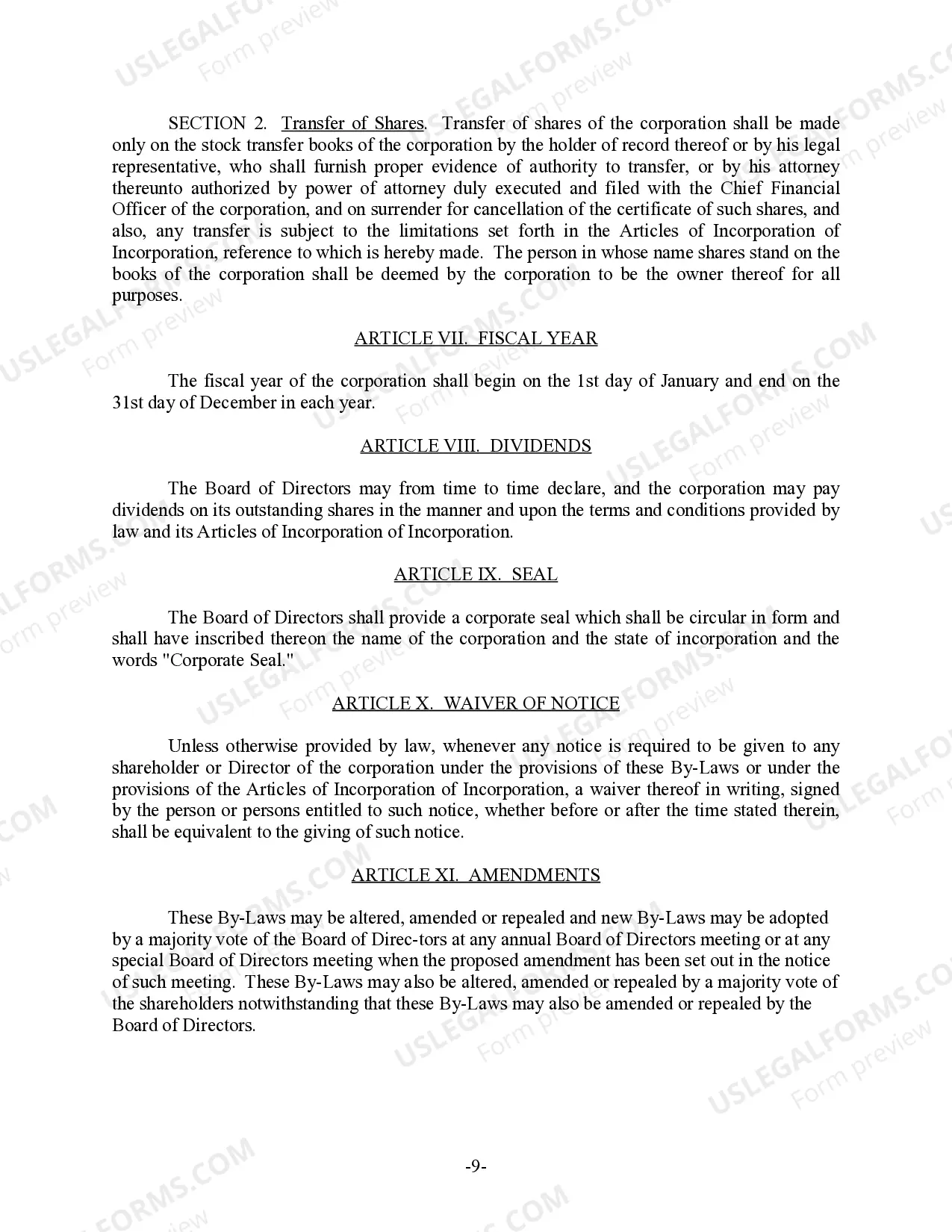

Minnesota Bylaws for Corporation

Description