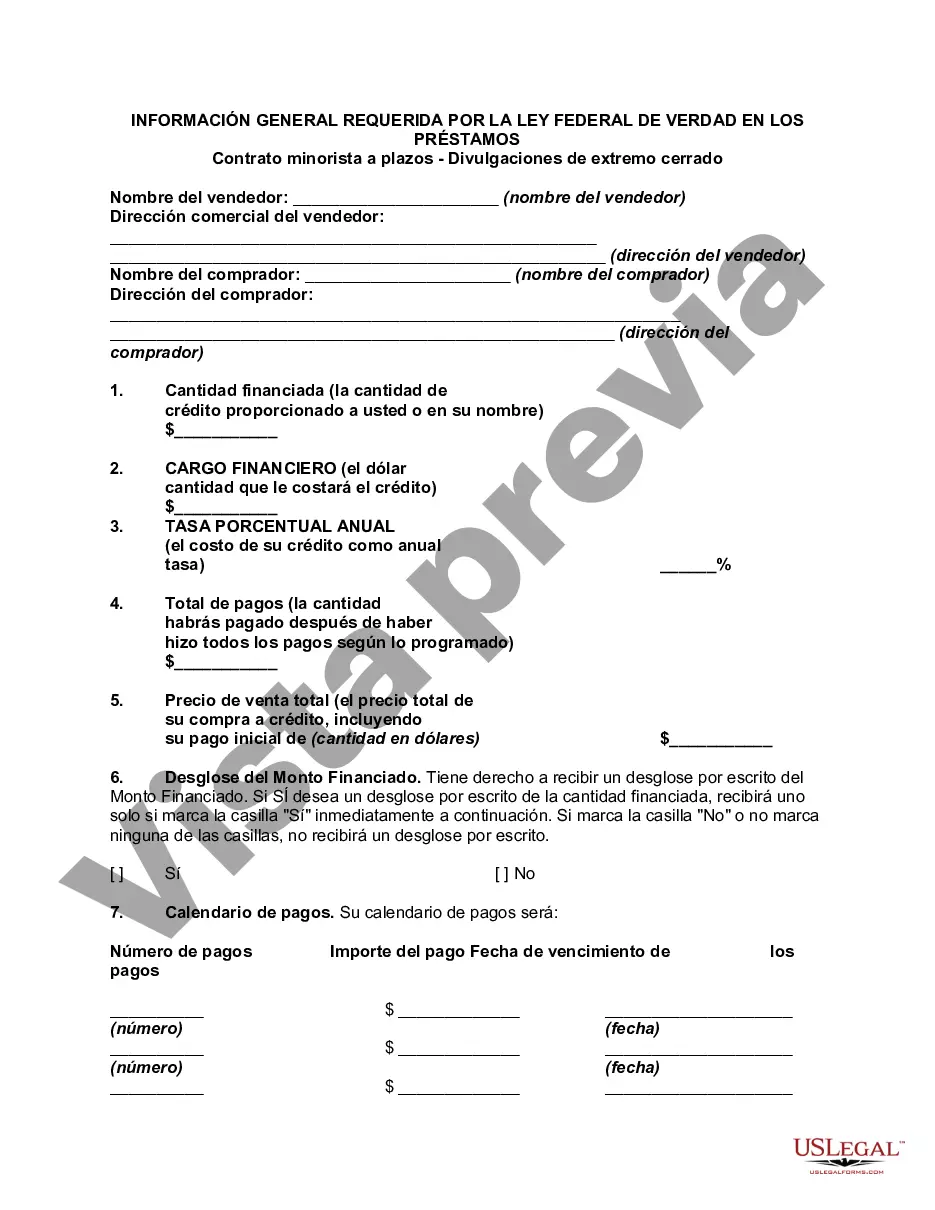

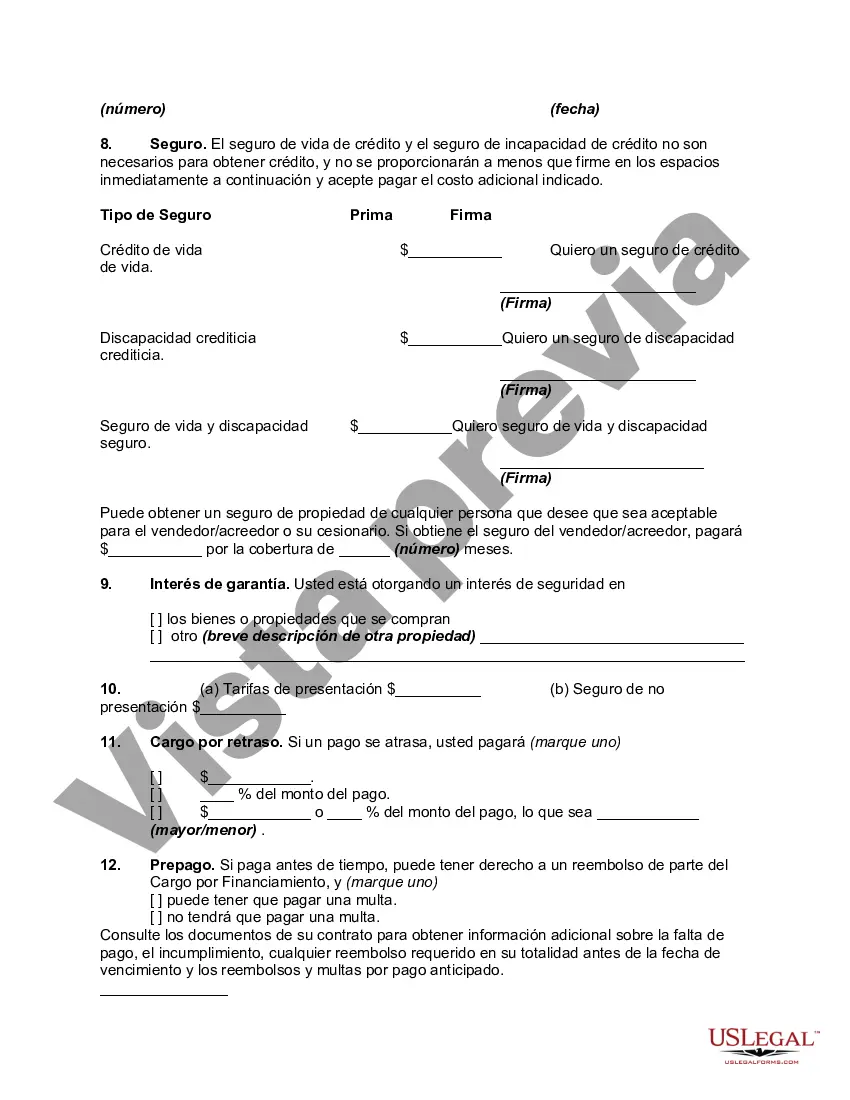

Michigan General Disclosures Required By The Federal Truth In Lending Act — Retail Installment Contract – Closed End Disclosures are essential for lenders and borrowers alike to ensure transparency, fairness, and compliance with federal regulations. These disclosures provide important information about the terms and conditions of a retail installment contract, empowering consumers to make informed financial decisions. Here are the different types of Michigan General Disclosures that fall under the umbrella of the Federal Truth In Lending Act for Retail Installment Contract — Closed End Disclosures: 1. Annual Percentage Rate (APR) Disclosure: The APR reflects the actual cost of borrowing, including interest, fees, and other charges associated with the loan. It enables borrowers to compare loan offers and understand the total cost over the loan term. 2. Finance Charge Disclosure: The finance charge is the total dollar amount the borrower will pay to finance the loan. This includes interest, fees, and other charges. 3. Amount Financed Disclosure: This disclosure reveals the actual amount of credit provided to the borrower, excluding any prepaid finance charges or other costs required upfront. 4. Total of Payments Disclosure: This figure indicates the total amount the borrower will have paid by the end of the loan term, including principal, interest, and all applicable charges. 5. Payment Schedule Disclosure: The payment schedule outlines the number and frequency of payments the borrower must make to repay the loan. It includes due dates, amounts, and any possible changes in payment amounts throughout the loan term. 6. Total Sales Price Disclosure: This disclosure represents the sum of the amount financed and the finance charge, giving borrowers a clear understanding of the total cost of the purchase. 7. Late Payment Disclosure: This disclosure explains the penalties or fees that may be incurred if the borrower fails to make timely payments. It may outline the amount charged, conditions for late payment, and any potential consequences. 8. Prepayment Disclosure: If there are any restrictions or penalties associated with repaying the loan early, this disclosure must outline those conditions and potential incurred costs. 9. Security Interest Disclosure: If the lender intends to secure the loan with any collateral, such as a vehicle or property, this disclosure should provide details about the type of security interest granted. 