Title: Michigan Resolution of Meeting of LLC Members to Make Specific Loan — A Comprehensive Guide Introduction: In the state of Michigan, limited liability companies (LCS) often hold meetings to make important decisions regarding their financial activities. One such crucial decision is the approval of loans. The Michigan Resolution of Meeting of LLC Members to Make Specific Loan is a document that outlines the required steps for LLC members to officially authorize a loan. Types of Michigan Resolution of Meeting of LLC Members to Make Specific Loan: 1. General Resolution of Meeting of LLC Members to Make Specific Loan: The general resolution is the most common type and is used when LLC members reach a consensus to approve a specific loan. This resolution specifies the details of the loan, such as the amount, purpose, repayment terms, and any other relevant information. 2. Unanimous Resolution of Meeting of LLC Members to Make Specific Loan: The unanimous resolution is required when all members of the LLC need to agree on the loan proposal. In this type of resolution, every member's approval is essential for it to be passed. This ensures a higher level of agreement and reinforces the commitment of all members towards the loan. 3. Special Resolution of Meeting of LLC Members to Make Specific Loan: A special resolution comes into play when the loan proposal involves specific circumstances requiring special attention. This could include provisions such as extended loan terms, higher loan amounts, or unique collateral arrangements. The special resolution must outline these exceptional circumstances and the reasons for approval. Key Elements of the Michigan Resolution of Meeting of LLC Members to Make Specific Loan: 1. Meeting Details: The resolution begins with a header indicating the name of the LLC, the date, and location where the meeting is being held. This ensures accurate record-keeping and variability. 2. Identification of Loan Purpose: A specific and detailed description of the purpose of the loan is provided, including the project or investment the loan will support. This clarifies the motivation behind the loan and establishes its relevance to the LLC's operations. 3. Loan Amount and Terms: The resolution specifies the loan amount and outlines the agreed-upon repayment terms, such as interest rate, payment schedule, and any applicable fees. This ensures transparency and clarity for all members involved. 4. Voting and Approval: The resolution defines the voting process required for the loan approval and highlights the majority or unanimous consent needed for the resolution to pass. This safeguards the interests of all members and provides a fair decision-making mechanism. 5. Signature and Notarization: At the end of the resolution, space is provided for each member to sign and date the document, reaffirming their approval. Notarization may also be required to validate the resolution's authenticity. Conclusion: The Michigan Resolution of Meeting of LLC Members to Make Specific Loan is a critical tool for LCS in Michigan to formally approve loans. Whether it is a general, unanimous, or special resolution, each type serves a specific purpose. By adhering to the appropriate resolution type and fulfilling the necessary elements, LLC members can make informed decisions regarding loans, ensuring the financial stability and growth of their business.

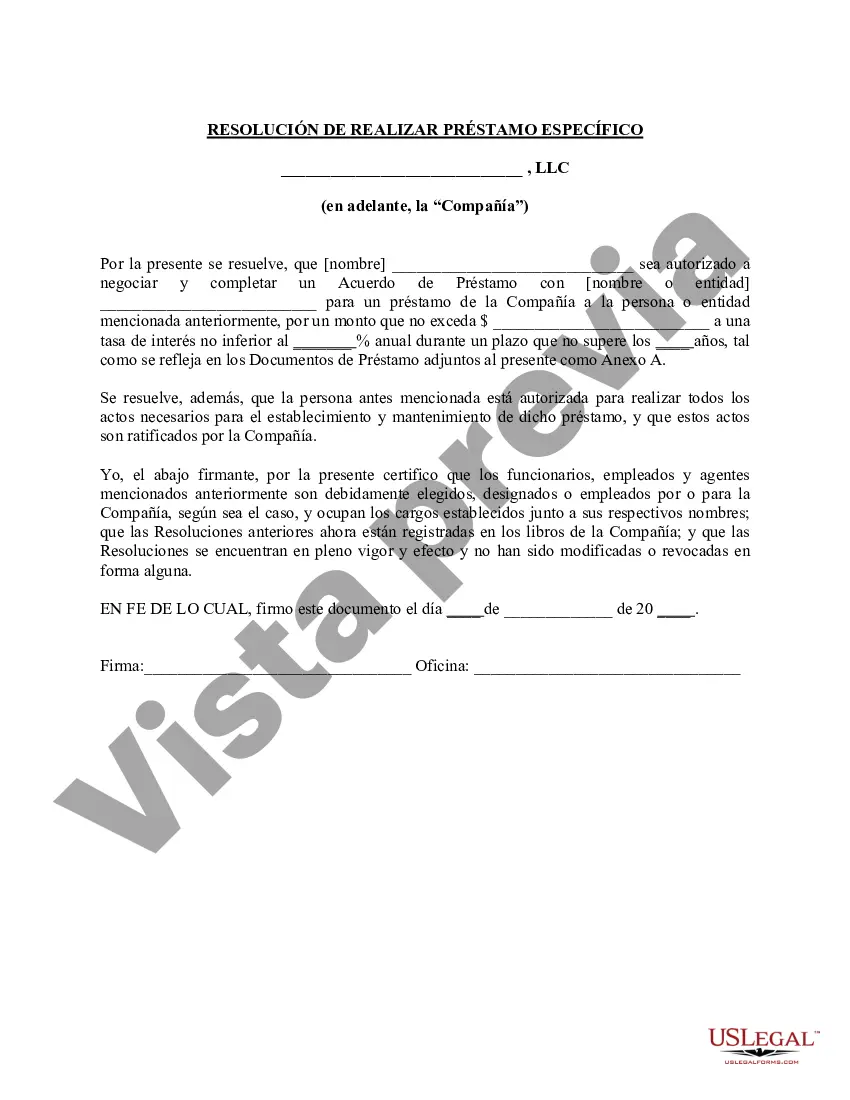

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out Michigan Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

US Legal Forms - one of several greatest libraries of legal varieties in America - gives an array of legal papers layouts you are able to acquire or printing. While using internet site, you can find thousands of varieties for business and specific functions, sorted by categories, states, or keywords and phrases.You will find the latest types of varieties much like the Michigan Resolution of Meeting of LLC Members to Make Specific Loan in seconds.

If you already have a membership, log in and acquire Michigan Resolution of Meeting of LLC Members to Make Specific Loan in the US Legal Forms catalogue. The Obtain option will show up on every develop you view. You get access to all previously saved varieties inside the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share simple directions to get you started out:

- Ensure you have selected the right develop for the metropolis/state. Select the Preview option to analyze the form`s content. Read the develop information to ensure that you have selected the right develop.

- In case the develop does not match your demands, take advantage of the Look for area towards the top of the display screen to discover the one which does.

- In case you are satisfied with the shape, confirm your choice by visiting the Acquire now option. Then, pick the rates strategy you prefer and offer your credentials to sign up to have an bank account.

- Process the purchase. Make use of Visa or Mastercard or PayPal bank account to complete the purchase.

- Choose the format and acquire the shape on your system.

- Make modifications. Fill out, revise and printing and indicator the saved Michigan Resolution of Meeting of LLC Members to Make Specific Loan.

Each and every format you included in your bank account lacks an expiry time which is the one you have eternally. So, if you would like acquire or printing one more copy, just check out the My Forms section and click on the develop you require.

Gain access to the Michigan Resolution of Meeting of LLC Members to Make Specific Loan with US Legal Forms, one of the most comprehensive catalogue of legal papers layouts. Use thousands of expert and express-particular layouts that meet up with your company or specific requirements and demands.