A Michigan Pot Testamentary Trust, also known as a testamentary trust for marijuana assets, is a legal arrangement that allows individuals in Michigan to protect and distribute their marijuana-related assets after their death. This specialized trust is designed specifically for individuals who have owned or invested in marijuana-related businesses, such as dispensaries, cultivation facilities, or manufacturing operations. The primary purpose of a Michigan Pot Testamentary Trust is to provide a clear plan for the management and distribution of marijuana assets, ensuring that they are handled in accordance with state and federal laws, as well as the wishes of the trust creator. It offers a level of certainty and protection for those involved in the rapidly growing and complex marijuana industry. Within the context of a Michigan Pot Testamentary Trust, there are several types that individuals can consider depending on their specific needs and requirements: 1. Marijuana Business Asset Trust: This type of trust focuses mainly on the management and distribution of actual marijuana-related business assets such as real estate properties, equipment, inventory, licenses, and other operational assets. 2. Marijuana Investment Asset Trust: Designed for individuals who have invested in marijuana-related businesses, this trust primarily deals with managing and distributing investment assets, such as stocks, shares, interests, or proportional ownership rights in marijuana companies. 3. Marijuana Intellectual Property Asset Trust: Intellectual property assets, including patents, trademarks, copyrights, or trade secrets associated with marijuana products or services, can be effectively managed and protected through this trust. It ensures that ownership and licensing rights are maintained and appropriately passed down after the trust creator's death. 4. Marijuana Charity Trust: This trust provides a mechanism for individuals to contribute their marijuana-related assets to charitable causes or organizations. It allows donors to support initiatives related to marijuana research, education, treatment, or social equity programs, ensuring their assets are utilized for a specific philanthropic purpose. Michigan Pot Testamentary Trusts offer the flexibility to dictate how assets are managed, distributed, and protected, while also providing the necessary guidance and compliance with existing marijuana laws. It is essential for individuals involved in the marijuana industry to consult with an experienced attorney specializing in trusts and estate planning to ensure proper execution and adherence to all legal requirements.

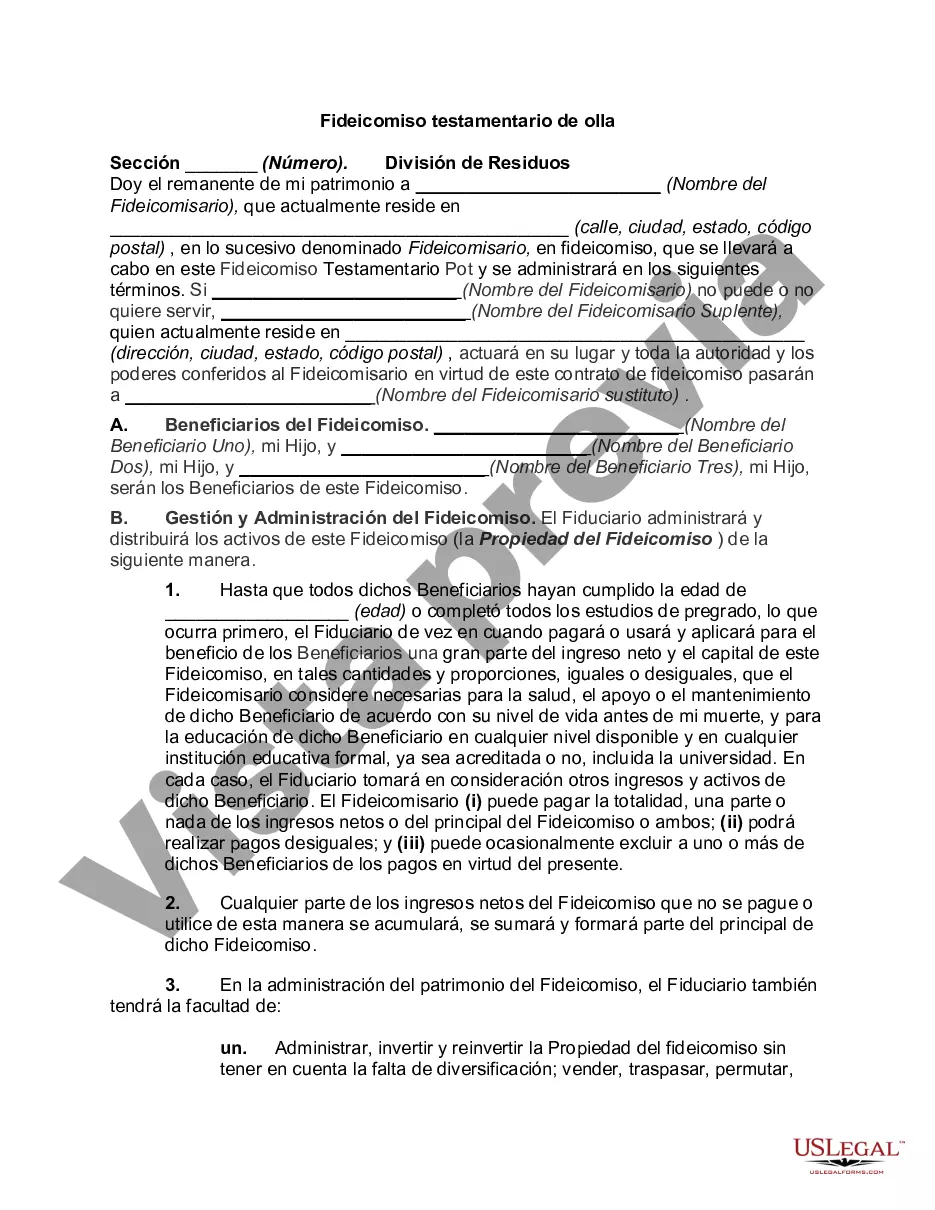

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out Michigan Fideicomiso Testamentario De Olla?

If you need to comprehensive, download, or printing authorized record templates, use US Legal Forms, the most important variety of authorized kinds, which can be found on-line. Take advantage of the site`s basic and convenient search to discover the papers you will need. Different templates for business and person uses are sorted by classes and says, or key phrases. Use US Legal Forms to discover the Michigan Pot Testamentary Trust within a couple of mouse clicks.

Should you be presently a US Legal Forms client, log in in your accounts and click on the Obtain button to find the Michigan Pot Testamentary Trust. You can even accessibility kinds you previously delivered electronically inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your appropriate area/region.

- Step 2. Take advantage of the Review option to check out the form`s articles. Do not overlook to learn the outline.

- Step 3. Should you be unsatisfied with all the form, utilize the Research industry on top of the monitor to discover other variations in the authorized form format.

- Step 4. Once you have discovered the shape you will need, click the Buy now button. Pick the prices strategy you like and add your references to sign up to have an accounts.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Choose the formatting in the authorized form and download it on the device.

- Step 7. Full, revise and printing or sign the Michigan Pot Testamentary Trust.

Each authorized record format you buy is your own eternally. You possess acces to every single form you delivered electronically with your acccount. Go through the My Forms portion and select a form to printing or download once more.

Remain competitive and download, and printing the Michigan Pot Testamentary Trust with US Legal Forms. There are thousands of skilled and status-certain kinds you can use for your personal business or person needs.