10. Right to Rescind Disclosure: In certain cases, such as refinancing or home equity loans, borrowers may have a specific timeframe to cancel the loan without penalty. This disclosure informs borrowers of their right to rescind the agreement within a designated period. Complying with these Michigan General Disclosures ensures that lenders are transparent about the terms and costs of a loan while providing borrowers with the necessary information to make informed decisions and protect their interests. Keywords: Michigan, General Disclosures, Federal Truth In Lending Act, Retail Installment Contract, Closed End Disclosures, APR, Finance Charge, Amount Financed, Total of Payments, Payment Schedule, Total Sales Price, Late Payment, Prepayment, Security Interest, Right to Rescind.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Michigan Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

US Legal Forms - one of many greatest libraries of authorized forms in the States - offers a wide array of authorized record templates it is possible to down load or produce. Using the site, you will get a large number of forms for business and personal reasons, sorted by classes, states, or key phrases.You can find the newest models of forms much like the Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in seconds.

If you currently have a membership, log in and down load Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in the US Legal Forms library. The Down load button will show up on each and every form you look at. You gain access to all in the past acquired forms in the My Forms tab of the account.

If you wish to use US Legal Forms initially, here are easy instructions to obtain started out:

- Be sure you have chosen the proper form for your town/state. Go through the Review button to examine the form`s information. Look at the form information to ensure that you have selected the right form.

- In case the form does not match your needs, use the Look for discipline towards the top of the screen to obtain the one that does.

- When you are content with the shape, confirm your selection by clicking the Purchase now button. Then, opt for the prices plan you like and offer your credentials to register for an account.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Choose the file format and down load the shape in your gadget.

- Make alterations. Complete, change and produce and indication the acquired Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Each format you put into your account does not have an expiration time which is your own permanently. So, if you wish to down load or produce an additional version, just check out the My Forms segment and then click around the form you will need.

Gain access to the Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with US Legal Forms, the most comprehensive library of authorized record templates. Use a large number of specialist and status-certain templates that fulfill your small business or personal requires and needs.