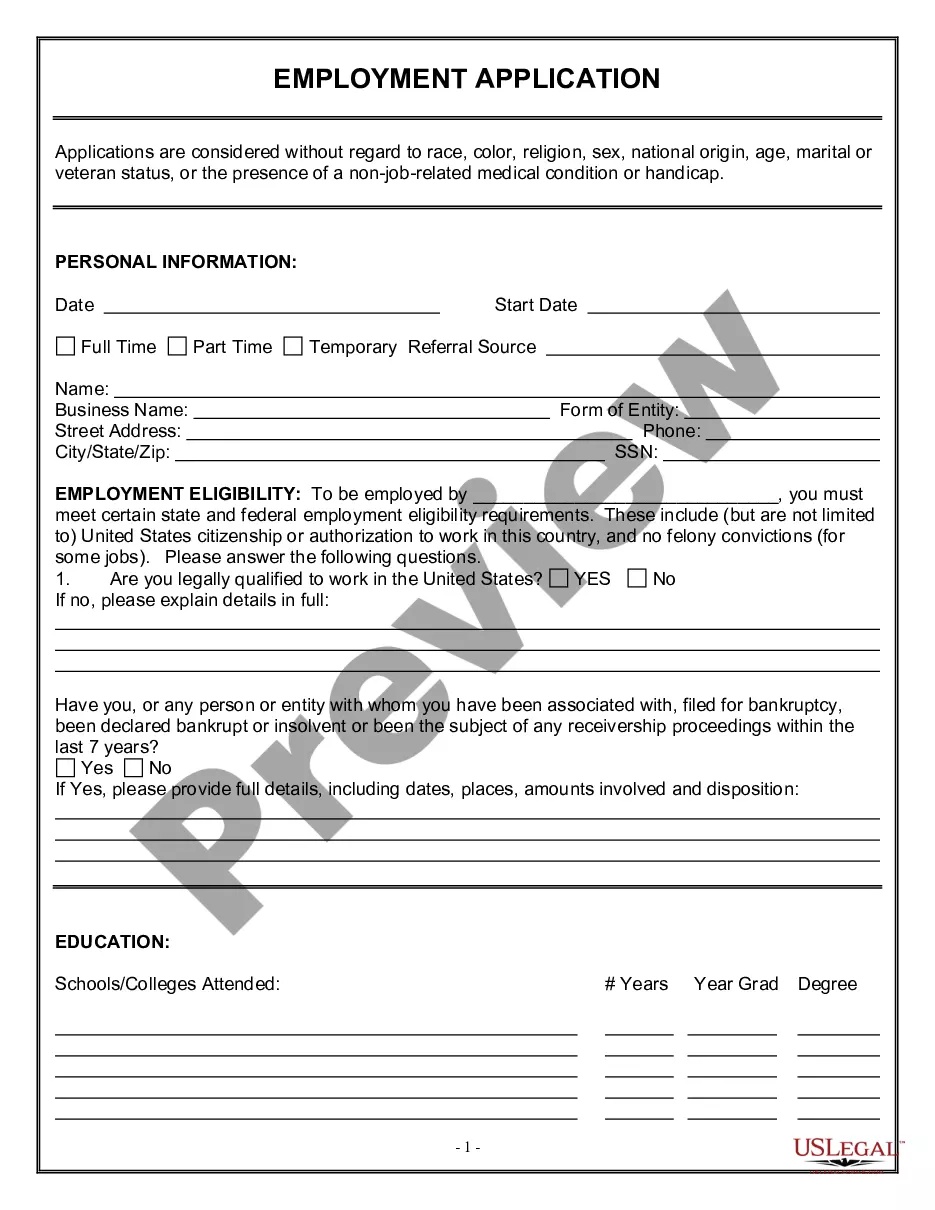

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions listed below.

- First, ensure that you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have selected the appropriate form.

- If available, utilize the Preview option to examine the document template as well.

- If you wish to find another version of the form, take advantage of the Search box to locate the template that fits your needs and requirements.

- Once you have identified the template you need, click Buy now to proceed.

- Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

Form popularity

FAQ

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

There is no legal requirement for most promissory notes to be witnessed or notarized in Michigan (a promissory note for a home loan, however, may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.