Corporation Form Business

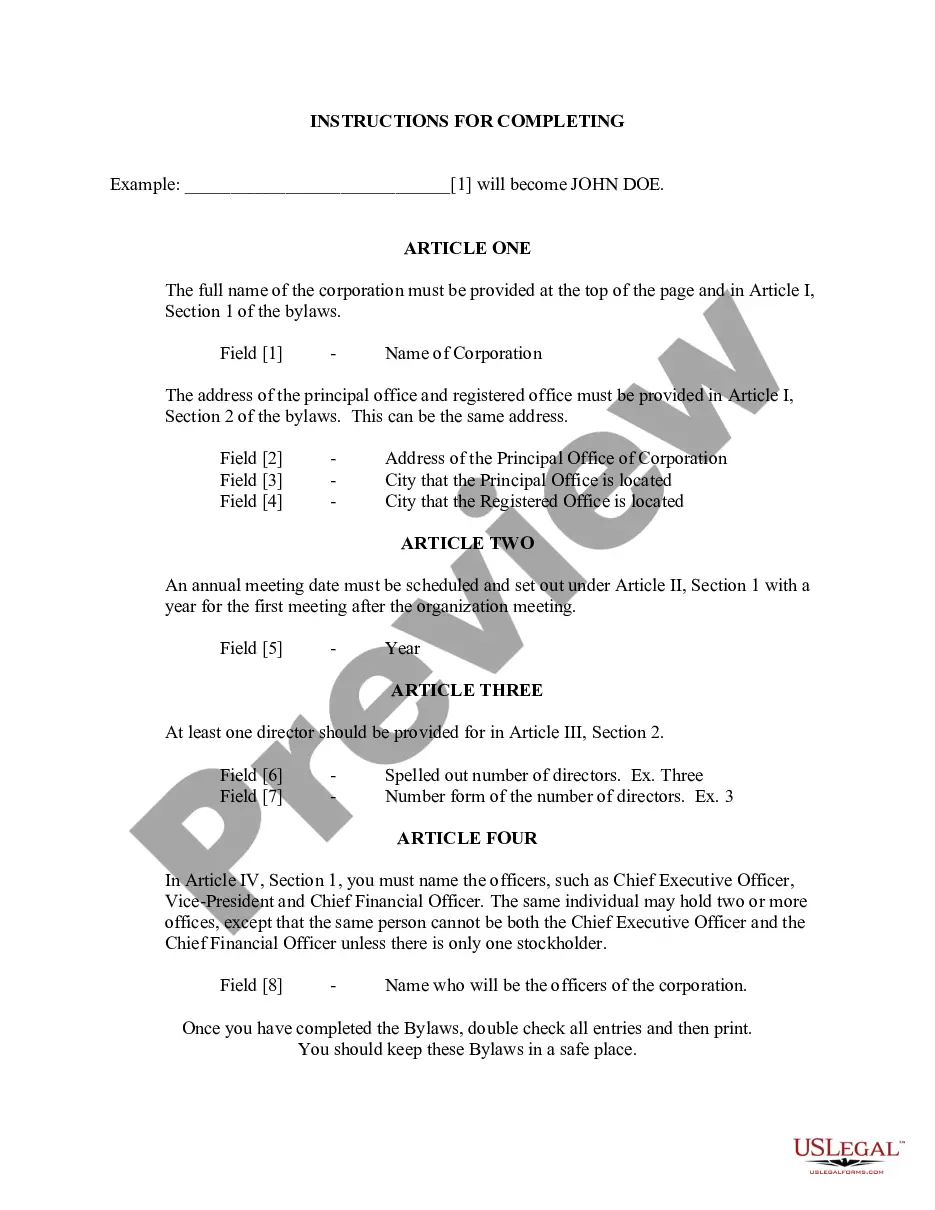

How to fill out Bylaws Form?

