A Michigan Security Agreement between a dealer and distributor is a legally binding contract that outlines the terms and conditions regarding the financing and security interest in goods provided by the distributor to the dealer. This agreement is usually used in commercial transactions where a distributor supplies goods to a dealer for resale in Michigan. The purpose of a Michigan Security Agreement is to protect the distributor's interests in case the dealer defaults on payment, goes bankrupt, or fails to fulfill their obligations under the contractual agreement. By establishing a security interest, the distributor ensures that they have a legal claim to the goods supplied, enabling them to recover their investment in the event of non-payment. There are several types of Michigan Security Agreements that can be established between a dealer and a distributor. These agreements may vary based on the nature of the goods being supplied or the specific requirements of the parties involved. Some common types of Michigan Security Agreements include: 1. Inventory Financing Agreement: This type of agreement allows the dealer to use their inventory as collateral for securing a loan or credit facility from the distributor. It provides the distributor with a security interest in the dealer's inventory to protect themselves if the dealer defaults on their loan obligations. 2. Accounts Receivable Financing Agreement: In this agreement, the dealer pledges their accounts receivable as collateral in exchange for financing from the distributor. This allows the dealer to access funds based on their outstanding invoices, and the distributor gains a security interest in the dealer's receivables. 3. Equipment Financing Agreement: This type of agreement involves the financing of specific equipment or machinery by the distributor to the dealer. The distributor retains a security interest in the equipment until the dealer fulfills their payment obligations. 4. Consignment Agreement: A consignment agreement allows the distributor to place goods or inventory with the dealer for resale, while maintaining ownership until the goods are sold. In this case, the distributor may establish a security interest to protect their ownership rights until the dealer completes the sale and pays for the goods. 5. Conditional Sales Agreement: In a conditional sales agreement, the distributor retains ownership of the goods until the dealer fulfills all payment obligations specified in the agreement. This type of agreement typically includes a security interest clause to protect the distributor's rights to the goods. By establishing a Michigan Security Agreement, both the dealer and the distributor can protect their respective interests in the commercial transaction. It provides a legal framework for financing and security, ensuring that both parties understand their rights and obligations. It is important for both parties to carefully review and negotiate the terms of the agreement to ensure that it meets their specific needs and protects their interests effectively.

Michigan Security Agreement between Dealer and Distributor

Description

How to fill out Security Agreement Between Dealer And Distributor?

If you need to full, down load, or print lawful record web templates, use US Legal Forms, the biggest assortment of lawful types, that can be found online. Use the site`s easy and convenient look for to discover the files you want. Various web templates for organization and person functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Michigan Security Agreement between Dealer and Distributor in just a number of mouse clicks.

If you are presently a US Legal Forms consumer, log in in your account and then click the Down load button to find the Michigan Security Agreement between Dealer and Distributor. You can even gain access to types you formerly acquired within the My Forms tab of the account.

If you use US Legal Forms the very first time, refer to the instructions below:

