Michigan Employment Form is a crucial document required by the state of Michigan for employers to collect necessary information from their employees for employment and tax purposes. This form serves as a record for employers to verify employee identities and eligibility for working in the United States, as well as to determine tax withholding requirements. The main purpose of the Michigan Employment Form is to gather personal information, employment details, and relevant tax information from employees. This form is used by employers to report wages paid to employees and to calculate and withhold income taxes, social security taxes, Medicare taxes, and unemployment taxes. It ensures that both employees and employers are in compliance with state tax regulations and labor laws. Keywords: Michigan Employment Form, employee information, tax information, personal details, employment verification, tax withholding requirements, wage reporting, income taxes, social security taxes, Medicare taxes, unemployment taxes, compliance, labor laws. Different types of Michigan Employment Forms: 1. Michigan Employee's Withholding Exemption Certificate (MI-W4): This form is used by employees to provide their employers with the necessary withholding allowance information. It helps employers determine the accurate amount of state income tax to withhold from employees' paychecks. 2. Michigan New Hire Reporting Form: This form is utilized by employers to report new hires to the state government. It includes information such as the employee's name, social security number, address, date of birth, and employment details. This form helps the state track individuals who owe child support or have unemployment compensation claims. 3. Michigan Form 518: This form is used for the reporting and payment of unemployment taxes by employers. It requires information about the employer's business, wages paid to employees, and the calculation of unemployment taxes owed. 4. Michigan Form 160: This form is utilized by employers for reporting annual wage details of employees to the state's Unemployment Insurance Agency. It includes information on wages earned, hours worked, and the number of employees. Keywords: Michigan Employee's Withholding Exemption Certificate, MI-W4, withholding allowance, state income tax, Michigan New Hire Reporting Form, child support, unemployment compensation, Michigan Form 518, unemployment taxes, labor force, Michigan Form 160, wage reporting, Unemployment Insurance Agency.

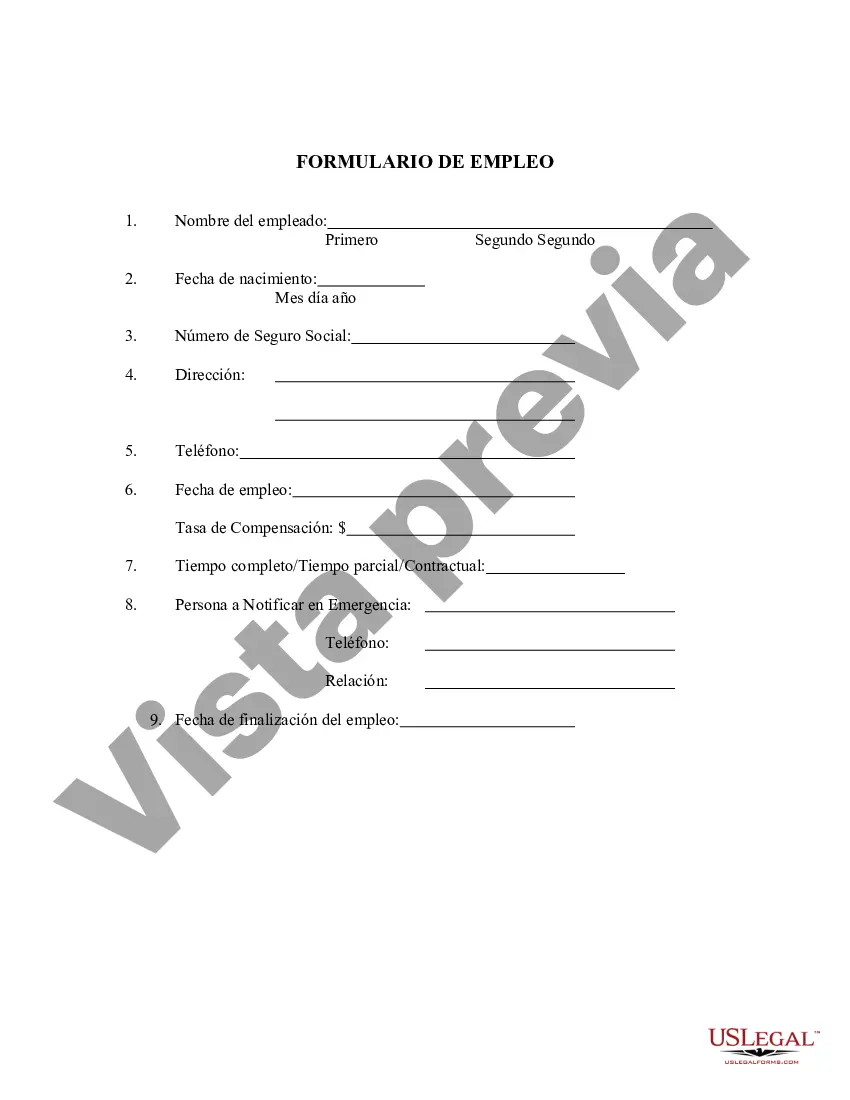

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Michigan Formulario de Empleo - Employment Form

Description

How to fill out Michigan Formulario De Empleo?

You may invest hours on the web attempting to find the lawful record web template that meets the state and federal needs you will need. US Legal Forms supplies a huge number of lawful varieties which can be evaluated by specialists. It is simple to acquire or print out the Michigan Employment Form from your assistance.

If you already have a US Legal Forms accounts, you can log in and click the Down load switch. Afterward, you can complete, modify, print out, or signal the Michigan Employment Form. Every lawful record web template you buy is the one you have forever. To have yet another copy associated with a bought kind, go to the My Forms tab and click the related switch.

If you are using the US Legal Forms website the very first time, keep to the straightforward instructions beneath:

- Initial, ensure that you have chosen the right record web template for the region/city that you pick. Browse the kind explanation to ensure you have chosen the correct kind. If offered, take advantage of the Preview switch to search from the record web template also.

- In order to locate yet another version from the kind, take advantage of the Lookup area to discover the web template that suits you and needs.

- When you have discovered the web template you desire, click Purchase now to move forward.

- Find the costs plan you desire, enter your references, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal accounts to pay for the lawful kind.

- Find the format from the record and acquire it to the gadget.

- Make adjustments to the record if possible. You may complete, modify and signal and print out Michigan Employment Form.

Down load and print out a huge number of record layouts using the US Legal Forms web site, which offers the largest assortment of lawful varieties. Use professional and status-distinct layouts to take on your small business or individual demands.