Michigan Sample Letter for Thank You - Purchase of Automobile

Description

How to fill out Sample Letter For Thank You - Purchase Of Automobile?

Selecting the finest valid document template can be rather challenging. It is evident that there are numerous templates accessible online, but how do you find the valid version you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Michigan Sample Letter of Gratitude - Purchase of Vehicle, which you can use for professional and personal needs. All forms are verified by specialists and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Michigan Sample Letter of Gratitude - Purchase of Vehicle. Use your account to review the legal forms you have previously acquired. Navigate to the My documents section of your account to get another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Michigan Sample Letter of Gratitude - Purchase of Vehicle. US Legal Forms is the largest repository of legal forms where you can find a range of document templates. Leverage the service to acquire professionally drafted documents that adhere to state requirements.

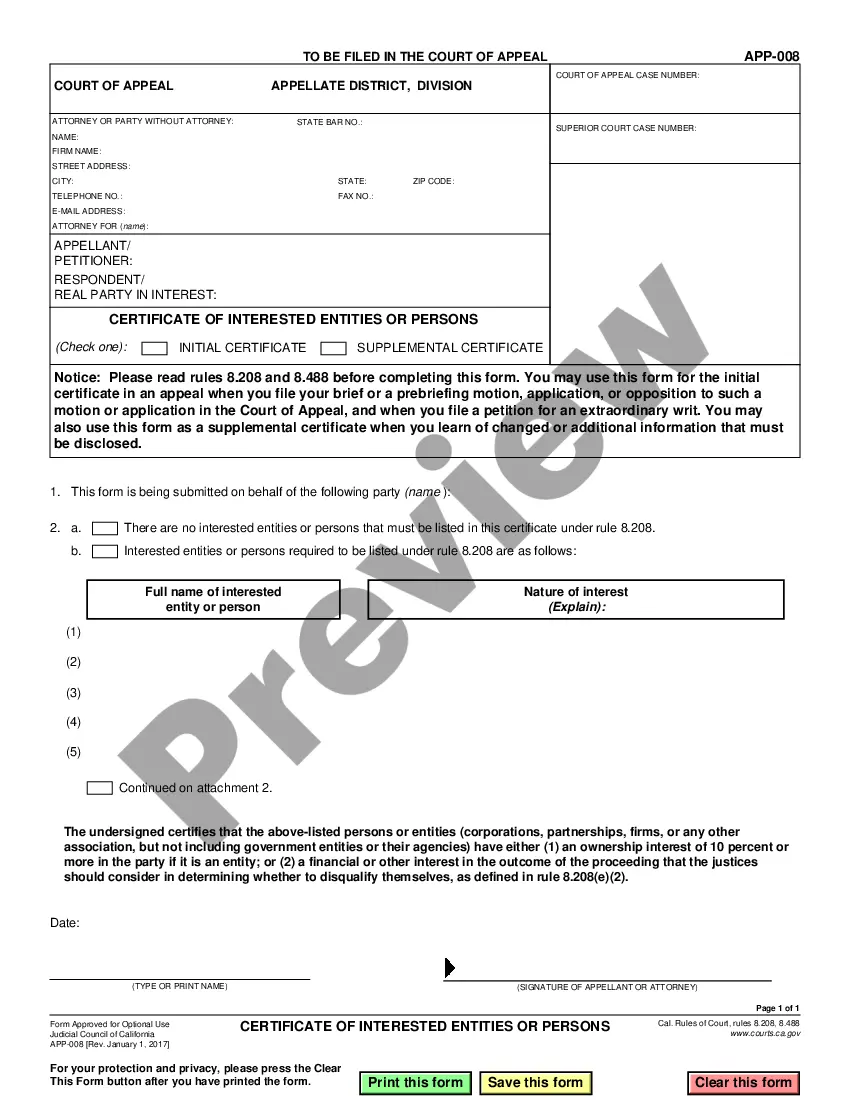

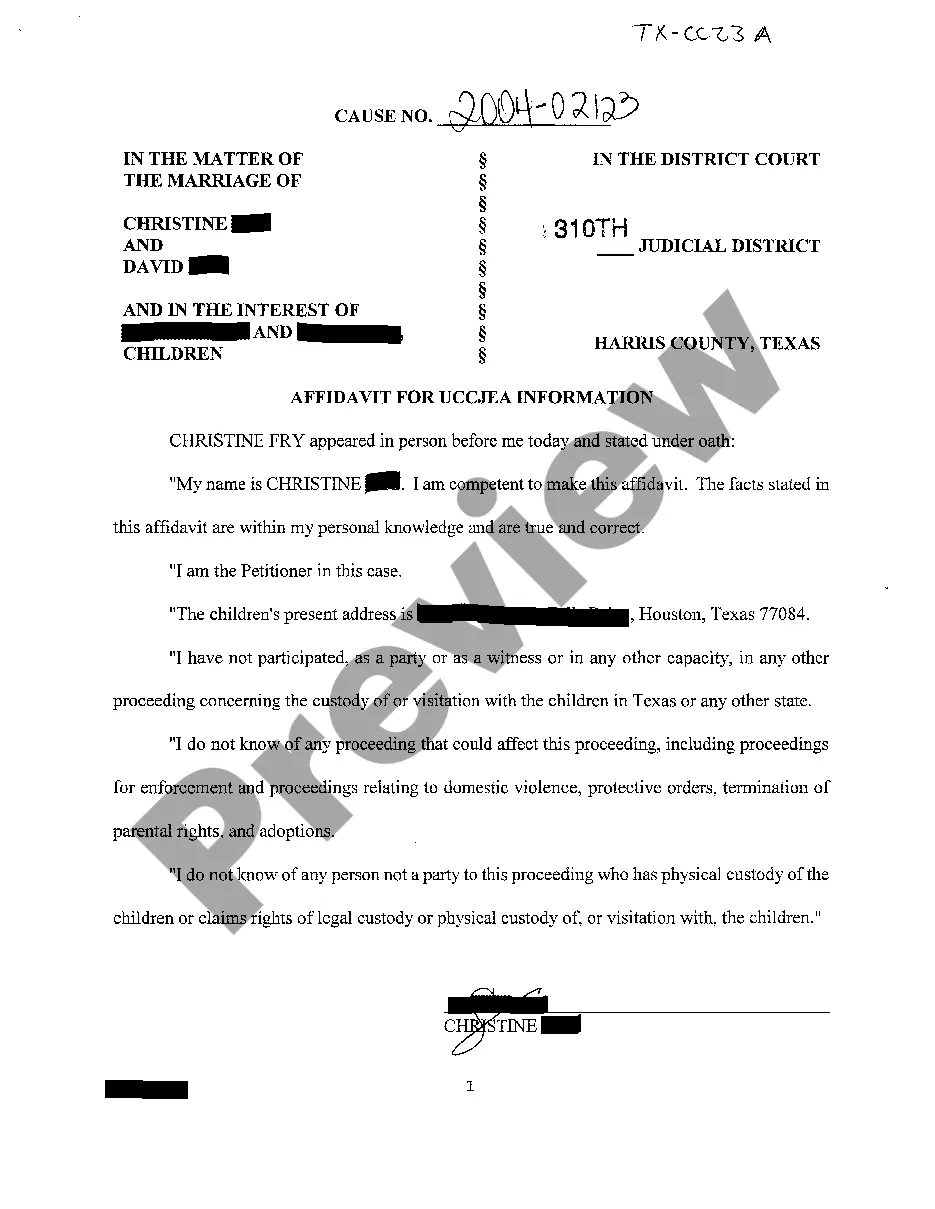

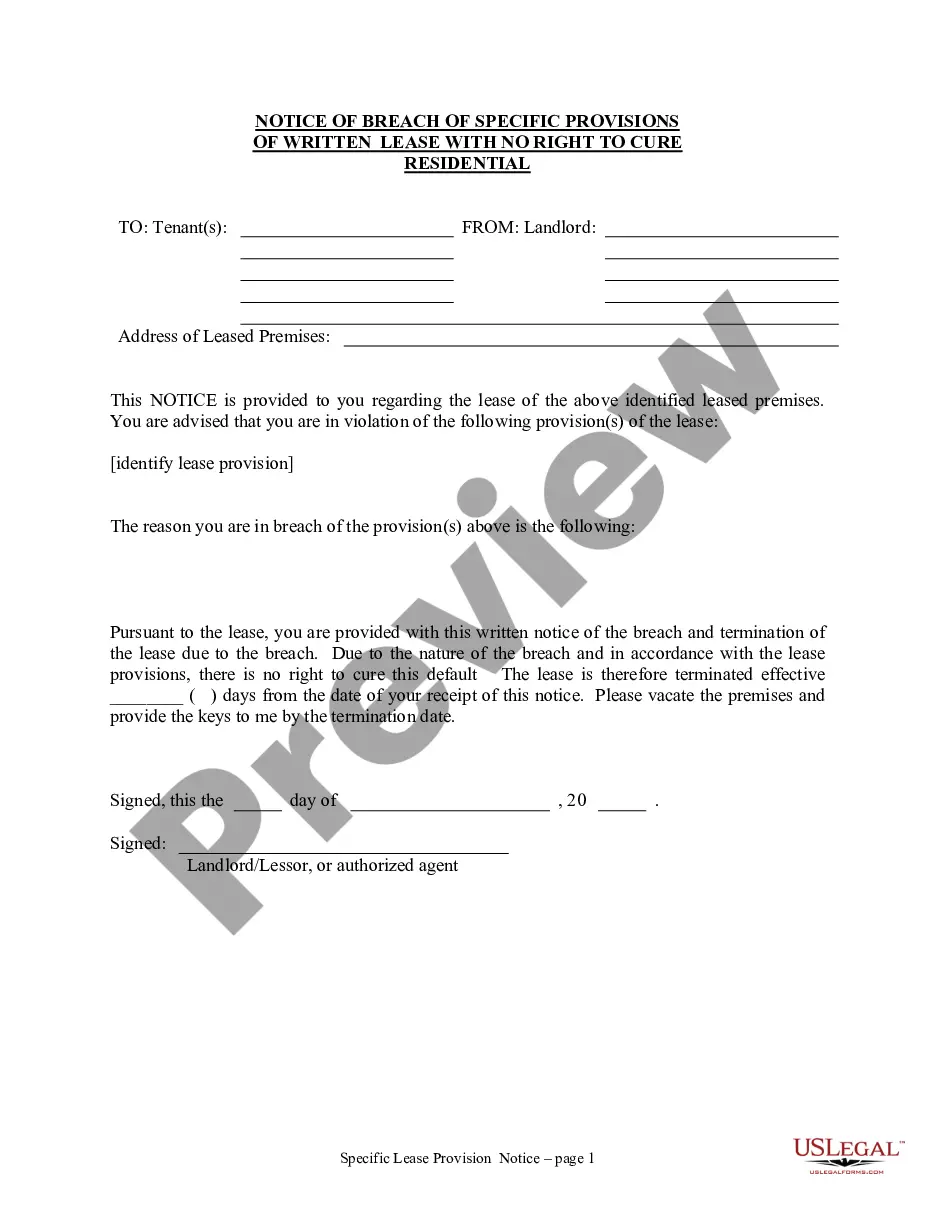

- First, confirm that you have chosen the correct template for your city/state.