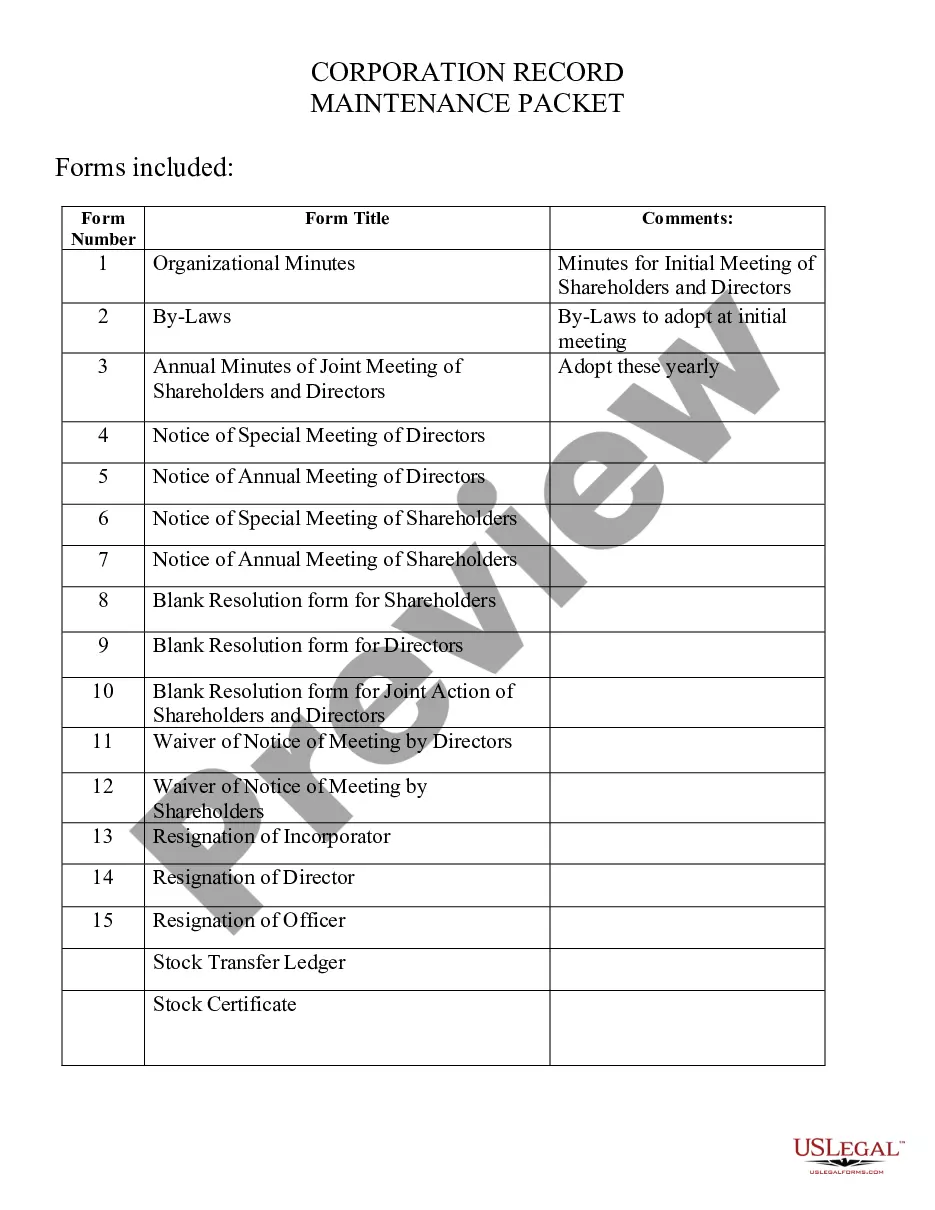

Get any template from 85,000 legal documents including Minnesota Bylaws for Corporation on-line with US Legal Forms. Every template is prepared and updated by state-certified lawyers.

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Bylaws for Corporation you would like to use.

- Read description and preview the template.

- When you’re confident the template is what you need, simply click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by bank card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the proper downloadable sample. The platform provides you with access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Minnesota Bylaws for Corporation fast and easy.

