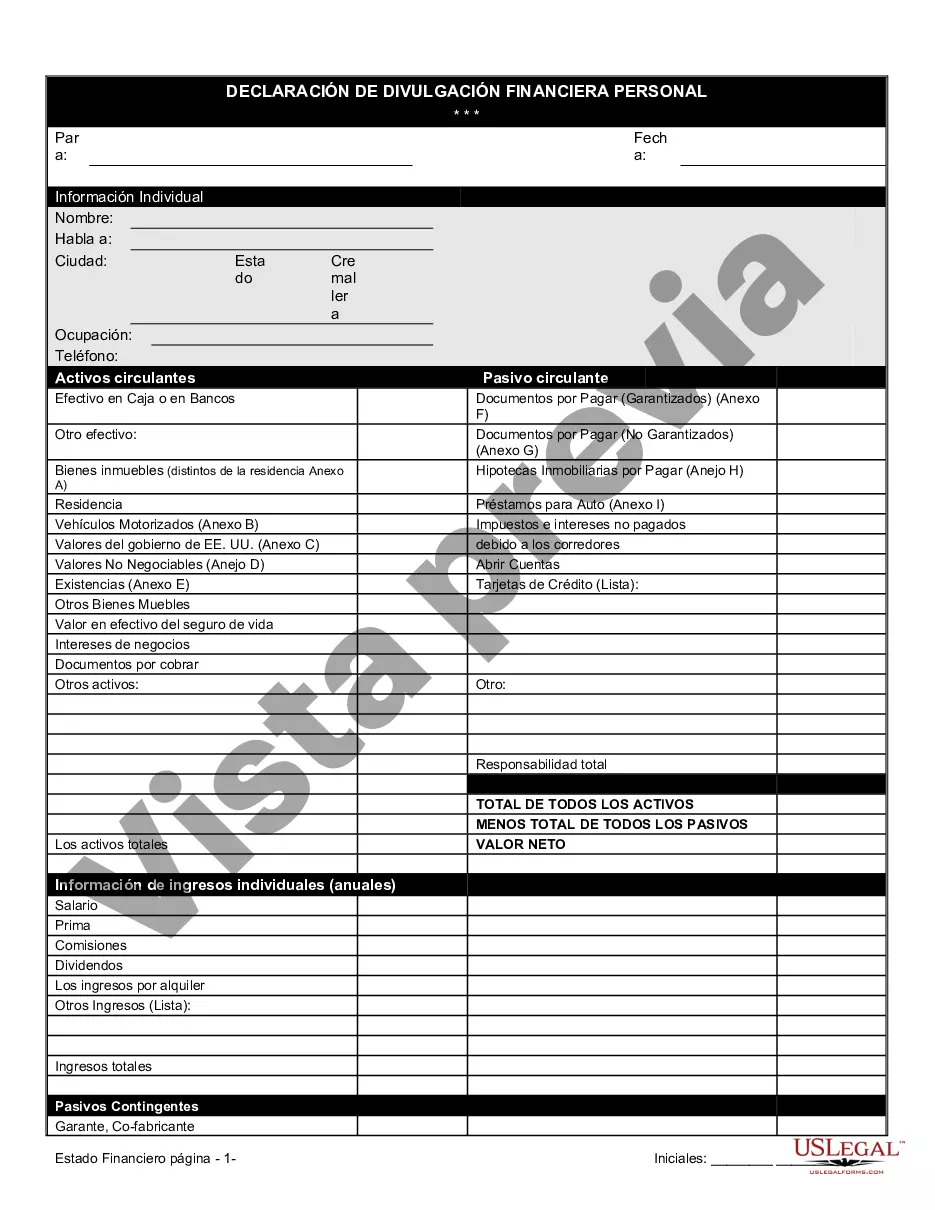

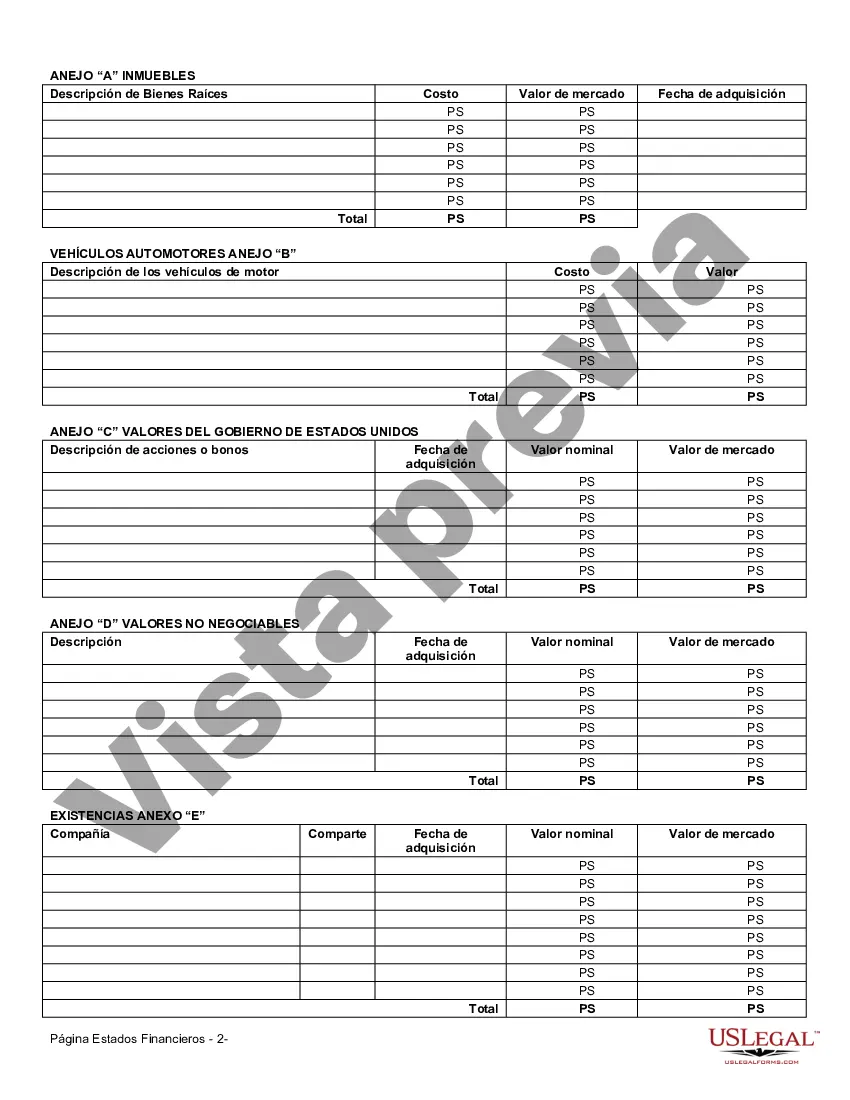

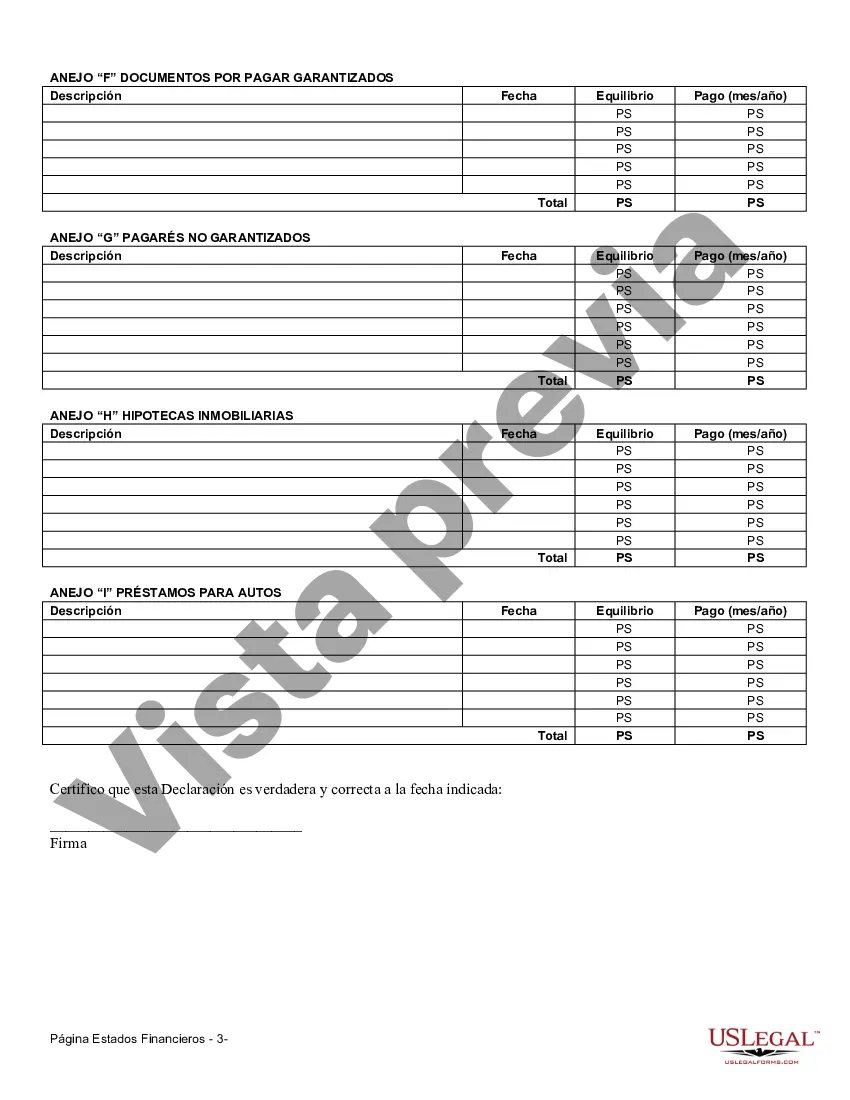

A Minnesota Financial Statement Form — Individual is a document that individuals in the state of Minnesota used to provide a comprehensive overview of their financial situation. This form is essential for various purposes, including applying for loans, seeking financial assistance, divorce proceedings, or establishing child support obligations. It is crucial to accurately fill out this form to provide an accurate snapshot of one's financial status. The Minnesota Financial Statement Form — Individual typically consists of several sections that require individuals to provide detailed information. These sections include personal information, assets, liabilities, income, and expenses. In the personal information section, individuals need to enter their name, address, contact details, and some basic information about their family or dependents. This section helps in identifying the individual and understanding their familial obligations. The assets section requires individuals to provide a detailed list of their assets, which can include real estate properties, vehicles, investments, bank accounts, retirement accounts, valuable personal belongings, and any other significant assets. Each asset must be accompanied by its current estimated value or market price. The liabilities section focuses on listing all outstanding debts and financial obligations such as mortgages, loans, credit card debts, student loans, taxes owed, or any other debts. Individuals must provide the current balance owing, monthly payment, and the name of the creditor. The income section demands individuals to disclose all sources of income, including employment salaries, self-employment income, rental income, alimony, child support, pensions, and any other