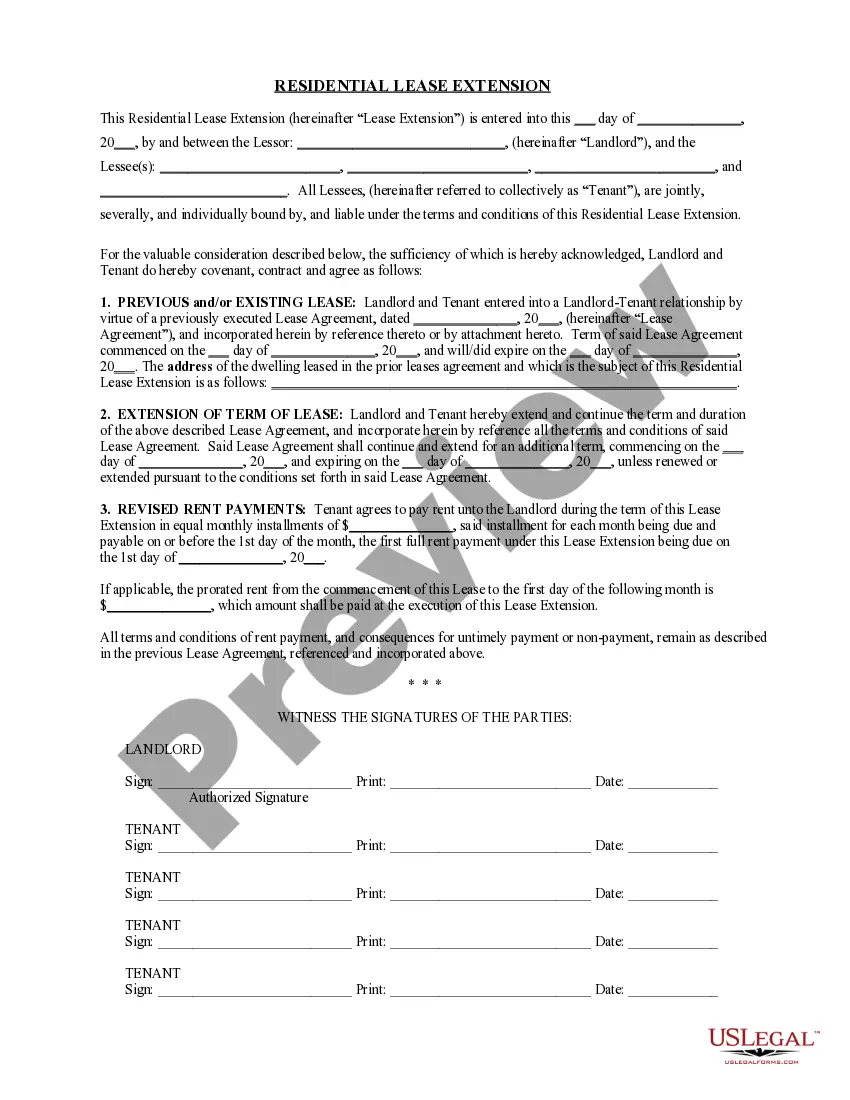

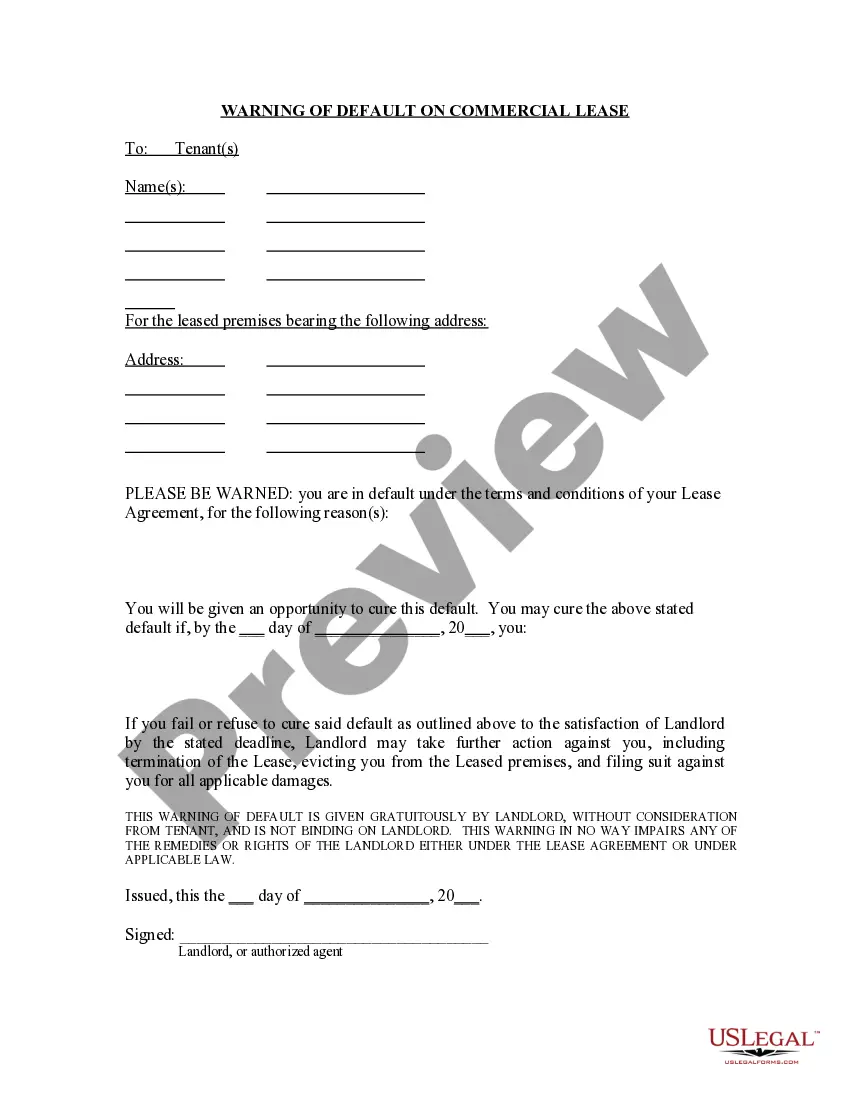

- Step 1. Ensure you have selected the form for that correct city/region.

- Step 2. Use the Preview option to check out the form`s articles. Never forget to learn the explanation.

- Step 3. If you are not happy together with the kind, take advantage of the Search field near the top of the monitor to find other types of your lawful kind format.

- Step 4. Once you have identified the form you want, select the Purchase now button. Choose the pricing strategy you prefer and add your accreditations to sign up on an account.

- Step 5. Process the transaction. You can use your bank card or PayPal account to accomplish the transaction.

- Step 6. Choose the format of your lawful kind and down load it in your gadget.

- Step 7. Total, edit and print or indicator the Michigan Security Agreement between Dealer and Distributor.

Each lawful record format you acquire is yours forever. You might have acces to every single kind you acquired with your acccount. Click on the My Forms area and select a kind to print or down load once more.

Contend and down load, and print the Michigan Security Agreement between Dealer and Distributor with US Legal Forms. There are millions of specialist and express-distinct types you can utilize for the organization or person requirements.