Title: Comprehensive Guide to Michigan Checklist of Matters for Drafting an Escrow Agreement Introduction: An escrow agreement plays a crucial role in various financial transactions, ensuring a secure and transparent transfer of assets between parties. In Michigan, there are specific considerations to keep in mind when drafting an escrow agreement. This detailed description will provide an overview of the essential factors to be considered, categorized into different types of Michigan Checklist of Matters during the drafting process. 1. Parties Involved: — Identify and accurately define the parties involved in the escrow agreement, including the buyer, seller, and escrow agent. — Specify their roles, responsibilities, and contact information to establish clear lines of communication. 2. Escrow Instructions: — Determine the purpose of the escrow, including the underlying transaction, such as real estate purchase, business acquisition, or settlement agreements. — Define the conditions and requirements that need to be satisfied prior to the release of funds or assets to the designated party. 3. Escrow Funds or Assets: — Clearly outline the funds or assets that will be held in escrow, specifying their nature, value, and ownership. — Address any potential liabilities associated with the BS crowed funds or assets, ensuring appropriate indemnification clauses are included. 4. Terms and Conditions: — Establish the duration of the escrow agreement, including any termination or extension provisions. — Specify the circumstances that may trigger the release or return of the BS crowed funds or assets. — Outline the procedures for addressing disputes, changes in circumstances, or breach of contract situations. 5. Escrow Account Management: — If the escrow agreement involves monetary funds, provide instructions for opening and managing an escrow account. — Comply with relevant Michigan laws, regulations, and industry best practices for financial management. 6. Confidentiality and Data Protection: — Incorporate measures to safeguard sensitive information shared during the escrow process, consistent with applicable privacy laws. — Outline responsibilities and liabilities related to data breaches or unauthorized access. 7. Jurisdiction and Governing Law: — Determine the jurisdiction where disputes will be resolved and specify the governing law, ensuring it aligns with Michigan regulations. Conclusion: In conclusion, drafting a comprehensive and legally compliant escrow agreement in Michigan requires careful consideration of the above checklist of matters. By addressing all relevant aspects, parties involved in the escrow agreement can ensure a smooth and transparent transaction while minimizing potential risks. It is crucial to consult with legal professionals experienced in Michigan escrow laws to tailor the agreement to the specific transaction and ensure compliance with state regulations.

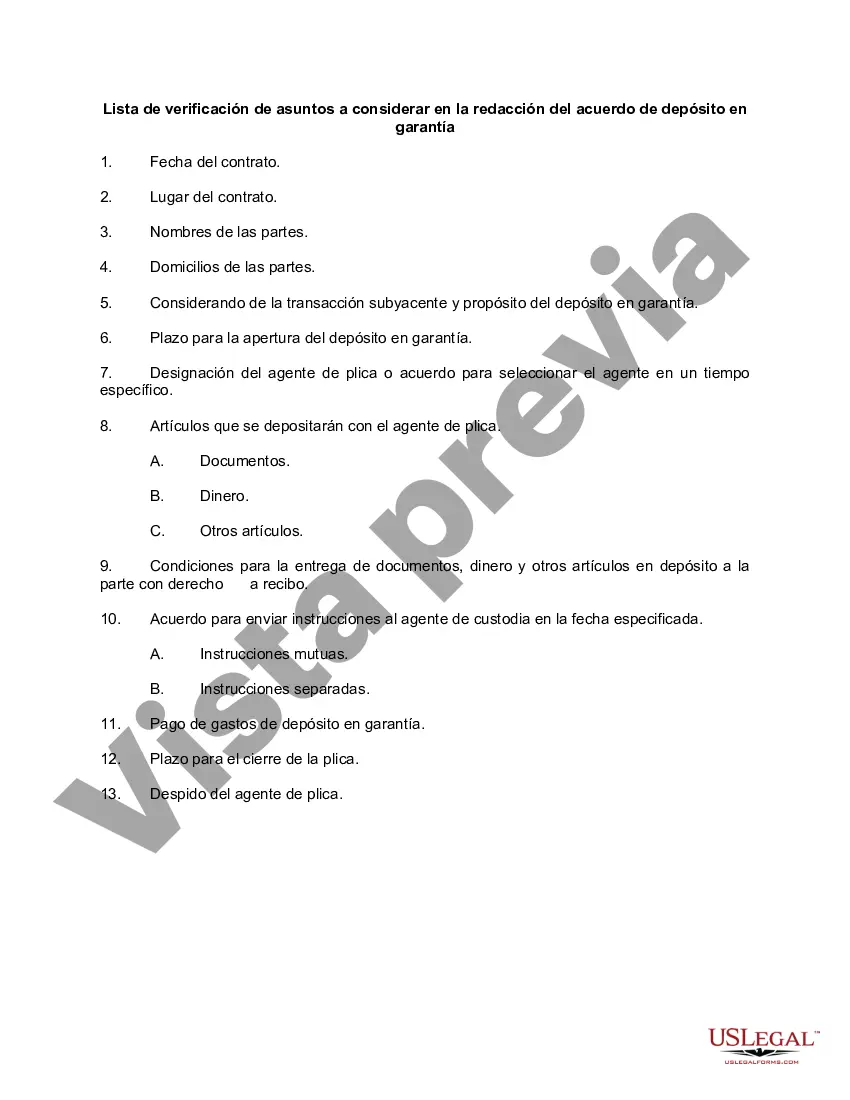

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Michigan Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

It is possible to devote several hours on-line trying to find the legal papers template which fits the state and federal requirements you want. US Legal Forms supplies a huge number of legal types that are examined by professionals. It is possible to download or print the Michigan Checklist of Matters to be Considered in Drafting Escrow Agreement from your assistance.

If you already possess a US Legal Forms bank account, you are able to log in and click the Obtain option. Afterward, you are able to total, edit, print, or indicator the Michigan Checklist of Matters to be Considered in Drafting Escrow Agreement. Each and every legal papers template you acquire is your own eternally. To have another version of the bought kind, visit the My Forms tab and click the related option.

If you work with the US Legal Forms internet site the very first time, follow the easy directions under:

- Initial, make certain you have chosen the proper papers template for the region/town of your liking. Read the kind description to ensure you have chosen the right kind. If available, utilize the Preview option to search throughout the papers template also.

- If you wish to discover another variation in the kind, utilize the Lookup area to find the template that suits you and requirements.

- After you have located the template you desire, click on Acquire now to move forward.

- Select the costs program you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Select the file format in the papers and download it to your system.

- Make changes to your papers if possible. It is possible to total, edit and indicator and print Michigan Checklist of Matters to be Considered in Drafting Escrow Agreement.

Obtain and print a huge number of papers layouts making use of the US Legal Forms website, that offers the greatest variety of legal types. Use specialist and status-certain layouts to handle your small business or personal requirements.