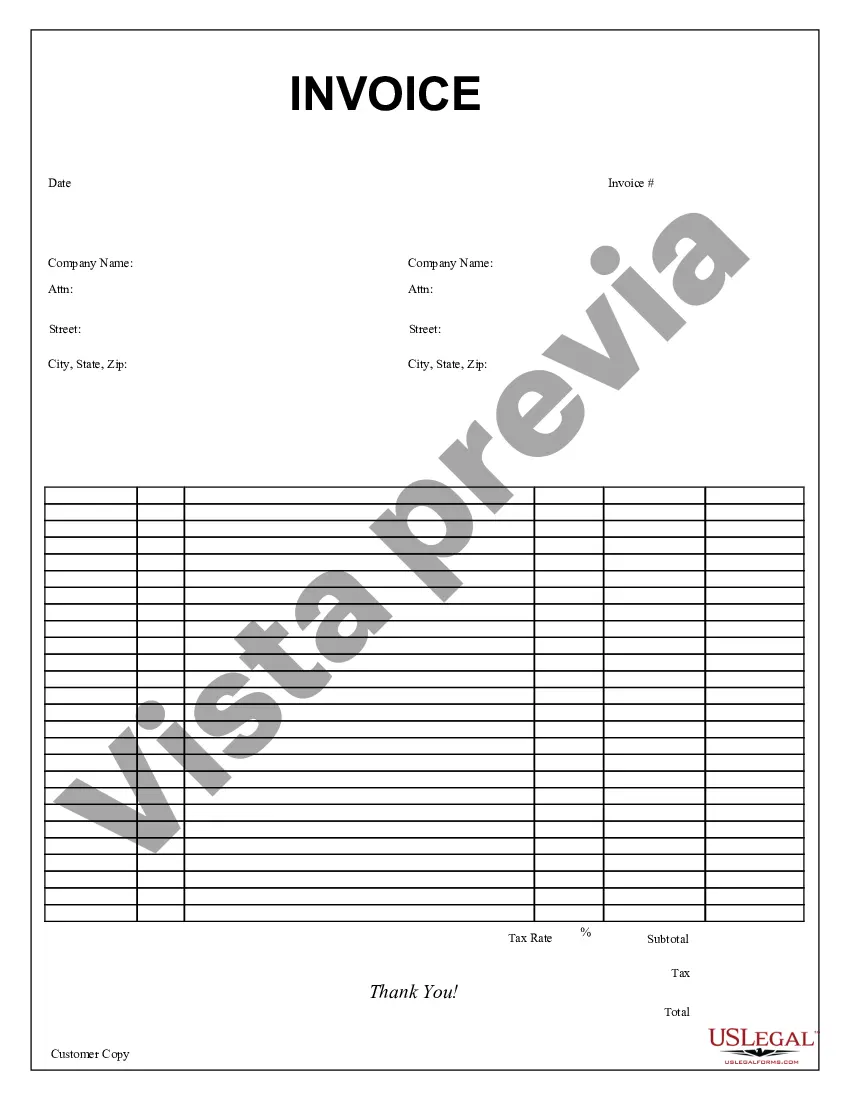

Michigan Purchase Invoice is a legal document that serves as proof of a commercial transaction between a buyer and a seller in the state of Michigan. This invoice includes all the relevant details of the purchase, providing a comprehensive breakdown of goods or services acquired, their quantities, prices, applicable taxes, and payment terms. Keywords: Michigan Purchase Invoice, commercial transaction, buyer, seller, proof, goods, services, quantities, prices, taxes, payment terms. There are different types of Michigan Purchase Invoices depending on the nature of the transaction and the parties involved: 1. Standard Michigan Purchase Invoice: This is the most common form of purchase invoice used for regular business-to-business transactions. It includes essential information such as seller and buyer details, invoice number, date, item description, quantity, unit price, applicable taxes, discounts, and the total amount payable. 2. Michigan Purchase Invoice for Services: This type of invoice is used when purchasing services rather than physical goods. It outlines the details of the services provided, including description, date, hours worked, hourly rate, and total amount due. Additional information related to expenses, fees, and applicable taxes may also be included. 3. Michigan Purchase Invoice for Wholesale Purchases: Wholesale transactions involve buying goods in larger quantities for resale. This type of invoice will typically include bulk quantity information, unit price, subtotal, applicable discounts, taxes, and the final total. It may also specify any specific terms and conditions related to wholesale purchases. 4. Michigan Purchase Invoice for Online Sales: With the rise of e-commerce, online businesses operating in Michigan utilize purchase invoices specific to their digital sales. This invoice captures relevant information, such as the buyer's name, billing address, email, and the digital products or services purchased. It may also include download links, license keys, or any other necessary details unique to online sales. 5. Michigan Purchase Invoice for International Transactions: In cases where goods or services are bought or sold across international borders, additional information is required. These invoices include details like import/export documentation, shipping terms, customs duties, and other relevant international trade terms necessary for compliance and smooth clearance of goods. Michigan Purchase Invoices play a crucial role in maintaining accurate financial records, facilitating smooth business transactions, ensuring adherence to tax regulations, and providing legal protection. It is essential for businesses to understand the different types of Michigan Purchase Invoices to choose and issue the appropriate invoice based on the specific transaction involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Factura de compra - Purchase Invoice

Description

How to fill out Michigan Factura De Compra?

Choosing the best authorized papers design can be quite a have difficulties. Needless to say, there are tons of templates available on the Internet, but how would you discover the authorized form you want? Utilize the US Legal Forms site. The services provides a large number of templates, like the Michigan Purchase Invoice, which you can use for organization and personal requirements. All the kinds are examined by professionals and satisfy state and federal needs.

When you are presently registered, log in to your profile and click the Obtain key to have the Michigan Purchase Invoice. Make use of profile to check throughout the authorized kinds you might have ordered in the past. Go to the My Forms tab of the profile and acquire yet another backup of the papers you want.

When you are a whole new customer of US Legal Forms, allow me to share basic recommendations that you can adhere to:

- First, make sure you have selected the right form for your personal town/county. You may look over the shape using the Review key and browse the shape information to make certain this is basically the right one for you.

- If the form fails to satisfy your needs, utilize the Seach area to find the correct form.

- When you are sure that the shape is proper, click on the Acquire now key to have the form.

- Pick the rates strategy you desire and type in the necessary info. Create your profile and buy your order making use of your PayPal profile or Visa or Mastercard.

- Opt for the data file format and acquire the authorized papers design to your system.

- Total, revise and print and indication the acquired Michigan Purchase Invoice.

US Legal Forms will be the largest local library of authorized kinds where you can discover different papers templates. Utilize the service to acquire skillfully-made papers that adhere to condition needs.