Michigan Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

Finding the correct official document template can be quite a challenge.

Of course, there are numerous templates available online, but how can you locate the official form you need.

Utilize the US Legal Forms platform. This service offers thousands of templates, such as the Michigan Notice of Returned Check, which can be utilized for both business and personal needs.

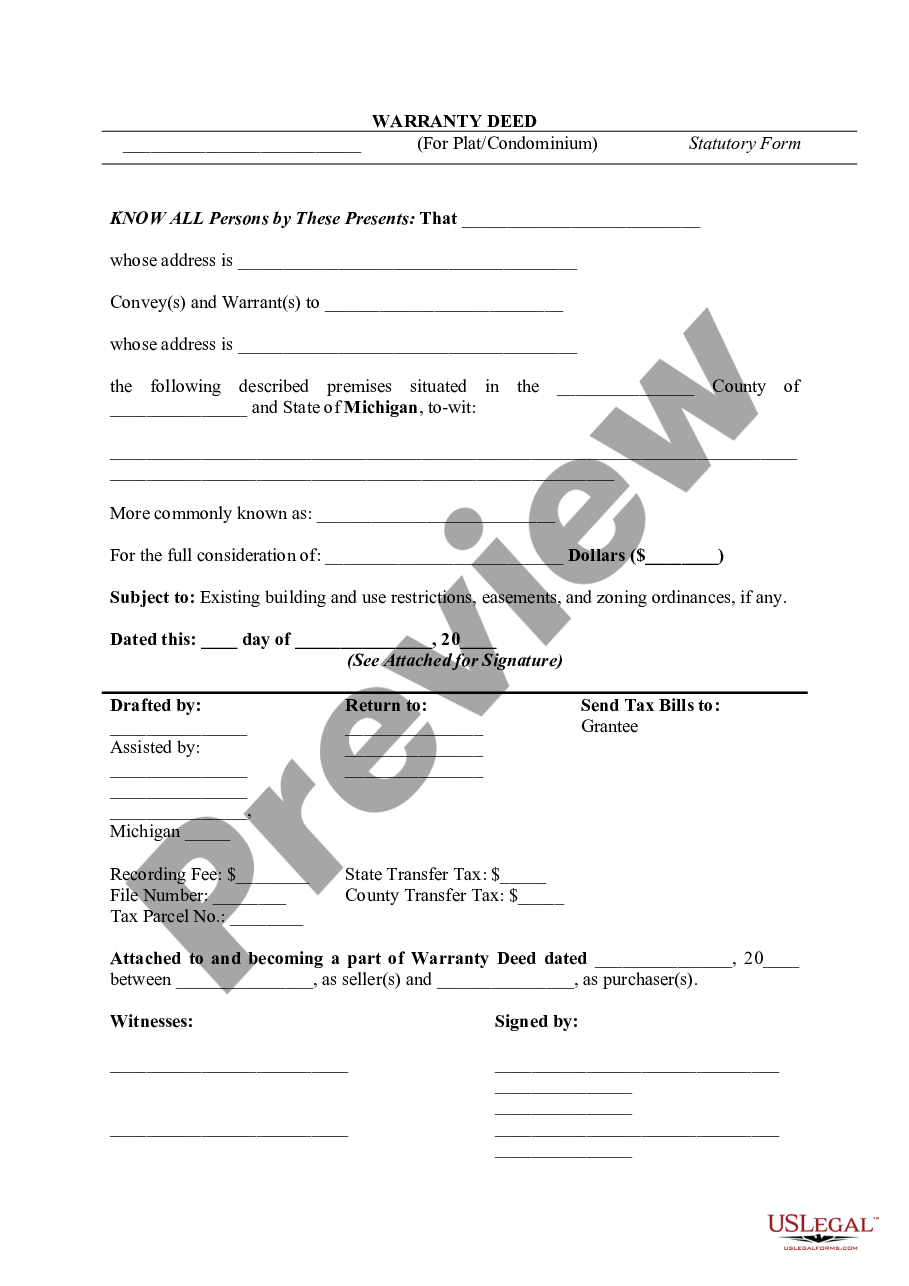

You can preview the form using the Preview button and read the form description to ensure it is suitable for you.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Michigan Notice of Returned Check.

- Use your account to search for the official documents you have previously acquired.

- Visit the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

When you receive a returned check notice, it is crucial to first review the reason for the return. You should promptly contact your bank to determine the specific issues and ensure that your account is in good standing. Next, consider reaching out to the payee to discuss the situation and see if you can resolve the matter amicably. Utilizing the US Legal Forms platform can help you generate necessary documentation to address the Michigan Notice of Returned Check efficiently and effectively.

A returned check notice is a formal communication sent to inform you that a check you issued could not be processed due to insufficient funds or account issues. This notice serves as a warning, highlighting the importance of timely rectification. Understanding the Michigan Notice of Returned Check is vital for managing your finances and avoiding further penalties. Receiving this notice means you need to act quickly to resolve any outstanding issues.

When you write a bad check for more than $500, you could face serious legal consequences. In Michigan, this situation is categorized under the Michigan Notice of Returned Check law, which can lead to criminal charges, such as felony theft. You may also be liable for the check amount, plus additional fees and interest. To navigate such issues effectively, consider utilizing resources available on the US Legal Forms platform, where you can find documents and guides to help address problems related to returned checks.

If someone gives you a check that bounces, you may face delays in receiving the expected funds. It is advisable to notify the issuer promptly, and a Michigan Notice of Returned Check can serve as a formal reminder. This notice outlines the issue and encourages the payer to address the situation quickly. It's essential to know your rights and options to remedy the situation.

A check may be returned to the sender for various reasons, including insufficient funds in the payer's account, a closed account, or a signature mismatch. Understanding these reasons is crucial for both parties involved. By using a Michigan Notice of Returned Check, you can formally address the issue and prompt the sender to resolve the matter. Being proactive helps avoid further complications.

When you receive a returned check, it indicates that the bank could not process the payment. This situation often leads to additional fees for both the payer and the receiver. You should review the check details and consider sending a Michigan Notice of Returned Check to inform the issuer about the bounced check. Taking these steps helps maintain clear communication and encourages resolution.

Notifying a customer about a bounced check involves being direct yet courteous. Send a formal letter or email, outlining the details of the bounced check and the actions required to address it. Utilizing resources that incorporate the Michigan Notice of Returned Check can help ensure that your communication is effective and legally compliant.

Writing a returned check letter requires a clear and professional approach. Begin by stating your intent to notify the issuer about the bounced check, include critical details like the check number and amount, and mention the consequences, if applicable. For assistance with format or legal language, refer to templates provided by platforms like UsLegalForms that focus on the Michigan Notice of Returned Check.

Recently, amendments have been made to Michigan's bouncing check laws to streamline the process for handling bad checks. These changes aim to make it easier for recipients of returned checks to pursue legal recourse. Staying updated on the Michigan Notice of Returned Check ensures you're knowledgeable about your legal options.

In Michigan, laws regarding bounced checks address both civil and criminal repercussions for issuing bad checks. The state defines specific standards for what constitutes a bounced check and sets forth penalties based on the amount involved. Familiarizing yourself with the Michigan Notice of Returned Check can provide clarity on your rights and responsibilities.