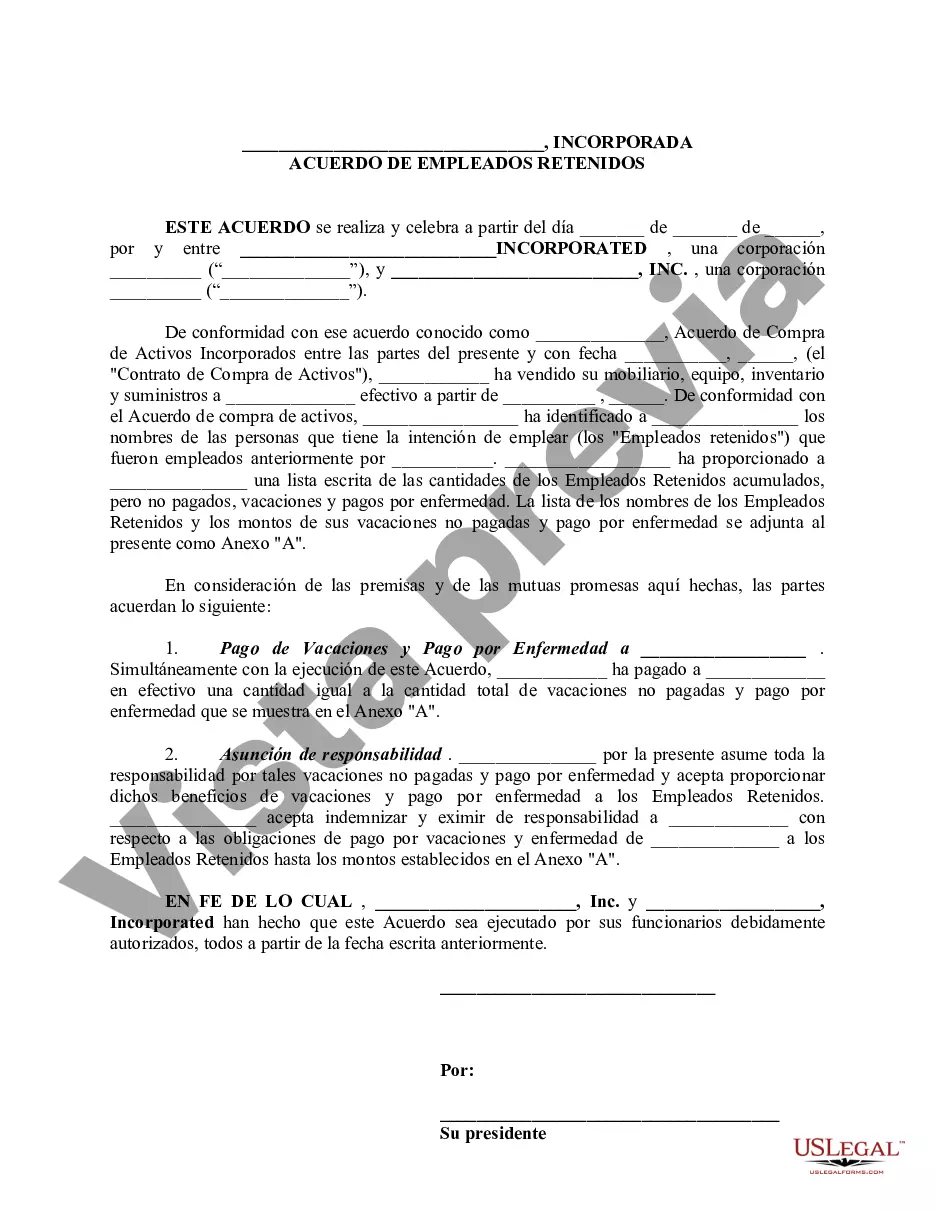

A Minnesota Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legal document that outlines the terms and conditions for the sale of a business in Minnesota, specifically with regard to retained employees. This agreement is typically used in asset purchase transactions, where the buyer acquires specific assets and liabilities of the seller's business. In this type of agreement, there are various clauses and provisions that need to be included to ensure a smooth transition and protect the interests of both parties involved. Some key elements addressed in a Minnesota Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction may include: 1. Parties involved: Clearly identify the buyer and seller, along with their respective addresses and contact information. 2. Assets and liabilities: Specify the assets and liabilities being transferred from the seller to the buyer. This could include tangible assets (such as inventory, equipment, and property) as well as intangible assets (such as goodwill, trademarks, and customer databases). 3. Purchase price: State the agreed-upon purchase price for the assets being transferred. This may be a lump sum amount or paid in installments, depending on the negotiations between the parties. 4. Employee retention: Outline the terms and conditions for the retention of certain employees by the buyer. This may include provisions for employee benefits, compensation, job security, and transfer of employment agreements. 5. Non-competition and non-solicitation: Include provisions that restrict the seller from competing with the buyer's business or soliciting its employees or customers for a specified period after the transaction. This is to protect the buyer's interests and ensure the continuity of business operations. 6. Representations and warranties: Include statements made by both parties regarding the accuracy of information provided, the ownership of assets, and the absence of undisclosed liabilities or litigation. 7. Indemnification: Specify the obligations of the parties to indemnify each other for any losses, claims, or damages arising from the transaction or any breaches of the agreement. 8. Governing law: State that the agreement is governed by the laws of the state of Minnesota and any disputes will be resolved in accordance with the courts of Minnesota. Types of Minnesota Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction: While the key elements mentioned above are generally standard, there can be variations in Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction documents based on the specific nature of the business being sold and the unique requirements of the parties involved. Some possible types of such transactions in Minnesota could include: 1. Manufacturing business acquisition: A sale agreement specific to the acquisition of a manufacturing business, where employees with specialized skills and knowledge are critical to the buyer's ongoing operations. 2. Service-based business acquisition: An agreement tailored for the acquisition of a service-based business, such as a consulting firm or accounting practice, where client relationships and employee retention are essential for maintaining revenue. 