Bylaws Uslegal Form popularity

Bylaws Form Template Other Form Names

Bylaws Form Business FAQ

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

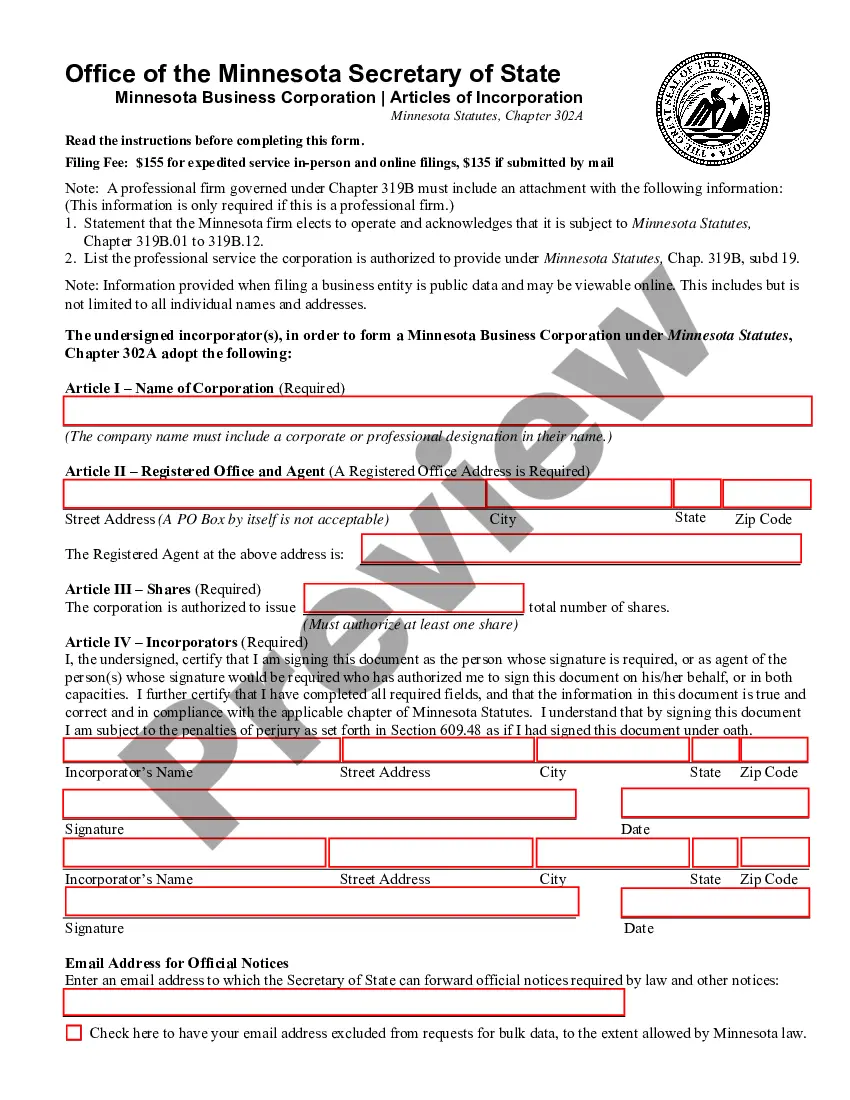

For a corporation, it's the articles of incorporation. The second concerns the internal operating procedures of the company. For corporations, these are bylaws, and for LLCs, this is an operating agreement. Corporate bylaws give a clear structure to a business, helping it run smoothly.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation. Any corporation whose articles of incorporation do not specify the number of directors must adopt bylaws before the first meeting of the board of directors specifying the number of directors.

Most states require you to memorialize your bylaws and, even in the states where there is no such requirement, having bylaws is a great idea. After all, corporate bylaws define your business' structure, roles, and specifies how your company will conduct its affairs.

Bylaws generally define things like the group's official name, purpose, requirements for membership, officers' titles and responsibilities, how offices are to be assigned, how meetings should be conducted, and how often meetings will be held.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.

Corporate bylaws commonly include information that specifies, for example, the number of directors the corporation has, how they will be elected, their qualification, and the length of their terms. It can also specify when, where, and how your board of directors can call and conduct meetings, and voting requirements.

The bylaws are the corporation's operating manual; they describe how the corporation is organized and runs its affairs. You do not file the bylaws with the state, but you need to explain the roles of the corporation's participants, and technology can play a role in carrying out the bylaws.

Step 1: Request a copy from the secretary of state in the business's registered state. Depending on your location, there may be a small fee. Step 2: Contact the company for a copy of its bylaws. Step 3: Search the EDGAR database. Step 4: Work with a business attorney.