A Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower (the debtor) and a lender (the creditor). In the case of commercial loans secured by real property in Michigan, a specific Promissory Note is used to secure the loan with real estate assets. The Michigan Promissory Note for Commercial Loan Secured by Real Property is a comprehensive contract that provides explicit details regarding the loan amount, interest rate, repayment terms, and property securing the loan. It serves as evidence of the borrower's promise to repay the loan amount plus interest to the lender within a specified period. Keywords: Michigan, Promissory Note, commercial loan, secured loan, real property, borrower, lender, loan agreement, loan amount, interest rate, repayment terms, property securing, evidence, promise, specified period. There may be different types or variations of the Michigan Promissory Note for Commercial Loan Secured by Real Property, including but not limited to: 1. Fixed-Rate Promissory Note: This type of Promissory Note defines a specific interest rate that remains consistent throughout the loan term. Borrowers benefit from a predictable repayment structure, ensuring stability in their monthly payment obligations. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate Promissory Note, an adjustable-rate note allows the interest rate to fluctuate over time. These notes often have a lower initial interest rate, but it can change periodically based on market conditions, potentially affecting the borrower's repayment amount. 3. Balloon Promissory Note: Balloon notes establish regular payment terms for a set period, similar to other Promissory Notes. However, they require a larger payment, often the remaining loan balance or a significant portion of it, at the end of the loan term. Balloon notes are useful for borrowers seeking lower monthly payments coupled with a final lump sum or the ability to refinance the loan before the balloon payment becomes due. 4. Installment Promissory Note: An installment note outlines a pre-determined payment schedule, specifying equal or varying payment amounts to be made at regular intervals. This type of Promissory Note enables borrowers to repay the loan in fixed or flexible installments, ensuring gradual debt reduction over time. 5. Interest-Only Promissory Note: An interest-only note allows borrowers to make payments solely towards the accrued interest for a certain period, without reducing the principal loan amount. After the interest-only period elapses, the borrower typically transitions to regular installment payments including both principal and interest. By specifying the Michigan jurisdiction in the description, it ensures that the Promissory Note adheres to the state's legal requirements, ensuring its enforceability and applicability under Michigan legislation. Remember, it is crucial to consult with legal professionals to ensure compliance with any specific Michigan laws and regulations pertaining to commercial loans secured by real property.

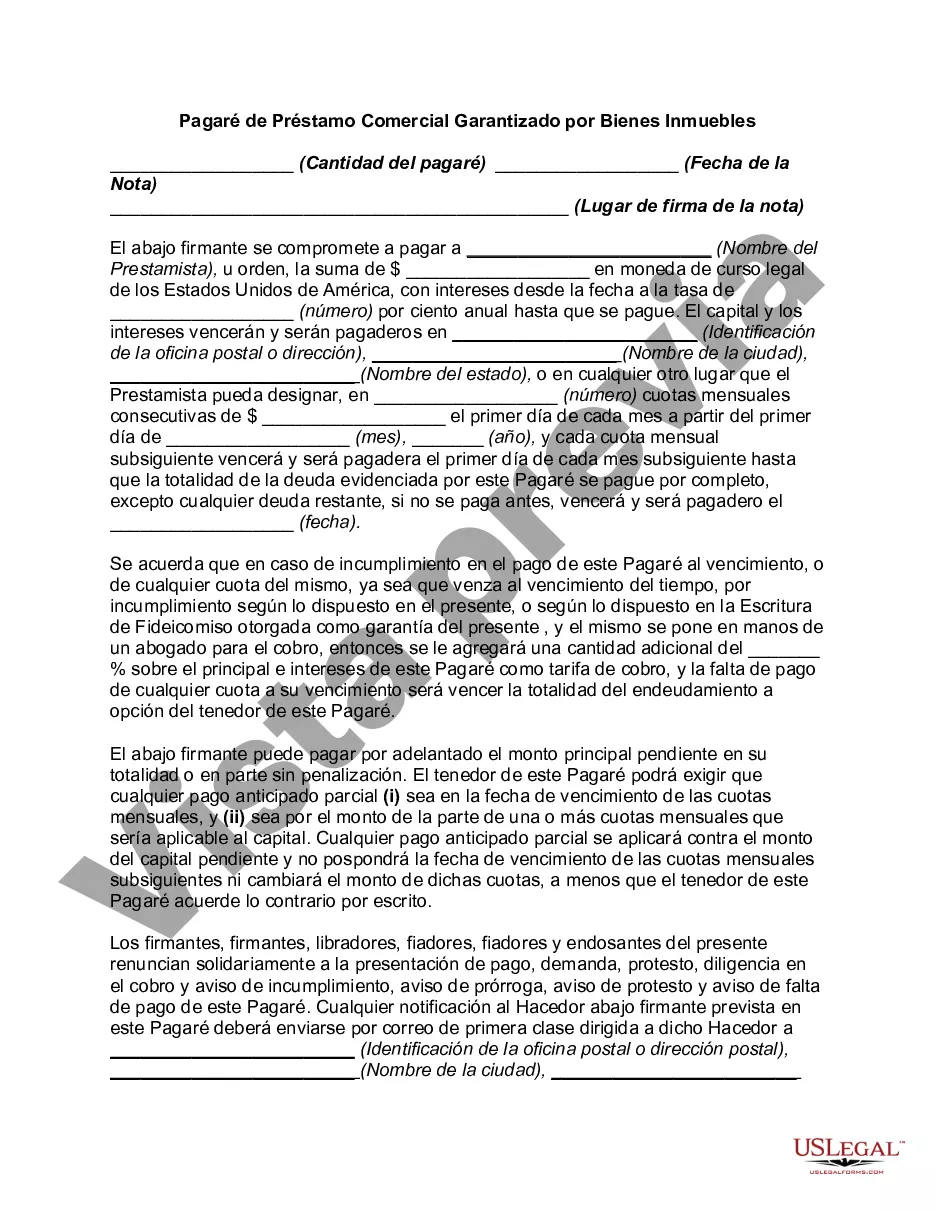

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Michigan Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

You can invest several hours online attempting to find the legitimate papers web template that fits the state and federal requirements you require. US Legal Forms gives a huge number of legitimate varieties that are evaluated by specialists. It is simple to download or printing the Michigan Promissory Note for Commercial Loan Secured by Real Property from your support.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Down load button. Next, it is possible to complete, change, printing, or signal the Michigan Promissory Note for Commercial Loan Secured by Real Property. Each legitimate papers web template you acquire is your own property permanently. To acquire one more copy associated with a obtained form, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms web site initially, stick to the basic directions under:

- Very first, be sure that you have selected the correct papers web template for your region/town of your liking. Browse the form outline to ensure you have selected the appropriate form. If available, make use of the Review button to look throughout the papers web template as well.

- In order to find one more edition of your form, make use of the Research discipline to discover the web template that suits you and requirements.

- When you have located the web template you desire, just click Get now to continue.

- Pick the prices plan you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal accounts to purchase the legitimate form.

- Pick the file format of your papers and download it to your system.

- Make adjustments to your papers if needed. You can complete, change and signal and printing Michigan Promissory Note for Commercial Loan Secured by Real Property.

Down load and printing a huge number of papers layouts while using US Legal Forms Internet site, which provides the greatest assortment of legitimate varieties. Use skilled and condition-certain layouts to tackle your business or personal needs.