3. Retail business acquisition: A transaction agreement designed for the sale of a retail business, where inventory, customer contracts, and employee retention play significant roles in ensuring the continued success of the buyer's operations. Each of these types of Minnesota Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions would have unique provisions and considerations based on the industry, specific assets involved, and the buyer's strategic goals for the acquisition.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Venta de negocio - Acuerdo de empleados retenidos - Transacción de compra de activos - Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Minnesota Venta De Negocio - Acuerdo De Empleados Retenidos - Transacción De Compra De Activos?

US Legal Forms - one of the largest libraries of lawful kinds in the USA - offers a wide range of lawful document web templates it is possible to acquire or produce. Utilizing the internet site, you will get thousands of kinds for business and specific reasons, categorized by classes, claims, or search phrases.You can find the newest types of kinds such as the Minnesota Sale of Business - Retained Employees Agreement - Asset Purchase Transaction within minutes.

If you already possess a monthly subscription, log in and acquire Minnesota Sale of Business - Retained Employees Agreement - Asset Purchase Transaction from the US Legal Forms library. The Download switch will show up on each and every kind you perspective. You have accessibility to all in the past acquired kinds from the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed here are simple recommendations to obtain started:

- Be sure to have picked out the proper kind for the area/area. Click on the Preview switch to review the form`s articles. Read the kind description to ensure that you have chosen the right kind.

- When the kind does not match your requirements, make use of the Search industry towards the top of the screen to obtain the the one that does.

- When you are content with the shape, validate your option by visiting the Get now switch. Then, pick the costs strategy you want and provide your accreditations to sign up for the accounts.

- Method the transaction. Use your credit card or PayPal accounts to perform the transaction.

- Pick the file format and acquire the shape on your own device.

- Make changes. Fill up, edit and produce and sign the acquired Minnesota Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

Each template you added to your money lacks an expiry day which is yours for a long time. So, if you would like acquire or produce an additional version, just proceed to the My Forms section and click on the kind you want.

Gain access to the Minnesota Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with US Legal Forms, one of the most comprehensive library of lawful document web templates. Use thousands of expert and express-specific web templates that satisfy your small business or specific demands and requirements.