The Minnesota Corporate Right of First Refusal (ROAR) is a legal concept that grants a corporation the first opportunity to purchase a specific interest or asset before it can be sold to a third party. It is commonly implemented through corporate resolutions, which are formal decisions made by a corporation's board of directors. A ROAR can be included in the corporate bylaws or articles of incorporation, or it can be established through a separate agreement between the corporation and its shareholders. The purpose of a ROAR is to provide the corporation with the ability to maintain control over its ownership structure and prevent unwanted transfers of ownership or assets. This right ensures that the corporation has the first chance to take advantage of investment opportunities or to retain ownership within its existing shareholder base. It is especially common in closely-held corporations, where maintaining control over ownership is of utmost importance. There are different types of Minnesota Corporate Right of First Refusal — Corporate Resolutions, including: 1. Shareholder ROAR: This type of ROAR allows existing shareholders to purchase additional shares of the corporation before they can be sold to outsiders. It ensures that any new investors must give existing shareholders the opportunity to maintain their proportional ownership in the company. 2. Asset ROAR: This type of ROAR enables the corporation to acquire specific assets or property before they are sold to third parties. It can include intellectual property, real estate, equipment, or any other valuable assets owned by the corporation. 3. Stock Transfer ROAR: This type of ROAR is triggered when a shareholder wishes to sell their shares to a third party. Before completing the transaction, the shareholder must offer the shares to the corporation at a price determined either through negotiation or as per a predetermined formula. If the corporation declines to purchase the shares, only then can the shareholder proceed with selling to the third party. 4. Option ROAR: This type of ROAR gives the corporation an option to match the terms of a proposed sale by a shareholder or a third party. If the corporation exercises this option, it effectively steps into the shoes of the proposed purchaser and acquires the interest or asset. In Minnesota, the implementation of a Corporate Right of First Refusal through Corporate Resolutions ensures that all necessary legal and regulatory requirements are met. It is crucial for corporations to consult with legal professionals specializing in corporate law to draft appropriate resolutions and ensure compliance with state laws. Additionally, any ROAR should be clearly defined and agreed upon by all relevant parties to avoid potential conflicts or disputes in the future.

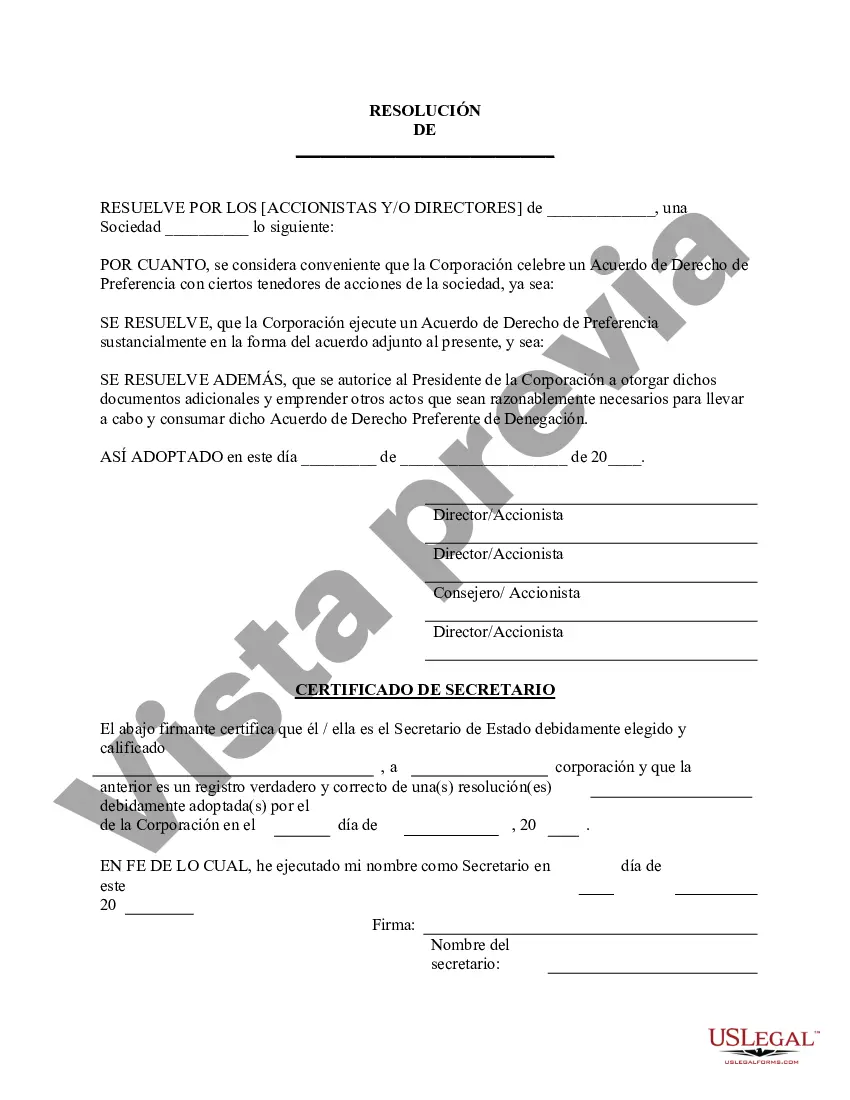

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Minnesota Derecho Corporativo De Preferencia - Resoluciones Corporativas?

US Legal Forms - one of several most significant libraries of authorized varieties in the USA - delivers a wide array of authorized file web templates you can obtain or print out. Making use of the site, you can find a large number of varieties for company and person purposes, sorted by groups, claims, or search phrases.You can find the most up-to-date versions of varieties much like the Minnesota Corporate Right of First Refusal - Corporate Resolutions in seconds.

If you have a monthly subscription, log in and obtain Minnesota Corporate Right of First Refusal - Corporate Resolutions in the US Legal Forms library. The Acquire button can look on each and every develop you look at. You have accessibility to all formerly delivered electronically varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed below are straightforward recommendations to get you started:

- Ensure you have picked out the right develop to your city/county. Select the Preview button to check the form`s content material. Look at the develop outline to ensure that you have selected the appropriate develop.

- In case the develop doesn`t satisfy your demands, utilize the Research field on top of the display to discover the one which does.

- In case you are satisfied with the shape, confirm your choice by clicking on the Get now button. Then, select the pricing plan you favor and supply your credentials to register for an profile.

- Method the transaction. Make use of your bank card or PayPal profile to accomplish the transaction.

- Find the structure and obtain the shape in your device.

- Make modifications. Fill out, edit and print out and signal the delivered electronically Minnesota Corporate Right of First Refusal - Corporate Resolutions.

Each and every format you put into your account does not have an expiration date which is yours eternally. So, if you wish to obtain or print out yet another backup, just proceed to the My Forms section and then click on the develop you want.

Obtain access to the Minnesota Corporate Right of First Refusal - Corporate Resolutions with US Legal Forms, one of the most comprehensive library of authorized file web templates. Use a large number of specialist and condition-specific web templates that meet up with your company or person demands and demands.