A Minnesota Promissory Note — Payable on Demand is a legal agreement that outlines the terms and conditions of a loan between two parties in the state of Minnesota. This type of promissory note is characterized by the borrower's promise to repay the loan amount in full on demand by the lender. In this document, the lender is often referred to as the "payee," while the borrower is referred to as the "maker." The key feature of this promissory note is that the loan is payable immediately upon the lender's request. Unlike other types of promissory notes, which specify a fixed date or a series of installments for repayment, the Payable on Demand note grants the lender the flexibility to demand full repayment at any time. This type of promissory note is often used in various financial transactions, such as personal loans, business loans, or even loan agreements between family members or friends. It provides a level of trust and clarity by documenting the terms of the loan, including the principal amount, interest rate (if applicable), repayment terms, and any other specific conditions agreed upon by both parties. Different types or variations of a Minnesota Promissory Note — Payable on Demand may exist, depending on the specific terms and requirements of the loan. Some common variations may include secured or unsecured notes, fixed or variable interest rates, and the inclusion of additional clauses or provisions such as acceleration clauses or late payment penalties. In Minnesota, it is essential to comply with state laws and regulations when drafting a Promissory Note — Payable on Demand. The note must adhere to the requirements set forth in the Minnesota statutes, ensuring enforceability and validity in case of any legal disputes. Seeking legal advice or utilizing professionally drafted templates can help parties ensure compliance and protect their interests. In summary, a Minnesota Promissory Note — Payable on Demand is a legally binding document that establishes the terms of a loan where the borrower promises to repay the loan amount upon the lender's demand. It offers flexibility for the lender while providing clarity for both parties involved. Understanding the specific variations and complying with relevant state laws is crucial when creating this type of promissory note.

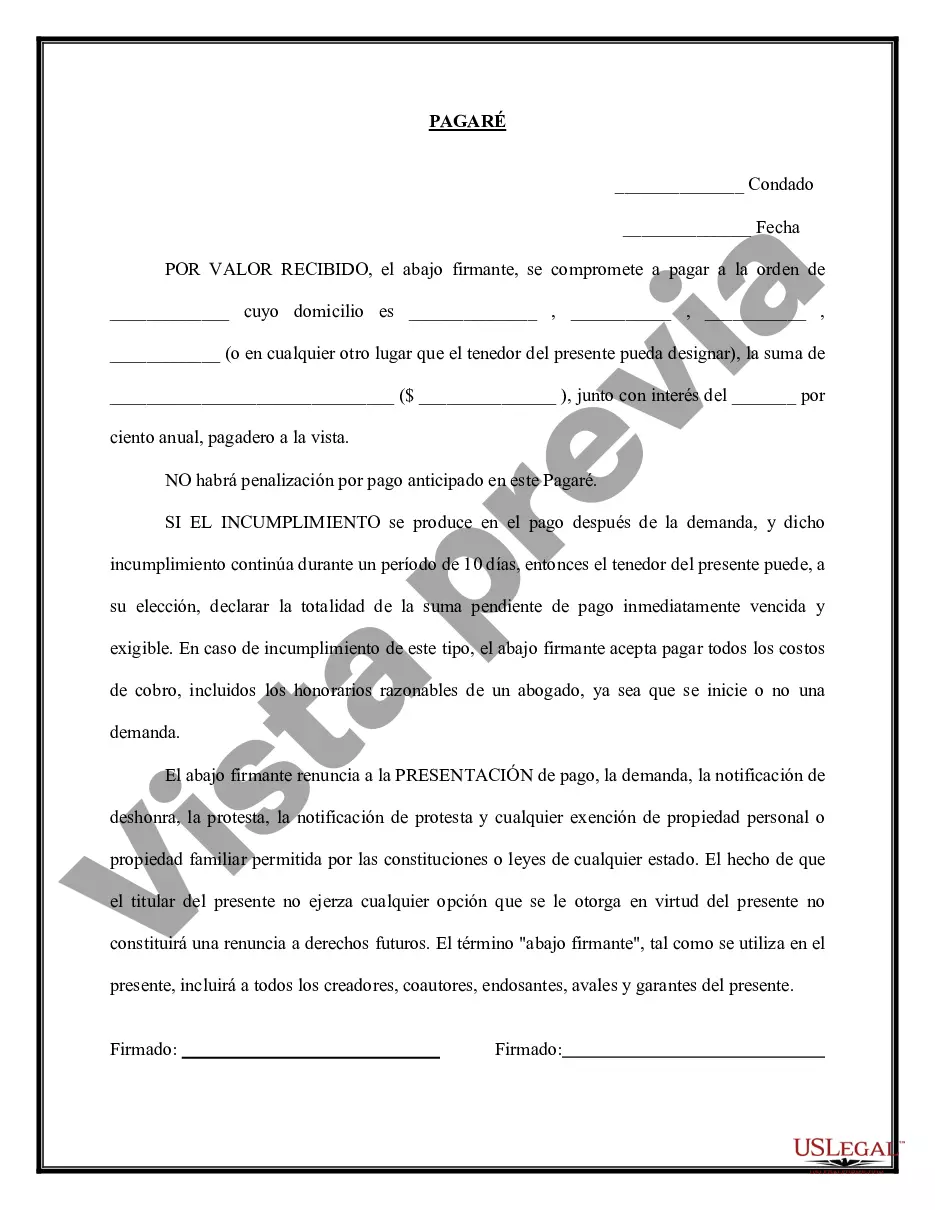

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Minnesota Pagaré - Pagadero A La Vista?

US Legal Forms - one of many most significant libraries of legitimate types in the States - gives a wide array of legitimate document layouts you may download or produce. Utilizing the internet site, you will get a huge number of types for enterprise and specific reasons, categorized by categories, suggests, or search phrases.You will find the most recent types of types much like the Minnesota Promissory Note - Payable on Demand in seconds.

If you have a subscription, log in and download Minnesota Promissory Note - Payable on Demand from the US Legal Forms local library. The Download switch will show up on every kind you see. You get access to all previously saved types in the My Forms tab of the bank account.

In order to use US Legal Forms the first time, allow me to share simple recommendations to help you get began:

- Make sure you have picked out the best kind for your personal town/area. Click the Preview switch to analyze the form`s articles. Browse the kind description to ensure that you have chosen the right kind.

- When the kind doesn`t fit your requirements, make use of the Look for area on top of the screen to find the one which does.

- Should you be happy with the form, verify your selection by visiting the Acquire now switch. Then, pick the pricing program you want and give your references to sign up for an bank account.

- Process the transaction. Utilize your credit card or PayPal bank account to accomplish the transaction.

- Select the format and download the form on your own product.

- Make adjustments. Fill out, modify and produce and indicator the saved Minnesota Promissory Note - Payable on Demand.

Every single design you added to your account does not have an expiry day which is the one you have forever. So, if you would like download or produce another copy, just go to the My Forms portion and then click about the kind you will need.

Gain access to the Minnesota Promissory Note - Payable on Demand with US Legal Forms, one of the most substantial local library of legitimate document layouts. Use a huge number of expert and status-specific layouts that meet up with your company or specific requires and requirements.