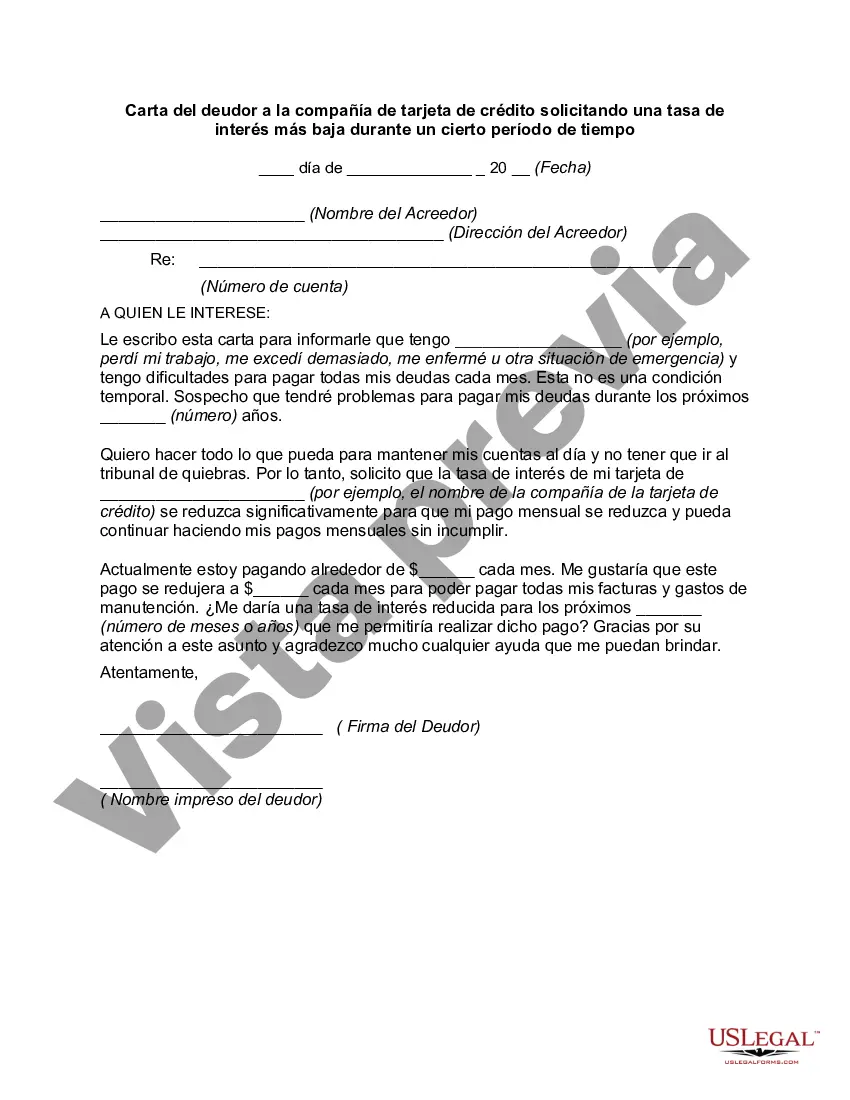

Title: Michigan Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In the State of Michigan, debtors seeking relief from high credit card interest rates can write a formal letter to their respective credit card companies requesting a temporary reduction in interest rates. This letter will outline the purpose of the request, highlight financial hardships faced by the debtor, and provide supporting documentation if necessary. Various types of Michigan Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time include letters based on financial difficulty, improved creditworthiness, or balance transfer opportunities. Keyword-rich Content: 1. Financial Difficulty: If a debtor is struggling with financial hardship, they can write a Michigan Letter to their credit card company explaining their circumstances and politely requesting a reduced interest rate. Keywords: Michigan, letter, debtor, credit card company, requesting, lower interest rate, financial difficulty. Sample opening paragraph: Dear [Credit Card Company's Name], I am writing to request a temporary reduction in the interest rate applied to my [insert credit card name and number]. I have been a loyal customer for [number of years] and have consistently maintained a good payment history. Unfortunately, I have recently encountered unexpected financial difficulties that have made it challenging for me to afford the current interest rate on my credit card balance. 2. Improved Creditworthiness: Debtors who have significantly improved their creditworthiness can compose a Michigan Letter requesting a lower interest rate based on their improved financial situation. Keywords: Michigan, letter, debtor, credit card company, requesting, lower interest rate, improved creditworthiness. Sample opening paragraph: Dear [Credit Card Company's Name], I am writing to request a revision in the interest rate applied to my [insert credit card name and number]. Over the past few months, I have diligently worked towards improving my creditworthiness and successfully raised my credit score. As a loyal customer for [number of years], I believe I now qualify for a lower interest rate that reflects my current financial stability. 3. Balance Transfer Opportunity: In some cases, debtors may present a Michigan Letter to their credit card company seeking a temporary reduction in their interest rate to consolidate their balances through a balance transfer operation. Keywords: Michigan, letter, debtor, credit card company, requesting, lower interest rate, balance transfer opportunity. Sample opening paragraph: Dear [Credit Card Company's Name], I am writing to discuss the possibility of obtaining a lower interest rate on my [insert credit card name and number]. As a responsible and committed customer for [number of years], I have recently come across a balance transfer opportunity that would help me consolidate my credit card debts onto a single card. To fully take advantage of this option and ease my financial burden, I kindly request a temporary decrease in my interest rate for a specific period of time. Closing: When requesting a lower interest rate from a Michigan credit card company, debtors should express their appreciation for the company's attention to their request, provide all relevant information, and indicate their willingness to discuss further details if required.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Michigan Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Are you presently within a place where you need to have paperwork for either organization or personal reasons nearly every working day? There are tons of lawful file layouts available on the net, but locating ones you can depend on is not simple. US Legal Forms provides a huge number of type layouts, just like the Michigan Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, which are published to fulfill federal and state specifications.

In case you are presently knowledgeable about US Legal Forms internet site and also have an account, just log in. Next, you are able to obtain the Michigan Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time format.

If you do not provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you need and ensure it is to the right city/area.

- Use the Review button to review the shape.

- Read the outline to actually have chosen the proper type.

- In the event the type is not what you`re seeking, use the Look for discipline to find the type that meets your needs and specifications.

- Once you get the right type, click Get now.

- Opt for the costs prepare you desire, complete the specified details to create your money, and buy the order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical paper structure and obtain your version.

Discover all of the file layouts you might have purchased in the My Forms menus. You may get a more version of Michigan Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time anytime, if necessary. Just go through the essential type to obtain or print the file format.

Use US Legal Forms, the most considerable assortment of lawful kinds, to conserve efforts and prevent mistakes. The assistance provides skillfully manufactured lawful file layouts that can be used for a variety of reasons. Generate an account on US Legal Forms and initiate creating your daily life a little easier.