- You can preview the form using the Preview button and examine the form details to ensure it is suitable for you.

- If the template does not meet your needs, utilize the Search field to find the correct template.

- Once you are confident that the document is accurate, click the Get now button to access the template.

- Select the pricing plan you desire and provide the required information.

- Create your account and finalize your purchase using your PayPal account or credit card.

Form popularity

FAQ

Some states have a maximum limit a dealer is allowed to charge. Doc fees are limited by Michigan State law to $190 or 5% of vehicle price, whichever is less. The average doc fee in Michigan is $165. Note that doc fees are also taxed.

Dear customer name, Thank you for trusting me to help you with your recent car purchase. You were such a pleasure to work with and I hope you have been enjoying your make/model of vehicle they purchased.

I just wanted to take the opportunity to write my sincerest thanks for your service and dedication. You went above and beyond to sell me my first car on (Date). I've been wary of car salesmen in the past, but you've helped in breaking the stereotype. Thank you for answering all my questions with honesty.

Under Michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the retail value of the vehicle at the time of transfer.

How to get things put rightContact the dealer as soon as you notice the problem in person if possible.If the dealer offers to fix the problem, make sure you understand any costs involved.If all else fails, you can reject your car as long as you tried to resolve the issue with the dealer first.More items...

In the state of Michigan, your registration renewal amount is calculated based upon the MSRP, age and weight of your vehicle.With your registration fee, you may also notice a 6% Use Tax assessed and added to your renewal fee.

Michigan collects a 6% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in Michigan may be subject to other fees like registration, title, and plate fees.

Dealer fees you need to payTitle and registration fee.Sales tax.Other common dealer fees.Advertising fees.Dealer preparation fee.Additional destination or transportation fees.Extended warranties and maintenance plans.VIN etching.More items...?

30+ Thank You for Your Order Phrases and NotesA special thanks to our favorite customer.An attitude of gratitude here2026Appreciation from the bottom of our hearts.Good things come in small packages, thanks for your order!Good things come to those who wait, thank you for ordering!Heads up!More items...?