Michigan Credit Information Request is a process to obtain credit-related information in the state of Michigan. This procedure allows individuals, organizations, or entities to request and receive specific credit details from credit reporting agencies operating in Michigan. The information obtained through this request helps in determining creditworthiness, evaluating financial risk, or making informed decisions related to credit lending. Keywords: Michigan Credit Information Request, credit-related information, credit reporting agencies, Michigan, creditworthiness, financial risk, credit lending. Different Types of Michigan Credit Information Requests: 1. Personal Credit Information Request: This type of request allows individuals to access their own credit information to review and check for inaccuracies, verify credit scores, detect any identity theft or fraudulent activities, and monitor their financial health. 2. Business Credit Information Request: This type of request is designed for businesses and organizations to obtain credit-related information about other companies, potential partners, or clients. It assists in assessing the creditworthiness of other entities before initiating any financial transactions or business relationships. 3. Employment Credit Information Request: Some employers may require credit information as part of the recruitment process, especially for job positions that involve financial responsibilities or sensitive corporate data. This request type provides employers the ability to access credit reports to evaluate an applicant's financial stability, responsibility, and reliability. 4. Landlord or Rental Credit Information Request: When renting or leasing properties, landlords often request credit information from prospective tenants to assess their financial reliability and ability to pay rent on time. This request type helps landlords make informed decisions regarding rental applications. 5. Creditors or Collection Agencies Credit Information Request: Creditors or collection agencies may use this type of request to gather information about debtors who may be behind on payments or have a history of delinquencies. It aids them in assessing the debtor's creditworthiness and deciding on appropriate collection strategies. Keywords: Personal Credit Information Request, Business Credit Information Request, Employment Credit Information Request, Landlord or Rental Credit Information Request, Creditors or Collection Agencies Credit Information Request.

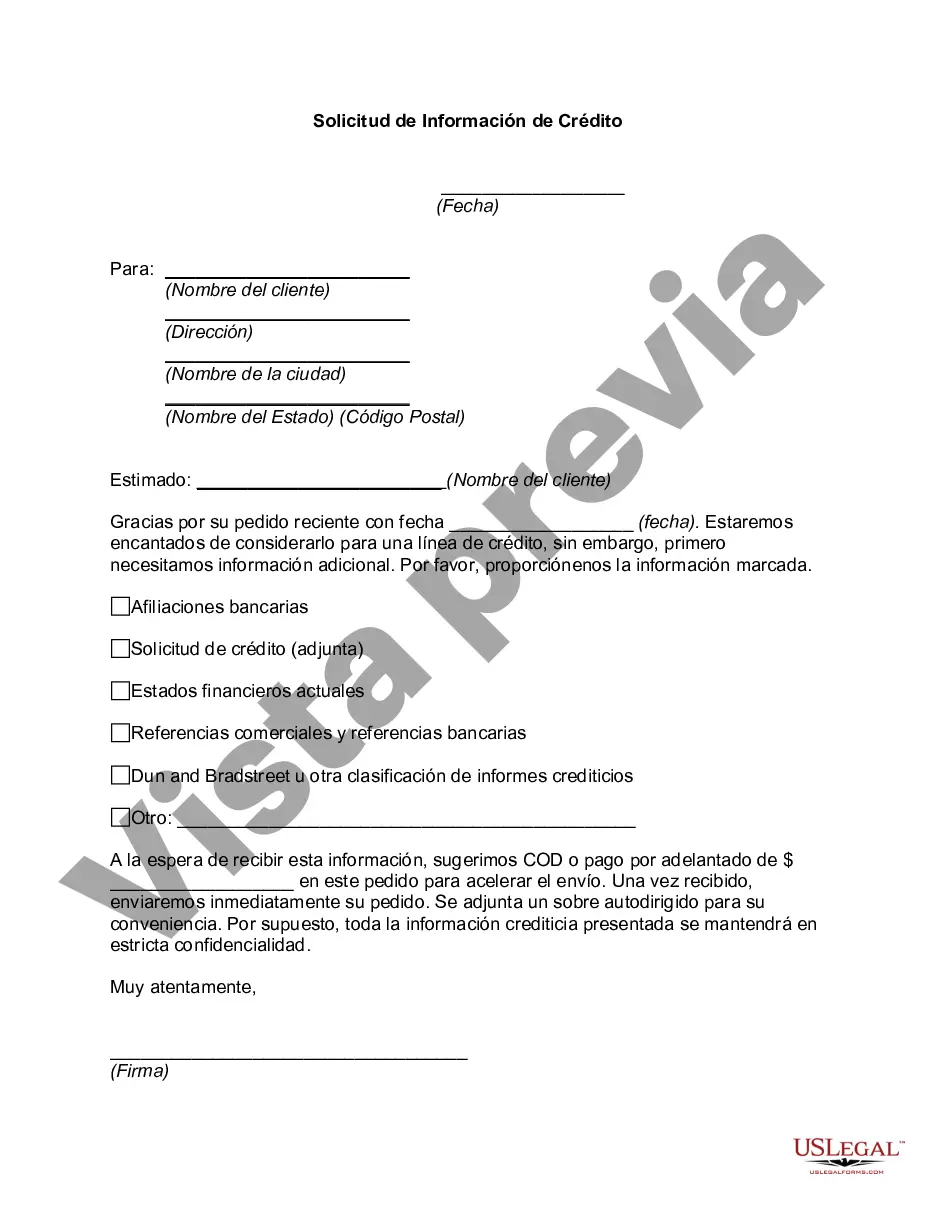

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Michigan Solicitud De Información De Crédito?

If you have to total, download, or produce lawful document themes, use US Legal Forms, the largest collection of lawful kinds, that can be found on the Internet. Take advantage of the site`s basic and hassle-free research to get the files you will need. Various themes for enterprise and person uses are sorted by classes and says, or keywords and phrases. Use US Legal Forms to get the Michigan Credit Information Request within a handful of click throughs.

Should you be currently a US Legal Forms customer, log in in your account and click on the Down load button to get the Michigan Credit Information Request. You can also accessibility kinds you earlier downloaded from the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the correct town/land.

- Step 2. Make use of the Preview option to look over the form`s articles. Don`t forget to read through the outline.

- Step 3. Should you be not satisfied with all the kind, utilize the Lookup field towards the top of the display screen to get other variations from the lawful kind design.

- Step 4. When you have located the shape you will need, go through the Acquire now button. Choose the prices prepare you like and put your qualifications to sign up to have an account.

- Step 5. Approach the deal. You should use your credit card or PayPal account to complete the deal.

- Step 6. Choose the structure from the lawful kind and download it on your own gadget.

- Step 7. Full, change and produce or sign the Michigan Credit Information Request.

Each and every lawful document design you buy is your own forever. You might have acces to each and every kind you downloaded inside your acccount. Select the My Forms section and choose a kind to produce or download yet again.

Remain competitive and download, and produce the Michigan Credit Information Request with US Legal Forms. There are thousands of professional and status-certain kinds you may use for your personal enterprise or person demands.