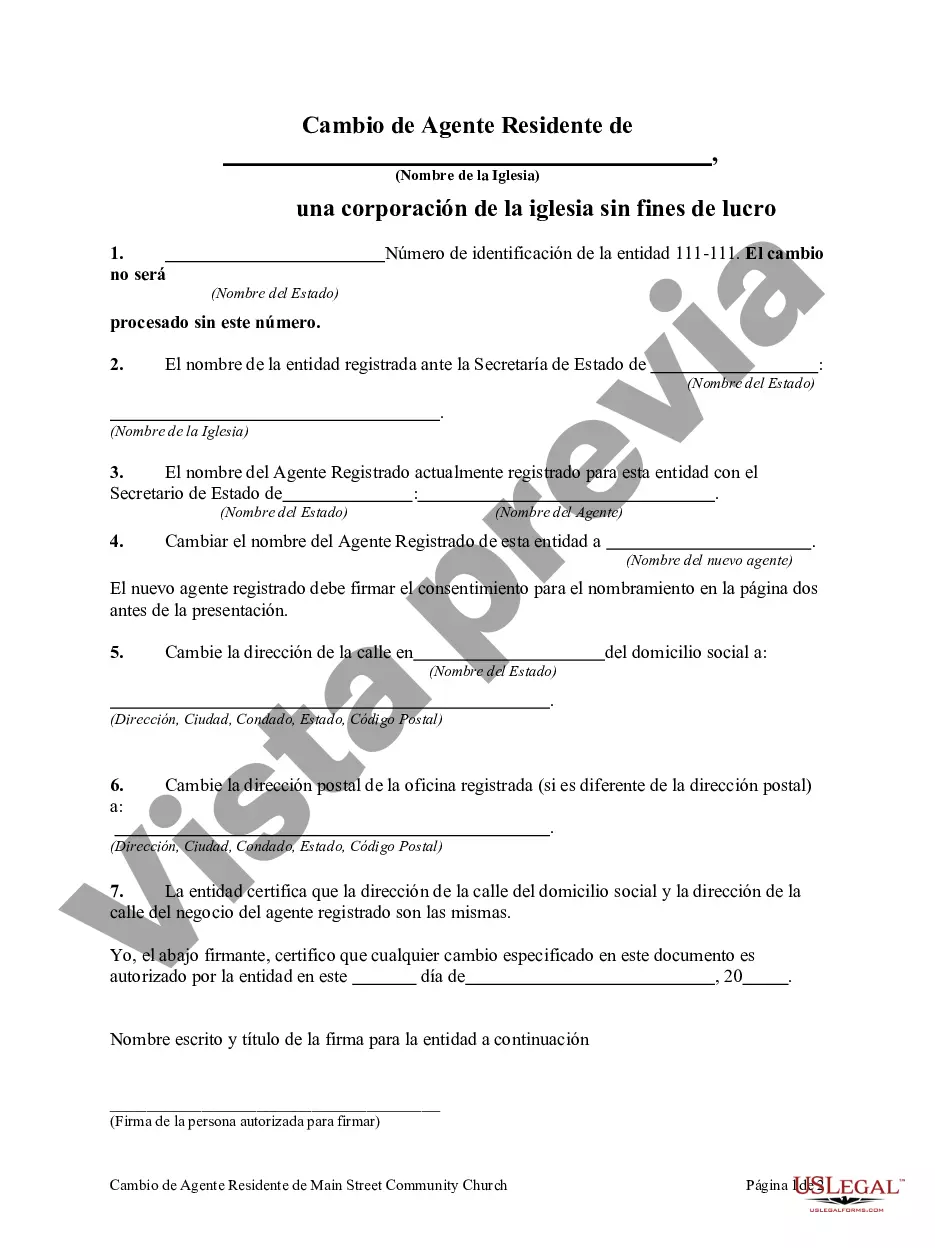

A Michigan Change of Resident Agent of Non-Profit Church Corporation refers to the process and documentation involved when a non-profit church corporation in Michigan wishes to change its resident agent. The resident agent is an individual or entity designated by the corporation to receive important legal and official documents on behalf of the church. When a non-profit church corporation changes its resident agent, it must comply with the regulations set forth by the Michigan Department of Licensing and Regulatory Affairs (LARA), particularly the Michigan Nonprofit Corporation Act. This act ensures that the church corporation maintains proper communication and compliance with state legal requirements. The steps involved in the Michigan Change of Resident Agent process for a Non-Profit Church Corporation typically include: 1. Choose a new resident agent: The church corporation must designate a new resident agent to receive legal documents and official notices. The resident agent can be an individual resident of Michigan, a domestic corporation, or a foreign corporation authorized to transact business in the state. 2. Prepare the necessary documentation: The church corporation is required to complete the appropriate forms provided by LARA. This typically includes the Change of Resident Agent Form, which requires the corporation's name, identification number, the new resident agent's name and address, and the effective date of the change. 3. File the documentation: The completed Change of Resident Agent Form must be filed with the Michigan Department of Licensing and Regulatory Affairs, along with the applicable filing fee. The filing can typically be done online through the LARA website or by mail. 4. Notify relevant parties: Once the Change of Resident Agent is approved and processed, the church corporation must provide notice of the change to its members, directors, and any other parties that may need to be aware of the new resident agent. It's important to note that there are no specific variations or types of Michigan Change of Resident Agent of Non-Profit Church Corporation. The process generally remains the same for all church corporations registered in Michigan. However, it is crucial for the corporation to carefully follow all the guidelines provided by LARA to ensure a smooth and compliant transition. In summary, a Michigan Change of Resident Agent of Non-Profit Church Corporation involves designating a new individual or entity to receive legal documents and official notices on behalf of the corporation. By following the prescribed steps and complying with the Michigan Nonprofit Corporation Act, church corporations can efficiently and legally change their resident agents to maintain proper communication and compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Michigan Cambio De Agente Residente De Non-Profit Church Corporation?

Choosing the best legal papers web template could be a battle. Naturally, there are plenty of layouts available on the Internet, but how can you get the legal form you will need? Make use of the US Legal Forms website. The support provides thousands of layouts, including the Michigan Change of Resident Agent of Non-Profit Church Corporation, that can be used for enterprise and personal demands. Each of the varieties are examined by experts and fulfill federal and state requirements.

In case you are previously registered, log in to the account and then click the Obtain option to find the Michigan Change of Resident Agent of Non-Profit Church Corporation. Use your account to search through the legal varieties you might have purchased formerly. Visit the My Forms tab of your respective account and get yet another duplicate in the papers you will need.

In case you are a new end user of US Legal Forms, allow me to share straightforward directions that you can follow:

- First, make certain you have chosen the correct form for your personal metropolis/county. You are able to examine the shape utilizing the Preview option and look at the shape explanation to guarantee it is the right one for you.

- In the event the form will not fulfill your needs, take advantage of the Seach industry to obtain the appropriate form.

- Once you are certain the shape is acceptable, click on the Purchase now option to find the form.

- Opt for the rates prepare you desire and enter the essential information and facts. Create your account and buy an order utilizing your PayPal account or Visa or Mastercard.

- Select the file formatting and acquire the legal papers web template to the gadget.

- Complete, edit and print out and sign the acquired Michigan Change of Resident Agent of Non-Profit Church Corporation.

US Legal Forms may be the biggest library of legal varieties where you can discover numerous papers layouts. Make use of the service to acquire appropriately-created paperwork that follow state requirements.