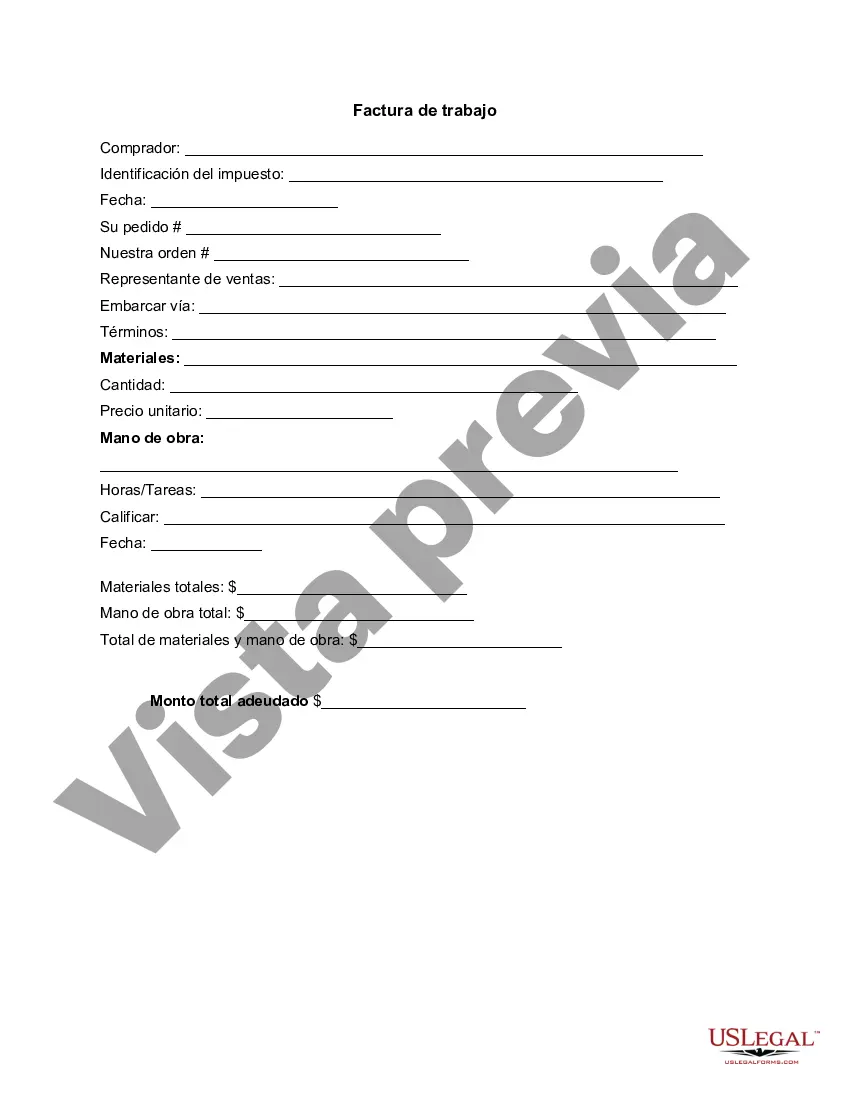

Michigan Invoice Template for Accountant is a customizable and professional document used by accountants in the state of Michigan to bill their clients for services rendered. This template simplifies the invoicing process and ensures accurate record-keeping for both the accountant and their clients. The Michigan Invoice Template for Accountant typically includes the key elements needed for an invoice, such as: 1. Business Information: The template includes the accountant's business name, address, and contact details, making it easy for clients to identify and contact the accountant. 2. Client Information: The invoice includes spaces for the client's name, address, and contact details, ensuring accuracy and specificity when addressing the invoice. 3. Invoice Number: Each Michigan Invoice Template for Accountant includes a unique invoice number to easily track and reference the document. 4. Invoice Date: The date of the invoice issuance is mentioned on the template, enabling both the accountant and client to keep track of billing cycles. 5. Description of Services: This section provides a comprehensive breakdown of the services provided by the accountant, along with the corresponding fees or hourly rates. Itemizing the services provides clarity and transparency to the client regarding the work performed. 6. Subtotals and Total Amount: The Michigan Invoice Template for Accountant will include subtotals for individual services, calculating the sum of all services provided, followed by the final total amount payable by the client. 7. Payment Terms: This section specifies the payment terms, such as acceptable payment methods, due date, and any late payment penalties or discounts offered. Clear payment terms help streamline the payment process and ensure timely payments. There may be different types of Michigan Invoice Template for Accountant available, including: 1. Standard Invoice Template: This is the most commonly used template format that includes all the essential elements mentioned above. 2. Hourly Rate Invoice Template: This template variation is useful for accountants who charge clients based on the number of hours worked. It allows the accountant to specify the hourly rate, number of hours worked, and calculate the subtotals accordingly. 3. Recurring Invoice Template: For accountants who provide services on a retainer basis or have recurring billing cycles, this template simplifies the invoicing process by enabling the accountant to set up automatic recurring invoices. 4. Expense Invoice Template: This type of template caters to accountants who incur expenses on behalf of their clients, such as travel expenses or purchasing supplies. It includes a dedicated section to itemize these expenses along with their amounts. In conclusion, Michigan Invoice Template for Accountant is an essential tool for accountants operating in Michigan to bill their clients. These templates streamline the invoicing process, enhance professionalism, and ensure accurate record-keeping. Various types of templates, such as standard, hourly rate, recurring, and expense invoice templates, can cater to different accounting needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Plantilla de factura para contador - Invoice Template for Accountant

Description

How to fill out Michigan Plantilla De Factura Para Contador?

Choosing the right lawful file template can be a have difficulties. Naturally, there are a lot of templates available online, but how do you obtain the lawful type you want? Take advantage of the US Legal Forms website. The assistance delivers a huge number of templates, for example the Michigan Invoice Template for Accountant, that you can use for organization and private needs. All the varieties are checked out by specialists and meet up with federal and state demands.

Should you be presently listed, log in in your profile and click on the Download switch to obtain the Michigan Invoice Template for Accountant. Utilize your profile to check through the lawful varieties you have bought earlier. Check out the My Forms tab of your own profile and get an additional backup in the file you want.

Should you be a new consumer of US Legal Forms, listed below are straightforward guidelines that you should adhere to:

- Initially, be sure you have selected the correct type for the city/area. You may examine the form utilizing the Review switch and browse the form information to make certain it is the best for you.

- When the type is not going to meet up with your requirements, use the Seach industry to get the proper type.

- When you are certain that the form would work, go through the Acquire now switch to obtain the type.

- Pick the prices prepare you desire and type in the needed information. Create your profile and pay money for the transaction with your PayPal profile or credit card.

- Select the data file structure and download the lawful file template in your device.

- Comprehensive, change and print out and sign the acquired Michigan Invoice Template for Accountant.

US Legal Forms is the biggest local library of lawful varieties in which you will find numerous file templates. Take advantage of the company to download professionally-manufactured papers that adhere to condition demands.