Title: Understanding Michigan Release from Liability under Guaranty: Types and Scope Introduction: In Michigan, a Release from Liability under Guaranty is a legal document intended to protect the guarantor from legal or financial responsibility for a debt or obligation. This article provides a detailed description of this concept, exploring its different types and highlighting the essential keywords associated with it. 1. General Overview of Michigan Release from Liability under Guaranty: A Release from Liability under Guaranty is a legal agreement between two parties -- the guarantor and the creditor (or lender). It releases the guarantor from any liability associated with a debt or obligation that they have guaranteed. 2. Types of Michigan Release from Liability under Guaranty: a) Specific Release: This type of release occurs when a guarantor is released from liability for a particular debt or obligation. It is typically documented in a specific release agreement, which includes the relevant details of the debt or obligation, the parties involved, and the effective date of the release. b) Blanket Release: A blanket release encompasses a broader scope, releasing a guarantor from multiple debts or obligations. This type of release is commonly used when a guarantor wants to be free from all existing and future obligations with respect to a particular creditor or lender. 3. Essential Keywords: To provide a more in-depth understanding of Michigan Release from Liability under Guaranty, let's highlight some relevant keywords: a) Guaranty Agreement: The initial agreement between a guarantor and a creditor or lender that outlines the obligations and conditions under which the guarantor becomes responsible for the debt. b) Release Agreement: An agreement that explicitly states the terms and conditions under which a guarantor will be released from their liability. c) Indemnification: A protection mechanism for the guarantor, ensuring that they will be compensated if they suffer any losses due to fulfilling their obligations as a guarantor. d) Consideration: Something exchanged between the guarantor and the creditor or lender, such as money, goods, or services, to make the release agreement legally binding. e) Covenant Not to Sue: A clause included in the release agreement, where the creditor or lender agrees not to sue the guarantor for the released debt or obligation. f) Future Obligations: Refers to those debts or obligations that may arise after the release agreement's effective date but are still covered by the release. 4. Conclusion: Michigan Release from Liability under Guaranty provides legal protection to guarantors, offering relief from financial obligations or debts they have guaranteed. Understanding the different types and associated keywords helps ensure a comprehensive grasp of this legal concept. It is important to consult with legal professionals to ensure the accuracy and suitability of any release agreements under Michigan law.

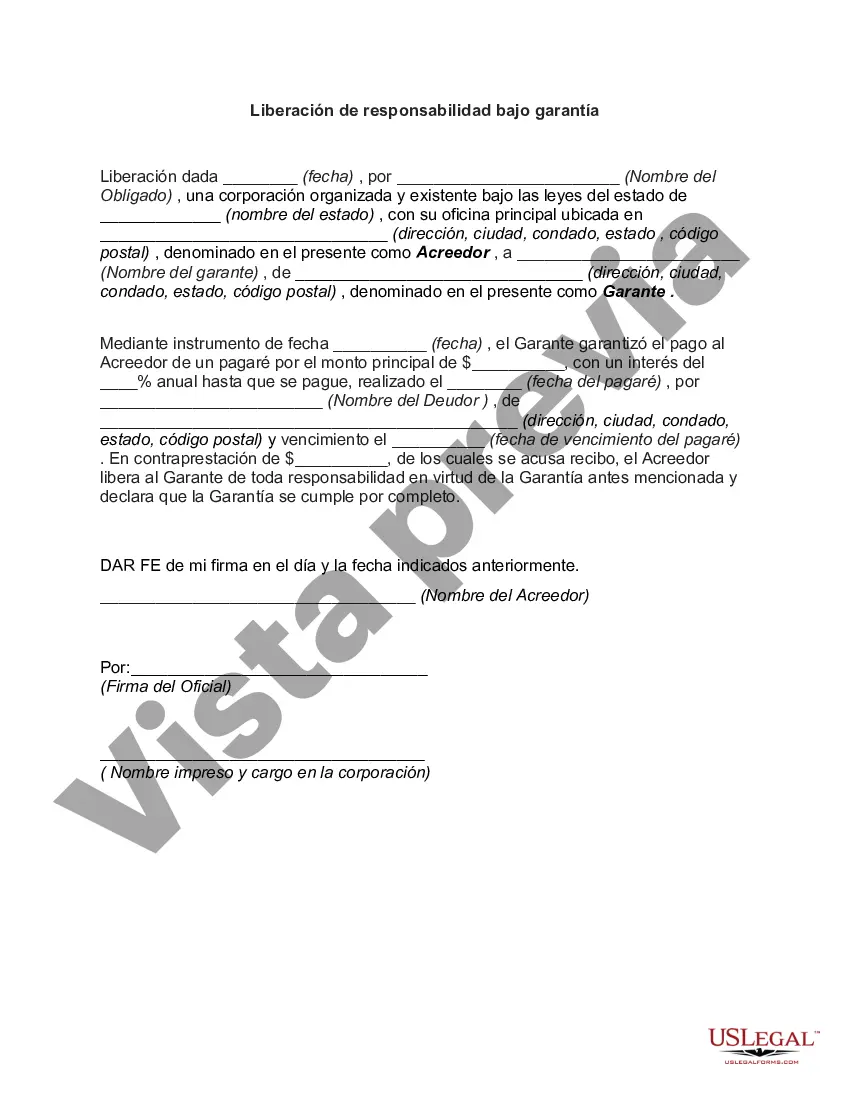

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Michigan Liberación De Responsabilidad Bajo Garantía?

US Legal Forms - among the largest libraries of authorized forms in the United States - provides an array of authorized document templates you are able to acquire or print. While using site, you may get thousands of forms for enterprise and personal uses, sorted by classes, suggests, or keywords.You can get the most recent versions of forms such as the Michigan Release from Liability under Guaranty in seconds.

If you already possess a membership, log in and acquire Michigan Release from Liability under Guaranty through the US Legal Forms collection. The Download option will show up on each and every form you perspective. You gain access to all earlier downloaded forms within the My Forms tab of your own accounts.

In order to use US Legal Forms initially, here are basic instructions to get you started out:

- Make sure you have chosen the correct form for your town/region. Select the Preview option to review the form`s content material. Browse the form description to ensure that you have chosen the right form.

- When the form doesn`t suit your demands, utilize the Research area near the top of the display screen to get the the one that does.

- Should you be pleased with the shape, verify your option by clicking the Get now option. Then, select the costs plan you prefer and give your qualifications to register to have an accounts.

- Procedure the purchase. Use your credit card or PayPal accounts to finish the purchase.

- Select the structure and acquire the shape on the system.

- Make modifications. Complete, edit and print and signal the downloaded Michigan Release from Liability under Guaranty.

Every single format you added to your bank account does not have an expiry time and is also yours for a long time. So, in order to acquire or print an additional duplicate, just proceed to the My Forms portion and click on in the form you need.

Gain access to the Michigan Release from Liability under Guaranty with US Legal Forms, probably the most extensive collection of authorized document templates. Use thousands of expert and condition-specific templates that meet your company or personal needs and demands.