forms of revenue. It is important to include accurate and up-to-date information to give a realistic representation of one's financial capacity. In the expenses section, individuals need to outline all their monthly expenses, which may include housing costs (mortgage or rent), utilities, insurance premiums, transportation expenses, education expenses, personal care, groceries, child support payments, and any other regular or recurring expenses. Providing thorough details helps in understanding one's financial commitments and obligations. If there are different types of Minnesota Financial Statement Form — Individual, they could be categorized based on their specific purpose. For instance, there might be a Minnesota Financial Statement Form — Individual specifically designed for divorce proceedings, which may include additional sections or require more specific information related to spousal support or property division. Another potential variant could be a Minnesota Financial Statement Form — Individual for loan applications, which might prioritize information relevant to creditworthiness and the ability to repay the loan, such as employment history, previous loan defaults, or collateral information. In summary, a Minnesota Financial Statement Form — Individual is a comprehensive document that aims to provide a detailed overview of an individual's financial situation. It collects information about personal details, assets, liabilities, income, and expenses. Different variants of this form may exist to meet specific requirements, such as divorce proceedings or loan applications. Accurate and thorough completion of this form is crucial to properly evaluate an individual's financial status.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out Minnesota Formulario De Estados Financieros - Individuo?

You are able to devote time online looking for the lawful record format that fits the state and federal requirements you want. US Legal Forms supplies thousands of lawful forms that happen to be reviewed by specialists. You can easily acquire or print out the Minnesota Financial Statement Form - Individual from my assistance.

If you already possess a US Legal Forms bank account, you can log in and then click the Down load option. Afterward, you can complete, change, print out, or sign the Minnesota Financial Statement Form - Individual. Each and every lawful record format you acquire is yours eternally. To obtain one more backup associated with a acquired develop, check out the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms web site the very first time, follow the straightforward guidelines under:

- Initial, make sure that you have selected the right record format to the state/metropolis of your choice. See the develop explanation to make sure you have chosen the appropriate develop. If available, utilize the Preview option to check with the record format at the same time.

- In order to locate one more edition from the develop, utilize the Look for discipline to obtain the format that fits your needs and requirements.

- Once you have identified the format you desire, simply click Get now to move forward.

- Find the rates prepare you desire, type your qualifications, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the lawful develop.

- Find the format from the record and acquire it to your system.

- Make changes to your record if necessary. You are able to complete, change and sign and print out Minnesota Financial Statement Form - Individual.

Down load and print out thousands of record themes while using US Legal Forms website, which provides the greatest collection of lawful forms. Use expert and express-particular themes to take on your company or individual requires.